Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

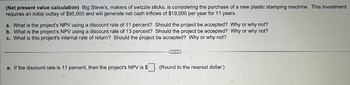

Transcribed Image Text:(Net present value calculation) Big Steve's, makers of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment

requires an initial outlay of $95,000 and will generate net cash inflows of $19,000 per year for 11 years.

a. What is the project's NPV using a discount rate of 11 percent? Should the project be accepted? Why or why not?

b. What is the project's NPV using a discount rate of 13 percent? Should the project be accepted? Why or why not?

c. What is this project's internal rate of return? Should the project be accepted? Why or why not?

a. If the discount rate is 11 percent, then the project's NPV is $

(Round to the nearest dollar.).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Need a little help with this onearrow_forwardTelevision is considering a project with an initial outlay of $X (you will have to determine this amount). It is expected that the project will produce a positive cash flow of $54,000 a year at the end of each year for the next 13 years. The appropriate discount rate for this project is 8 percent. If the project has an internal rate of return of 13 percent, what is the project's net present value? *** a. If the project has an internal rate of return of 13%, then the project's initial outlay is $ the nearest cent.) (Round toarrow_forward(Related to Checkpoint 11.1) (Net present value calculation) Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay of $4,000,000 and would generate annual net cash inflows of $1,100,000 per year for 6 years. Calculate the project's NPV using a discount rate of 5 percent. *** If the discount rate is 5 percent, then the project's NPV is $. (Round to the nearest dollar.)arrow_forward

- A project will have an initial investment requirement of $5,000. Then, it will generate 5 years of $1,000 per year, with all cash expected to be received at the end of the year. The discount rate is 10%. The hurdle rate is the same as the discount rate, 10%. 9.What is the NPV? 10.What is the Payback? 11.What is the IRR. 12.Do you accept this project? 13.At WHAT HURDLE RATE would the project result in an NPV of exactly $0?arrow_forward(Ignore income taxes in this problem.) Your Company is considering an investment in a project that will have a three-year life. The project will provide a 4% internal rate of return and is expected to have a $40,000 cash inflow the first year and a $0 cash inflow in the second year, and $50,000 cash inflow in the third year. What investment is required in the project?arrow_forwardYOU ARE A FINANCIAL ANALYST FOR A COMPANY THAT IS CONSIDERING A NEW PROJECT. IF THE PROJECT IS ACCEPTED, IT WILL USE A FRACTION OF A STORAGE FACILITY THAT THE COMPANY ALREADY OWNS BUT CURRENTLY DOES NOT USE. THE PROJECT IS EXPECTED TO LAST 10 YEARS, AND THE ANNUAL DISCOUNT RATE IS 10% (COMPOUNDED ANNUALLY). YOU RESEARCH THE POSSIBILITIES, AND FIND THAT THE ENTIRE STORAGE FACILITY CAN BE SOLD FOR €100,000 AND A SMALLER (BUT BIG ENOUGH) FACILITY CAN BE ACQUIRED FOR €40,000. THE BOOK VALUE OF THE EXISTING FACILITY IS €60,000, AND BOTH THE EXISITING AND THE NEW FACILITIES (IF IT IS ACQUIRED) WOULD BE DEPRECIATED STRAIGHT LINE OVER 10 YEARS (DOWN TO A ZERO BOOK VALUE). THE CORPORATE TAX RATE IS 40%. DISCUSS WHAT IS THE OPPORTUNITY COST OF USING THE EXISTING STORAGE CAPACITY?arrow_forward

- 1. what amount should be used as the initial cash flow for this project and why?? 2. What is the after-tax salvage value for the spectrometer? 3. What is the MPV of the project? Should the firm accept or reject this project?arrow_forwardWhat is the value of the abandonment option (in millions), in the question below? Round your answer to two decimal places... Sunshine Smoothies Company (SSC) manufactures and distributes smoothies.It is considering the introduction of a "weight loss" smoothie.The project would require a $4 million investment outlay today (t = 0).The after-tax cash flows would depend on whether the weight loss smoothie is well received by consumers.There is a 30% chance that demand will be good, in which case the project will produce after-tax cash flows of $2 million at the end of each of the next 3 years.There is a 70% chance that demand will be poor, in which case the after-tax cash flows will be $1 million for 3 years.The project is riskier than the firm's other projects, so it has a WACC of 12%.The firm will know if the project is successful after receiving first year's cash flows.After receiving the first year's cash flows it will have the option to abandon the project.If the firm decides to…arrow_forwardJasmine Manufacturing is considering a project that will require an initial investment of $49,400 and is expected to generate future cash flows of $9,500 for years 1 through 3, $7,600 for years 4 and 5, and $1,900 for years 6 through 10. What is the payback period for this project? fill in the blank yearsarrow_forward

- (Net present value calculation) Dowling Sportswear is considering building a new factory to produce aluminum baseball bats. This project would require an initial cash outlay of $6,000,000 and would generate annual net cash inflows of $1,100,000 per year for 9 years. Calculate the project's NPV using a discount rate of 5 percent. If the discount rate is 5 percent, then the project's NPV is $___________________(Round to the nearest dollar.)arrow_forwardQuestion: Big Steve's, maker of swizzle sticks, is considering the purchase of a new plastic stamping machine. This investment requires an initial outlay of $105,000 and will generate net cash inflows of $19,000 per year for 8 years. a. What is the project's NPV using a discount rate of 8 percent? Should the project be accepted? Why or why not? b. What is the project's NPV using a discount rate of 17 percent? Should the project be accepted? Why or why not? c. What is this project's internal rate of return? Should the project be accepted? Why or why not?arrow_forwarda. What is the net present value (at the discount rate of 10%) of this project?b. Perot’s engineers have determined that spending $10 million more on development will allow them to add even more advanced features. Having a more advanced chip will allow them to price the chip $50 higher in both years ($870 for year 1 and $700 for year 2). What is the NPV of the project if this option is implemented?c. If sales are only 200,000 the first year and 100,000 the second year, what would the NPV of the project be? Assume the development costs and sales price are as originally estimated. Development cost - $1,250,000Estimated development time - 9 monthsPilot testing - $200,000Ramp-up cost - $400,000Marketing and support cost - $150,000/yrSales & Production volume - $60,000/yrUnit production cost - $100Unit price - $205Interest rate - 8%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education