FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:(a) - Make a "Condensed Income Statements". Prepare a horizontal analysis of

the income statement data for Vaughn Corporation, using 2021 as a base. (b

) - Make a "Condensed Income Statements". Prepare a vertical analysis of the

income statement data for Vaughn Corporation for both years.

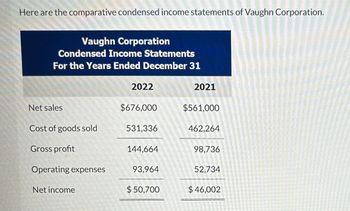

Transcribed Image Text:Here are the comparative condensed income statements of Vaughn Corporation.

Vaughn Corporation

Condensed Income Statements

For the Years Ended December 31

Net sales

Cost of goods sold

Gross profit

Operating expenses

Net income

2022

$676,000

531,336

144,664

93,964

$50,700

2021

$561,000

462.264

98,736

52,734

$46,002

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Horizontal Analysis of the Income Statement Income statement data for Winthrop Company for two recent years ended December 31, are as follows: Current Year Previous Year Sales $965,200 $760,000 Cost of goods sold 818,400 660,000 Gross profit $146,800 $100,000 Selling expenses $43,290 $37,000 Administrative expenses 38,750 31,000 Total operating expenses $82,040 $68,000 Income before income tax $64,760 $32,000 Income tax expenses 25,900 12,800 Net income $38,860 $19,200 a. Prepare a comparative income statement with horizontal analysis, indicating the increase (decrease) for the current year when compared with the previous year. If required, round to one decimal place. Winthrop Company Comparative Income Statement For the Years Ended December 31 Current Previous Increase Increase year year (Decrease) (Decrease) Amount Amount Amount Percent Sales $965,200 $760,000 % Cost of goods sold 818,400 660,000 % Gross profit $146,800 $100,000 % Selling expenses $43,290 $37,000 % Administrative…arrow_forwardThe income statements for Urban Outfits, Inc. are presented below. Urban Outfits, Inc. Income Statements Year Ended December 31 Sales revenue Cost of goods sold Gross profit Operating and other expenses Interest expense Income tax expense Net income Sales Revenue Cost of Goods Sold Gross Profit Current Year Prior Year $800,059 398,202 401,857 Operating and Other Expenses Interest Expense Income Tax Expense Net Income 138,791 7,650 47,000 $208,416 Prepare a horizontal analysis of the income statement above. (Enter your answers to the nearest whole percent (i.e., enter 0.12 as 12.)) URBAN OUTFITS, INC Income Statements Year Ended December 31 Current Year Prior Year $800,059 $741,413 398,202 368,210 401,857 373,203 138,791 127,624 7,650 16,900 $741,413 368,210 47,000 45,500 208,416 183,179 373,283 127,624 16,900 45,500 $183,179 Increase (Decrease) Amount Percent (%)arrow_forwardLanfield, Inc. Comparative Income Statement Years Ended December 31, 2024 and 2023 2024 2023 Net Sales Revenue $459,000 $428,000 Cost of Goods Sold 234,000 212,000 Gross Profit 225,000 216,000 Operating Expenses 134,000 132,000 Income From Operations 91,000 84,000 Interest Expense 13,000 16,000 Income Before Income Tax 78,000 68,000 Income Tax Expense 24,000 26,000 Net Income $54,000 $42,000 Lanfield, Inc. Comparative Balance Sheet December 31, 2024 and 2023 2024 2023 2022* Assets Current Assets: Cash $98,000 $97,000 Accounts Receivables, Net 114,000 115,000 $104,000 Merchandise Inventory 146,000 158,000 202,000 Prepaid Expenses 13,000 6,000 Total Current Assets 371,000 376,000 Property, Plant, and Equipment, Net 211,000 180,000 Total Assets $582,000…arrow_forward

- Here are the comparative condensed income statements of Cheyenne Corporation. CHEYENNE CORPORATIONCondensed Income StatementsFor the Years Ended December 31 2022 2021 Net sales $588,000 $490,000 Cost of goods sold 474,516 416,010 Gross profit 113,484 73,990 Operating expenses 80,556 44,100 Net income $ 32,928 $ 29,890 (a)Prepare a horizontal analysis of the income statement data for Cheyenne Corporation, using 2021 as a base. (If amount and percentage are a decrease show the numbers as negative, e.g. -55,000, -20% or (55,000), (20%). Round percentages to 1 decimal place, e.g. 12.1%.) CHEYENNE CORPORATIONCondensed Income Statementschoose the accounting period Increase or (Decrease) During 2022 2022 2021 Amount Percentage Net sales $588,000 $490,000 $enter a dollar amount enter…arrow_forwardMac Donald company reported the following on its comparative income statement: 2017 2018 2019 Revenue 9,000 10,000 14,000 Cost of goods sold 6,000 4,000 9,000 Prepare a horizontal analysis of revenue , cost of goods sold and gross profitarrow_forwardThe comparative statements of Wildhorse Co. are presented here: WILDHORSE CO.Income StatementsFor the Years Ended December 31 2022 2021 Net sales $1,892,340 $1,752,300 Cost of goods sold 1,060,340 1,007,800 Gross profit 832,000 744,500 Selling and administrative expenses 501,800 480,800 Income from operations 330,200 263,700 Other expenses and losses Interest expense 23,700 21,700 Income before income taxes 306,500 242,000 Income tax expense 93,700 74,700 Net income $212,800 $167,300 WILDHORSE CO.Balance SheetsDecember 31 Assets 2022 2021 Current assets Cash $60,100 $64,200 Debt investments (short-term) 74,000 50,000 Accounts receivable (net) 119,600 104,600 Inventory 127,700 117,200 Total current assets 381,400 336,000 Plant assets (net) 663,000 534,300…arrow_forward

- Data for Kahn, Inc. follows: Kahn, Inc. Comparative Income Statement Years Ended Dec. 31, 2019 and 2018 2019 2018 Net Sales Revenue 550,000 500,000 Expenses: Cost of Goods Sold 245,000 220,000 Selling and Administrative Expenses 100,000 96,000 Other Expenses (Interest Expense) 12,000 9,000 Income Tax Expense 58,000 47,000 Total Expenses 415,000 372,000 Net Income 135,000 128,000 Prepare a horizontal analysis of the comparative income statement of Kahn, Inc. (Round to one decimal place.)arrow_forwardRetail Corporation reported the following Income Statement for the past two years: Retail Corporation Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $ 30,100,100 $ 26,210,200 Cost of goods sold 22,425,500 18,950,800 Gross profit 7,674,600 7,259,400 Selling expenses 1,525,500 1,480,600 Administrative expenses 1,425,300 1,325,000 Total operating expenses 2,950,800 2,805,600 Income from operations 4,723,800 4,453,800 Interest Expense 190,500 210,600 Other income 62,500 55,500 Income before income tax 4,595,800 4,298,700 Income tax expense 1,608,500 1,312,400 Net income $ 2,987,300 $ 2,986,300 a. What was Retail…arrow_forwardSelected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 2019 Sales $ 508,246 $ 389,358 $ 270,200 Cost of goods sold 305,964 246,853 172,928 Gross profit 202,282 142,505 97,272 Selling expenses 72,171 53,731 35,666 Administrative expenses 45,742 34,264 22,427 Total expenses 117,913 87,995 58,093 Income before taxes 84,369 54,510 39,179 Income tax expense 15,693 11,175 7,953 Net income $ 68,676 $ 43,335 $ 31,226 KORBIN COMPANY Comparative Balance Sheets December 31 2021 2020 2019 Assets Current assets $ 60,248 $ 40,324 $ 53,904 Long-term investments 0 1,000 3,350 Plant assets, net 113,627 103,113 62,412 Total assets $ 173,875 $ 144,437 $ 119,666 Liabilities and Equity Current liabilities $ 25,386 $ 21,521 $ 20,942 Common stock 66,000 66,000 48,000 Other paid-in capital 8,250 8,250 5,333 Retained earnings 74,239 48,666…arrow_forward

- The income statement of Sweet Company is shown below. SWEET COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,960,000 Cost of goods sold Beginning inventory $1,910,000 Purchases 4,380,000 Goods available for sale 6,290,000 Ending inventory 1,610,000 Cost of goods sold 4,680,000 Gross profit 2,280,000 Operating expenses Selling expenses 450,000 Administrative expenses 710,000 1,160,000 Net income $1,120,000 Additional information: 1. Accounts receivable decreased $380,000 during the year. 2. Prepaid expenses increased $190,000 during the year. 3. Accounts payable to suppliers of merchandise decreased $290,000 during the year. 4. Accrued expenses payable decreased $90,000 during the year. 5. Administrative expenses include depreciation expense of $70,000. Prepare…arrow_forwardThe comparative statements of crane company are presented here. Crane Company Income Statement For the Years Ended December 31 2022 2021 Net sales $1,810,000 $1,745,000 Cost of goods sold 1,005,000 970,000 Gross profit 805,000 775,000 Selling and administrative expenses 511,000 472,000 Income from operations 294,000 303,000 Other expenses and losses Interest expense 17,000 13,000 Income before income taxes 277,000 290,000 Income tax expense 77,500 76,000 Net income 199500 214000 Crane Company Balance Sheets 31-Dec Assets 2022 2021 Current assets Cash $59,000 $63,000 Debt investments (short-term) 68,000 49,000 Accounts receivable (net) 116,000 101,000 Inventory 122,000 114,000 Total current assets 365,000 327,000 Plant assets (net) 595,000 515,000 Total assets $960,000 $842,000 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $159,000 $144,000…arrow_forwardplease explain the result of income statement that provided in image belowarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education