Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

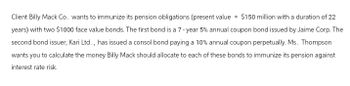

Transcribed Image Text:Client Billy Mack Co. wants to immunize its pension obligations (present value = $150 million with a duration of 22

years) with two $1000 face value bonds. The first bond is a 7-year 5% annual coupon bond issued by Jaime Corp. The

second bond issuer, Kari Ltd., has issued a consol bond paying a 10% annual coupon perpetually. Ms. Thompson

wants you to calculate the money Billy Mack should allocate to each of these bonds to immunize its pension against

interest rate risk.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ReNew Corporation raises funds to build renewable energy systems by issuing 3-year bonds with a coupon rate of 6% and a face value of $1,300. Assume that the market interest rate for a 3-year bond issued by a firm like ReNew is currently the same as the coupon rate. The price of each of these bonds is Suppose that the market interest rate for bonds that are similar to the ReNew bond has increased to 8%. The price of the ReNew bond changes toarrow_forwardPlease do excel like you did last timearrow_forwardYou have decided to invest in Corporate bonds. Your first bond investment (on Jan 2, 2021) is par value $1,000 DEF corporation bond, with a remaining maturity of 5 years, interest is paid semi-annual, the coupon rate is 4% (annual rate) and the effective market interest is 3% (annual rate). Calculate the amount you paid for the DEF bond on January 2, 2021 Calculate the amount of interest you will receive each year from the invest. How much cash will you receive at maturity for the bond?arrow_forward

- Bill Magness wants to purchase ERCOT bonds which are maturing in 15 years and yielding 3.87%. These ERCOT bonds have an annual coupon rate of 4.59% and a par value of $5,000. If the ERCOT bonds pay coupons twice per year, how much will Bill Magness have to spend to purchase one ERCOT bond? Note: the next coupon will be paid in exactly 6 months. a. $5,514.90 b. $5,406.76 c. $5,677.10 d. $5,190.49 e. $5,028.29arrow_forwardSupper Accountants Inc plans to sell a bond to finance its plant. The face value of the bond is $100,000 and it will be due in 5 years. The bond is offered at 6% annual interest rate, although the market rate is 7%. Supper Accountants is expected to receive $95,900 in cash when the sales is completed. How much interest expense should Supper Accountants record for the first year? 6,000 5,754 7,000 6.173arrow_forwardRivera Inc. is considering the issuance of $500,000 face value, ten-year term bonds. The bonds will pay 10% interest each December 31. The current market rate is 10%; therefore, the bonds will be issued at face value. I need help calculating the issue price of the bonds given interest is paid annually but that the market rate of interest is 8%; the nominal rate is still 10%.arrow_forward

- Please do both correctly, I'll rate the answerQuestion:(i) A $10,000 bond is purchased for $9600 and has a bond rate of 6% per year payable semiannually for 2 years. What is the interest rate?(ii) You borrow 35,000 for 10 years at 10% per year compounded monthly. After making 24 payments you decide to pay the loan off. What's that payoff amount? Note:- please dont use pen paperarrow_forwardA bond costs $925, with a face value of $1000 and pays 4% of the face value each year. If the bond will be paid off at the end of 10 years and your MARR is 5%, should you buy the bond? Please solve using NPV method if possible, and please do without excel or calculators since I'm trying yo understand the topic . Thank you!arrow_forwardPlease answer all questions and show all calculations. Thank you.arrow_forward

- Bones Ely owns a $1,000 face-value bond with three years to maturity. The bond makes annual interest payments of$75, the first to be made one year from today. The bond is currently priced at $975.48. Given an appropriate discount rate of 10%, should Bones hold or sell the bond?arrow_forwardA young engineering company is a subcontractor in an effort to develop technology that will reliably detect and respond to release of a nuclear weapon. The company is in need of additional funding and issues a series of $1,000 face value bonds that pay a nominal annual rate of 8% with quarterly payments. The bond matures in 6 years. Part a Your answer is correct. If you buy one bond for $905 and keep it until maturity, what is your effective annual rate of return? Click here to access the TVM Factor Table calculator. 10.52 % Carry all interim calculations to 5 decimal places and then round your final answer to 2 decimal places. The tolerance is ±0.02.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education