Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

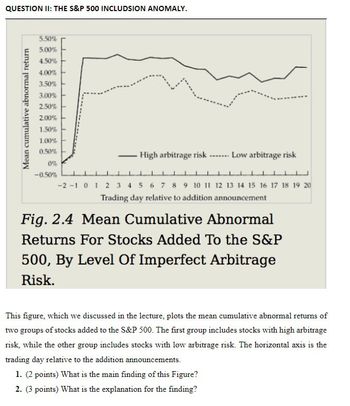

Transcribed Image Text:QUESTION II: THE S&P 500 INCLUDSION ANOMALY.

Mean cumulative abnormal return

5.50%

5.00%

4.50%

4.00%

3.50%

3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0%

-0.50%

High arbitrage risk ....... Low arbitrage risk

-2-1 0 123456789 10 11 12 13 14 15 16 17 18 19 20

Trading day relative to addition announcement

Fig. 2.4 Mean Cumulative Abnormal

Returns For Stocks Added To the S&P

500, By Level Of Imperfect Arbitrage

Risk.

This figure, which we discussed in the lecture, plots the mean cumulative abnormal returns of

two groups of stocks added to the S&P 500. The first group includes stocks with high arbitrage

risk, while the other group includes stocks with low arbitrage risk. The horizontal axis is the

trading day relative to the addition announcements.

1. (2 points) What is the main finding of this Figure?

2. (3 points) What is the explanation for the finding?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which asset in the following table has the most market risk (also known as systematic or non- diversifiable risk)? Asset A B Asset B Asset A Return Both Assets A and C Asset C (10% 12% 14% Beta 0.74 1.00 1.25 Standard Deviation 20% 40% 30%arrow_forwardCalculate the expected value of the scenario. X₁ P(x₁) -$0.25 0.1 $0 0.5 $0.25 0.1 $0.50 0.3arrow_forwardWhat is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (SDi), covariance (COVij), and asset weight (Wi) are as shown below? Asset (A) E(R₂) = 25% SDA = 18% WA = 0.75 COVA, B = -0.0009 Select one: A. 13.65% B. 20 U ODN 20.0% C. 18.64% D. 22.5% Asset (B) E(R₂) = 15% SDB = 11% WB = 0.25arrow_forward

- Sh19 Please help me. Solutionarrow_forwardConsider the following two securities X and Y. Y Security Expected Return Standard Deviation Beta 12.5% 10.0% Risk-free asset 5.0% OA. 1.33 ○ B. 0.88 OC. 1.17 OD. 1.67 20.0% 1.5 30.0% 1.0arrow_forwardWhich asset in the following table has the most market risk (also known as systematic or non-diversifiable risk)? (Ch. 8) Asset Return Beta Standard Deviation Asset A 9% 0.95 20% Asset B 13% 1.10 35% Asset C 10% 1.00 40% Group of answer choices Asset A Asset C Asset B and Asset C Asset Barrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning