FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

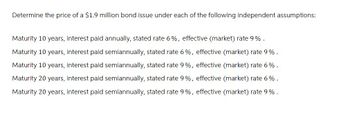

Transcribed Image Text:Determine the price of a $1.9 million bond issue under each of the following independent assumptions:

Maturity 10 years, interest paid annually, stated rate 6%, effective (market) rate 9%.

Maturity 10 years, interest paid semiannually, stated rate 6%, effective (market) rate 9%.

Maturity 10 years, interest paid semiannually, stated rate 9%, effective (market) rate 6%.

Maturity 20 years, interest paid semiannually, stated rate 9%, effective (market) rate 6%.

Maturity 20 years, interest paid semiannually, stated rate 9%, effective (market) rate 9%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A fifteen-year bond, which was purchased at a premium, has semiannual coupons. The amount for amortization of the premium in the second coupon is $977.19 and the amount for amortization of premium in the fourth coupon is $1,046.79. Find the amount of the premium.arrow_forwardThe market price is $1,100 for a 13-year bond ($1,000 par value) that pays 11 percent annual interest but makes interest payments on a semiannual basis (5.5 percent semiannually). What is the bond's yield to maturity?arrow_forwardThe market price is $725 for a 9-year bond ($1,000 par value) that pays 12 percent annual interest, but makes interest payments on a semiannual basis (6 percent semiannually). What is the bond's yield to maturity?arrow_forward

- Suppose a Puerto Rico government bond pays $3,255.80 in 4 years at 4% interest. Calculate the present value of the bond. Determine the value of the bond assuming it will mature in 6 years at 5% interest.arrow_forwardDavid Palmer identified the following bonds for investment: 1. 1) Bond A: A $1 million par, 10% annual coupon bond, which will mature on July 1, 2025. 2. 2) Bond B: A $1 million par, 14% semi-annual coupon bond (interest will be paid on January 1 and July 1 each year), which will mature on July 1, 2031. 3. 3) Bond C: A S1 million par, 10% quarterly coupon bond (interest will be paid on January 1, April 1, July 1, and October 1 each year), which will mature on July 1, 2026. The three bonds were issued on July 1, 2011. (a) If Bond B is issued at face value and both Bond Band Bond A are having the same yield to maturity (EAR) at issuance, calculate the market price of Bond A on July 1, 2011.arrow_forwarda 29000 bond with interest at 5.1% payable semi annually and redeemable ar par is bought two years before maturity to yield 7.8% compunded semi annually. complete the premium or discount and the purchase price and construct the appropriate bond schedulearrow_forward

- Use the method of averages to find the approximate yield rate for the bond shown in the table below. The bond is to be redeemed at par. Bond Rate Face Value $5,000 Payable Semi-annually Time Before Redemption 7 years 5% Market Quotation 103.375 The yield rate is%. (Round the final answer to two decimal places as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardCompany I issues a $40,000,000 bond on January 1, 2020 with a coupon rate of 7%. The present value of the bond is $37,282,062 and the market rate of interest was 8%. The bond has a 10-year life and will make semiannual interest payments and will use the straight line amortization method. A) Is the bond issued at a face value, a discount, or premium? B) What is the amount of the semi-annual interest payments? C) What is the amount that will be recorded to interest expense each time an interest payment is made? D) What is the carrying value of the bond on December 31, 2021?arrow_forwardHow do I Prepare a journal entry for a bond to record the installment payment and any interest. with an effective interest rate for the bond is 14% per year? Is this the correct way below? Credit Cash Debit Mortgage payable Debit Interest Payable Credit Casharrow_forward

- A $27,000 bond with interest at 5.3% payable semi-annually and redeemable at par is bought two years before maturity to yield 6.6% compounded semi-annually. Compute the premium or discount and the purchase price, and construct the appropriate bond schedule.arrow_forwardThe market price of an $960000, ten-year, 12% (pays interest semiannually) bond issue sold to yield an effective rate of 10% isarrow_forwardUse the following tables to calculate the present value of a $608,000 @ 6%, 6-year bond that pays $36,480 interest annually, if the market rate of interest is 7%. Round to the nearest dollar. Present Value of $1 ¦ Present Value of Annuity of $1 Periods 5 % 6 % 7 % 10 % ¦ Periods 5 % 6 % 7 % 10 % 1 .95238 .94340 .93458 .90909 ¦ 1 .95238 .94340 .93458 .90909 2 .90703 .89000 .87344 .82645 ¦ 2 1.85941 1.83339 1.80802 1.73554 3 .86384 .83962 .81630 .75131 ¦ 3 2.72325 2.67301 2.62432 2.48685 4 .82270 .79209 .76290 .68301 ¦ 4 3.54595 3.46511 3.38721 3.16987 5 .78353 .74726 .71299 .62092 ¦ 5 4.32948 4.21236 4.10020 3.79079 6 .74622 .70496 .66634 .56447 ¦ 6 5.07569 4.91732 4.76654 4.35526 7 .71068 .66506 .62275 .51316 ¦ 7 5.78637 5.58238 5.38929 4.86842 8 .67684 .62741 .58201 .46651 ¦ 8 6.46321…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education