CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

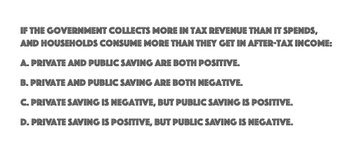

Transcribed Image Text:IF THE GOVERNMENT COLLECTS MORE IN TAX REVENUE THAN IT SPENDS,

AND HOUSEHOLDS CONSUME MORE THAN THEY GET IN AFTER-TAX INCOME:

A. PRIVATE AND PUBLIC SAVING ARE BOTH POSITIVE.

B. PRIVATE AND PUBLIC SAVING ARE BOTH NEGATIVE.

C. PRIVATE SAVING IS NEGATIVE, BUT PUBLIC SAVING IS POSITIVE.

D. PRIVATE SAVING IS POSITIVE, BUT PUBLIC SAVING IS NEGATIVE.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Financial Accountarrow_forwardThe money creation (seigniorage) to finance government purchases a. is inferior to a non distortionary tax in terms of welfare b. has the same effects in welfare as a non distortionary tax c. has better welfare effects compared to a non distortionary tax d. is the optimal policy in terms of welfarearrow_forwardOf the following, the most likely effect of an increase in income tax rates would be to: decrease the savings rate? decrease the supply of loanable funds? increase interest rates ? all of the choices are correctarrow_forward

- Vat tax - the popularity of this type of tax, the nature of this type of tax and the effect on government spending?arrow_forwardThe ideal taxation system is a good tax system, that is, it must complygovernment needs whose spending is increasing over time, which can encouragesociety to achieve the optimal allocation of resources, which can lead to their achievementequitable distribution of income and wealth and enables the implementation of economic stability.The ideal taxation is taxation that can direct the utilization of economic surplus forachieve optimal and dynamic use of economic resources.Please explain what kind of tax is the best and can be used assource of government revenue or financing in carrying out its tasks to achieveand improve people's welfare!arrow_forwardUsing loanable funds model, explain how tax cuts for businesses will impact the interest rate and supply & demand for funds.arrow_forward

- A county will invest $3,600,000 to clean up a chemical spill that occurred following a natural disaster. At the end of the 9-year planning horizon, an additional $900,000 will be spent in restoring the site to an environmentally acceptable condition. The investment is expected to produce net annual benefits that will decrease by 25% each year. The net annual public benefit in the 1st year is estimated to be $2,400,000. Determine the B/C ratio for the investment using a 5% MARR. Click here to access the TVM Factor Table calculator. | B/C= Carry all interim calculations to 5 decimal places and then round your final answer to 3 decimal places. The tolerance is ±0.003.arrow_forwardWhat is the equation for M & M Proposition II, without taxes, is best shown as?arrow_forwardhich of the following is leakages from the circular flow in a closed economy? a. household saving and government spending b. government spending and business investment c. household saving and net taxes d. household saving and business investmentarrow_forward

- Please provide as much detail as possible. It must be a detailed explanation for each. What are some of the tax-factor benefits of capital budgeting? a) annual depreciation... how and why is it a benefit? b) interest on loans...why? c) investment tax credits...why?arrow_forwardExplain in your own words, how you believe a reduction in the General Consumption Tax (GCT) rate can positively and/or negatively impact the Jamaican economy.arrow_forwardWhat are FUTA and SUTA taxes? Is there any possible reduction in the FUTA tax rate? If so, what is the reduction, and how is this determined?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you