Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

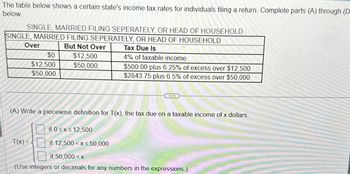

Transcribed Image Text:The table below shows a certain state's income tax rates for individuals filing a return. Complete parts (A) through (D

below.

SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD

SINGLE, MARRIED FILING SEPERATELY, OR HEAD OF HOUSEHOLD

Over

$0

$12,500

$50,000

But Not Over

$12,500.

$50,000

Tax Due Is

4% of taxable income

$500.00 plus 6.25% of excess over $12,500

$2843.75 plus 6.5% of excess over $50,000

(A) Write a piecewise definition for T(x), the tax due on a taxable income of x dollars.

if 0≤x≤12,500

T(x)=

if 12,500 x≤50,000

if 50,000 < x

(Use integers or decimals for any numbers in the expressions.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Compute the 2019 tax liability and the marginal and average tax rates for the following taxpayers (use the 2019 Tax Rate Schedules in Appendix A for this purpose): a. Chandler, who files as a single taxpayer, has taxable income of 94,800. b. Lazare, who files as a head of household, has taxable income of 57,050.arrow_forwardMelodie's taxable income is $39,000 and she pays income tax of $4,489. If Melodie's taxable income increases to $41,000, she would pay income taxes of $4,884. What is Melodie's marginal tax rate? 19.75 22.00 18.50 12.00 Some other amountarrow_forwardCompute the 2019 standard deduction for the following taxpayers. a. Ellie is 15 and claimed as a dependent by her parents. She has 800 in dividends income and 1,400 in wages from a part-time job. b. Ruby and Woody are married and file a joint tax return. Ruby is age 66, and Woody is 69. Their taxable retirement income is 10,000. c. Shonda is age 68 and single. She is claimed by her daughter as a dependent. Her earned income is 500, and her interest income is 125. d. Frazier, age 55, is married but is filing a separate return. His wife itemizes her deductions.arrow_forward

- Assume the following tax code for a married couple: 15% up to $24, 300; 28% between $ 24,300 and $47,500; and 31% above $47,500. What is the tax payable on an income of $ 118,000 (rounded to the nearest dollar)? Group of answer choices a)$27,475 b)$31,996 c) $24, 300 d)$8,750arrow_forwardUsing the tax table, determine the amount of taxes for the following situations: (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. A head of a household with a taxable income of $62,000. b. A single person with a taxable income of $37,800. c. Married taxpayers filing jointly with taxable income of $73,400arrow_forwardWhich equation could be used to identify one of the following levels of Federal Incomne Tax withholding? PERCENTAGE METHOD FOR FIT WITHHOLDING MARRIED PERSON WEEKLY PAYROLL PERIOD Allowance Rate = $63.46 The amount of FIT withholding is... each w %3D . If he Weekly Taxable Wage any rin Over But not over. $0.00 0.10(income 58) $36.00 + 0.12(income 222) $171.36 + 0.22(income 588) $1 $222 222 588 588 1,117 Select one: O A. FIT = 37.70 + 0.12g; where g = gross pay in dollars. O B. FIT = 36 + 0.22(g - 222); where g = gross pay in dollars. O C. FIT = 171.36g - 129.36; where g = gross pay in dollars. O D. FIT = 36 + 0.12g - 26.64; where g = gross pay in dollars. Outiarrow_forward

- Refer to the individual rate schedules in Appendix CRequired: A. What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $58,900 taxable income? Appendix C 2021 Income Tax Rates INDIVIDUAL TAX RATES Married Filing Jointly and Surviving Spouse If taxable income is The tax is Not over $19,900 10% of taxable income Over $19,900 but not over $81,050 $1,990.00 + 12% of excess over $19,900 Over $81,050 but not over $172,750 $9,328.00 + 22% of excess over $81,050 Over $172,750 but not over $329,850 $29,502.00 + 24% of excess over $172,750 Over $329,850 but not over $418,850 $67,206.00 + 32% of excess over $329,850 Over $418,850 but not over $628,300 $95,686.00 + 35% of excess over $418,850 Over $628,300 $168,993.50 + 37% of excess over $628,300 Married Filing Separately If taxable income is The tax is Not over $9,950 10% of taxable income Over $9,950 but not…arrow_forwardHaresharrow_forwardH1.arrow_forward

- Required: Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and Tax Rate Schedules. a. Married taxpayers, who file a joint return, have taxable income of $39,821. b. Married taxpayers, who file a joint return, have taxable income of $63,790. (For all requirements, use the tax tables to compute tax liability. Round "Average tax rate" to 2 decimal places.) Tax liability Marginal tax rate Average tax rate a % b.arrow_forwardPlease advisearrow_forwardThe 2020 Arizona graduated tax rate is given in the table below for those filing status is single or married filing separate. To use this table you will calculate the amount of money to be taxed at each level and then sum up the amount for each given tax rate. Find the income tax for a person filing single and has a taxable income reported as $81,600. Round your answer to the nearest whole dollar amount. Proper units on worksheet but: Do not include the $ sign in your answer here. Income Tax Rate The income between $0 and $27,272 2.59% The income between $27,272 and $54,544 3.34% The income between $54,544 and $163,632 4.17% The income above $163,632 4.50%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT