Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

53

Transcribed Image Text:Question: 53

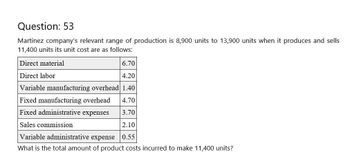

Martinez company's relevant range of production is 8,900 units to 13,900 units when it produces and sells

11,400 units its unit cost are as follows:

Direct material

Direct labor

6.70

4.20

Variable manufacturing overhead 1.40

Fixed manufacturing overhead

4.70

Fixed administrative expenses

3.70

Sales commission

2.10

Variable administrative expense

0.55

What is the total amount of product costs incurred to make 11,400 units?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Wrappers Tape makes two products: Simple and Removable. It estimates it will produce 369,991 units of Simple and 146,100 of Removable, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: Â How much is the overhead allocated to each unit of Simple and Removable?arrow_forwardThe following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardThe following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forward

- Crafts 4 All has these costs associated with production of 12,000 units of accessory products: direct materials, $19; direct labor, $30; variable manufacturing overhead, $15; total fixed manufacturing overhead, $450,000. What is the cost per unit under both the variable and absorption methods?arrow_forwardIdentify cost graphs The following cost graphs illustrate various types of cost behavior: For each of the following costs, identify the cost graph that best illustrates its cost behavior as the number of units produced increases: A. Total direct materials cost B. Electricity costs of 1,000 per month plus 0.10 per kilowatt-hour C. Per-unit cost of straight-line depreciation on factory equipment D. Salary of quality control supervisor, 20,000 per month E. Per-unit direct labor costarrow_forwardCost Classification Loring Company incurred the following costs last year: Required: 1. Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, 216,000. 2. What was the total product cost for last year? 3. What was the total period cost for last year? 4. If 30,000 units were produced last year, what was the unit product cost?arrow_forward

- Rex Industries has two products. They manufactured 12,539 units of product A and 8.254 units of product B. The data are: What is the activity rate for each cost pool?arrow_forwardRocks Industries has two products. They manufactured 12,539 units of product A and 8.254 units of product B. The data are: Â What is the activity rate for each cost pool?arrow_forwardansarrow_forward

- Cost Accounting Answer Pleasearrow_forwardQuestion 4 Achimota Ltd produces a single product and has the following financial information: Selling Price Cost per unit: Direct Materials Direct Labour Variable Overheads GH¢ 50 15 14 4 Fixed manufacturing overheads are GH¢40,000 per month, production volume is 10,000 units per month and sales is 9,200 units. You are required to: a) Calculate the cost per unit under: i. Absorption costing ii. Marginal costing b) Prepare the income statement of ABC Ltd under: i. Absorption costing technique ii. Marginal costing technique c) Reconcile the profits obtained under (bi) and (bii) d) Explain the reasons for the difference in profits in (c) above.arrow_forwardQuestion: Gangwer Corporation produces a single product and has the following cost structure: Number of units produced each year Variable costs per unit: Direct materials Direct Labor Variable Manufacturing overhead Variable selling and administrative expense Fixed Costs per year: Fixed manufacturing overhead Fixed Selling and administrative expense The absorption costing unit product cost is: A. $95 B. $119 6,000 $ 43 $ 13 $ 5 $ 1 $2,04,000 $ 1,38,000 C. $61 D. $56arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning