FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

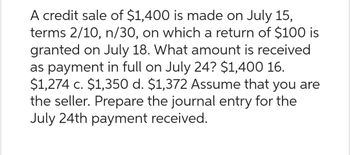

Transcribed Image Text:A credit sale of $1,400 is made on July 15,

terms 2/10, n/30, on which a return of $100 is

granted on July 18. What amount is received

as payment in full on July 24? $1,400 16.

$1,274 c. $1,350 d. $1,372 Assume that you are

the seller. Prepare the journal entry for the

July 24th payment received.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are to enter up the sale, purchases, return inwards and returns outwards day book" from the following details. then to post the items to the relevant accounts in the sales and purchases ledgern, The total of the day books are then to be transferred to the account in the general Ledger. 2009 in drawing May 1 Credit sales: T 0mpson Tshs 56,000; L Rodriguez Tshs 148,000; K Barton Tshs 145.000. 3 Credit purchase: P Potter 144.000'. H Harris Tshs 25000 Spencer Tshs 76.000. 7 credit sales K Kelly 89.000; N Mendes Toho 78.000; N lee Tshs 237,000. 9 Credit purchases: B Perkins 24,000; H Haris Tshs 58000 H miles Tshs 123000 11 Good return by to: p Potter Tshs 12000 B. Spencer Tshs22.000. 14 Goods returned to by: T. Thompson Tshs 5.000; K Barton Tshs 11,000; K Kelly Tshs 14000. 17 Credit purchases: H Harris Tshs 54,000; B Perkins Tshs 65000L Nixon Tshs 75.000. 20 Goods returned by us to B Spences Tshs 14000 24 credit sales: K Muhammed Tshs 57000 , K Kelly Tshs 65000, O . Green Tshs 112000 28…arrow_forwardAn invoice is dated for June 28 for $8657 with terms of 8/10 EOM,ROG . The merchandise was received on July 3 , how much should be paid on or before August 1?arrow_forward1. Merchandise with a list price of $7,425 is purchased on account, terms FOB shipping point, n/30. The seller prepaid transportation costs of $300. Prior to payment, $1,000 of the merchandise is returned. The correct amount is paid within the discount period.(net method) Record the foregoing transactions of the buyer in the sequence indicated below. a) Purchased the merchandise b) Recorded receipt of the credit memorandum for merchandise returned. c) Paid the amount owed.arrow_forward

- On October 5, your company buys and receives inventory costing $5,400, on terms 2/30, n/60. On October 20, your company pays the amount owed relating to the October 5 purchase.Prepare the journal entries needed on October 5 and 20, assuming the company uses a perpetual system and records purchase discounts using the net method.arrow_forwardA credit sale of $2,400 is made on April 25, terms 2/10, n/30, on which a return of $150 is granted on April 28. What amount is received as payment in full on May 4 $2,352 $2,400 $2,250 $2,205arrow_forwardA credit records financial informati. A. January 22, purchased, an asset, merchandise inventory on account for $2,800. EA7. Prepare journal entries to record the following transactions. will increase and the other side will- the terms debit and credit representedi- by calculating the difference between ectively. Depending on the acc 1. January 22, purchased, an asset merchandise inventory on account for $2,800. B. February 10, paid creditor for part of January 22 purchase, $1,600 C. July 1, issued common stock for cash, $15,000 D. July 15, purchased supplies, on account, $1,800 E. July 25, billed customer for accounting services provided, $950 BAT. Prepare journal entries to record the following transactions.arrow_forward

- Determine the amount to be paid by the buyer for full settlement of each invoice, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. Merchandise Transportation Paid by Seller Transportation Terms Returns and Allowances (a) $9,400 $366 FOB Shipping Point, 1/10, net 30 $900 (b) $9,300 $77 FOB Destination, 2/10, net 45 $2,000 a. $fill in the blank 1 b. $fill in the blank 2arrow_forwardOn October 5, your company buys and receives inventory costing $5,900, on terms 2/30, n/60. On October 20, your company pays the amount owed relating to the October 5 purchase.Prepare the journal entries needed on October 5 and 20, assuming the company uses a perpetual system and records purchase discounts using the gross method.arrow_forwardNotes Receivable Entries J. K. Pratt Co. had the following transactions: 20-1 July 20 Received a $800, 30-day, 4% note from J. Akita in payment for sale of merchandise. Aug. 19 J. Akita paid note issued July 20 plus interest. 25 Sold merchandise on account to L. Beene, $1,200. Sept. 5 L. Beene paid $100 and gave a $1,100, 30-day, 4% note to extend time for payment. Oct. 5 L. Beene paid note issued September 5, plus interest. 10 Sold merchandise to R. Harris for $750: $50 plus a $700, 30-day, 4% note. Nov. 9 R. Harris paid $140 plus interest on note issued October 10 and extended the note ($560) for 30 days. Dec. 9 R. Harris paid note extended on November 9, plus interest. 10 Sold merchandise on account to B. Kraus, $1,500. 15 B. Kraus paid $120 on merchandise purchased on account, and gave a $1,380, 30-day, 6% note to extend time for payment. 20-2 Jan. 14 B. Kraus's note of December 15 is dishonored. Feb. 13 Collected B. Kraus's dishonored note, plus…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education