Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

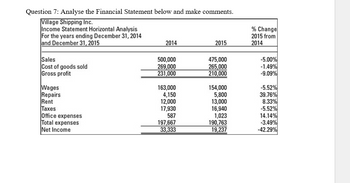

Transcribed Image Text:Question 7: Analyse the Financial Statement below and make comments.

Village Shipping Inc.

Income Statement Horizontal Analysis

For the years ending December 31, 2014

and December 31, 2015

Sales

Cost of goods sold

Gross profit

Wages

Repairs

Rent

Taxes

Office expenses

Total expenses

Net Income

2014

500,000

269,000

231,000

163,000

4,150

12,000

17,930

587

197,667

33,333

2015

475,000

265,000

210,000

154,000

5,800

13,000

16,940

1,023

190,763

19,237

% Change

2015 from

2014

-5.00%

-1.49%

-9.09%

-5.52%

39.76%

8.33%

-5.52%

14.14%

-3.49%

-42.29%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Provide answer pleasearrow_forwardEdison Company reported the following for the current year: $ 84,000 59,000 21,080 63,000 77,080 Net sales Cost of goods sold Net income Beginning balance of total assets Ending balance of total assets Compute (a) profit margin and (b) return on total assets. Complete this question by entering your answers in the tabs below. Profit Margin Ratio Compute the return on total assets. Return On Total Assets Numerator: 7 7 7 Return On Total Assets Denominator: = Return On Total Assets Return on total assets II =arrow_forwardVery important please be correct thank youarrow_forward

- Common-Sized Income Statement Revenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill's data are expressed in dollars. The electronics industry averages are expressed in percentages. Electronics Tannenhill Industry Company Average $1,390,000 100 % Sales 736,700 59 Cost of merchandise sold $653,300 41 % Gross profit $417,000 25 % Selling expenses Administrative expenses 152,900 10 Total operating expenses $569,900 35 % Income from operations $83,400 6 % Other revenue and expense: Other revenue 27,800 2 Other expense (13,900) 1 Income before income tax expense $97,300 7 % Income tax expense 41,700 Net income $55,600 2 % a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. If required, round percentages to one decimal place. econ.docx Show all Type here to search 6:05 AM 59 F 局 10/30/2021 12 prt sc 00 5.arrow_forwardThe following is an income statement from the financial records of Peace, Love and Joy Company for the year ended December 31, 2015: Income Statement Sales (net) $ 245,675 Cost of Goods Sold (67,500) Gross Profit $ 178,175 Operating expenses (125,000) Operating Income $ 53,175 Interest revenue 5,600 Interest expense (8,750) Income before taxes $ 50,025 Income tax expense (15,008) Net Income $ 35,017 Refer to Exhibit 5-2. Compute earnings-based interest coverage for Peace, Love, and Joy Company. 6.72 times 5.72 times 16.88 times 6.08 timesarrow_forwarddarrow_forward

- The Cullumber Supply Company reported the following information for 2017. Prepare a common-size income statement for the year ended June 30, 2017. (Round answers to 1 decimal place, e.g. 52.7%.) Cullumber Supply CompanyIncome Statement for the Fiscal Year Ended June 30, 2017($ thousands) % of Net Sales Net sales $2,111,000 enter percentages of net sales % Cost of goods sold 1,464,000 enter percentages of net sales % Selling and administrative expenses 312,200 enter percentages of net sales % Nonrecurring expenses 27,600 enter percentages of net sales % Earnings before interest, taxes, depreciation, and amortization (EBITDA) $307,200 enter percentages of net sales % Depreciation 117,000 enter percentages of net sales % Earnings before interest and taxes (EBIT) 190,200 enter percentages of net sales % Interest expense 118,600 enter percentages of net sales % Earnings before taxes (EBT)…arrow_forwardSelected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 Sales $ 562,795 2019 $ 299,200 338,803 Cost of goods sold Gross profit 191,488 223,992 107,712 Selling expenses 79,917 39,494 Administrative expenses 50,652 24,834 Total expenses 130,569 64,328 Income before taxes 93,423 43,384 Income tax expense 17,377 8,807 Net income $ 76,046 $ 34,577 KORBIN COMPANY Comparative Balance Sheets December 31 2021 2020 Assets Current assets $ 38,127 $ 56,965 0 Long-term investments 700 97,740 Plant assets, net Total assets 107,436 $164,401 $ 136,567 Liabilities and Equity Current liabilities $ 20,348 Common stock 68,000 $ 24,003 68,000 8,500 63,898 Other paid-in capital 8,500 Retained earnings 39,719 Total liabilities and equity $164,401 $ 136,567 2020 $431,147 273,778 157,369 59,498 37,941 97,439 59,930 12,286 $ 47,644 2019 $ 50,967 4,550 57,629 $ 113,146 $ 19,801 50,000 5,556 37,789 $113,146 4arrow_forwardDetermining Gross Profit During the current year, merchandise is sold for $45,870,000. The cost of the merchandise sold is $33,026,400. a. What is the amount of the gross profit? 12,843,600 b. Compute the gross profit percentage (gross profit divided by sales). % c. When will the income statement necessarily report a net income?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education