FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

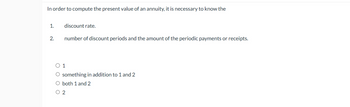

Transcribed Image Text:In order to compute the present value of an annuity, it is necessary to know the

1.

discount rate.

2.

number of discount periods and the amount of the periodic payments or receipts.

○ 1

O something in addition to 1 and 2

O both 1 and 2

○ 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In the time diagram below, which of the following concepts is depicted? 0 PV $1 2 $1 3 $1 O Present value of an annuity due O Future value of an ordinary annuity Present value of an ordinary annuity Future value of an annuity due 4 $1arrow_forwardChoose the letter of the correct answer and write it on the space provided _____ 1. A sequence of payments made at equal (fixed) intervals or periods of time. A. Annuity C. Ordinary Annuity B. Annuity due D. Simple Annuity ______2. The amount of each payment. A. Payment interval C. Annuity Payment B. Periodic Payment D. Time payment ______3. It is time between the purchase of an annuity and the start of the payments for the deferred annuity. A. Period of deferral C. Payment interval B. Annuity payment D. Period of payment ______4. A type of annuity in which the payments are made at the end of each payment interval. A. Annuity due C. General Annuity D. Simple Annuity D. Ordinary Annuity ______5. Compounding quarterly means the interest period is A. every year C. every 6 months B. every 4 months D. every 3 months ______6. In a monthly payment of P2,000 for 5 years that will start 7 months from now, what will be the period of deferral? A. 7 B. 5 C. 4 D. 6 ______7. A loan is given an…arrow_forwardEf 07.arrow_forward

- Use the table below to answer the following questions: Present Value of 1 Factor Present Value of an Annuity of 1 Factor Period 1/2 Yr Full-Yr 1/2 Yr Full-Yr 1 0.9578 0.9174 0.9578 0.9174 2 0.9174 0.8417 1.8753 1.7591 3 0.8787 0.7722 2.7540 2.5313 4 0.8417 0.7084 3.5957 3.2397 5 0.8062 0.6499 4.4019 3.8897 6 0.7722 0.5963 5.1740 4.4859 Assumption: Required annual effective rate (EPR) of return is 9%. If an investment pays you $108,000 at the end of each year for 3 years, what is its present value? Group of answer choices $291,703 $273,380 $279,396 $250,193arrow_forwardUse the table below to answer the following questions: Present Value of 1 Factor Present Value of an Annuity of 1 Factor Period 1/2 Yr Full-Yr 1/2 Yr Full-Yr 1 0.9578 0.9174 0.9578 0.9174 2 0.9174 0.8417 1.8753 1.7591 3 0.8787 0.7722 2.7540 2.5313 4 0.8417 0.7084 3.5957 3.2397 5 0.8062 0.6499 4.4019 3.8897 6 0.7722 0.5963 5.1740 4.4859 Assumption: Required annual effective rate (EPR) of return is 9%. If an investment pays you $324,000 at the end of 3 years, what is its present value? Group of answer choices $279,396 $291,703 $273,380 $250,193arrow_forwardAn annuity due is one in which _____. a. payments or receipts occur at the beginning of each period b. payments or receipts occur at the end of each period c. cash flows occur continuously d. payments or receipts occur foreverarrow_forward

- Explain the relationship between Table 2, Present Value of $1, and Table 4, Present Value of an OrdinaryAnnuity of $1.arrow_forwardTo determine the converted table factor for the present value of an annuity due, one must find the factor for the present value of an ordinary annuity for n + 1 and then add 1. n − 1 and then subtract 1. n − 1 and then add 1. n + 1 and then subtract 1.arrow_forwardThe formula 1/(1 + r)t is used to calculate Multiple Choice The present value annuity factor. The present value interest factor. The future value interest factor. The present value of $1 occurring t periods from now.arrow_forward

- Prove: FVA of an Ordinary Annuity times (1+i) = FVA of an Annuity Due, where i= interest rate. SHow all workarrow_forward1) The question screenshot has been attached down below answer question 16 a,b,c,d,e,f step-by-step.arrow_forwardQuestion 1 Saved An annuity with periodic payments made at the end of each payment period is called: A) ordinary Oi general Cannuity due O simple Onone of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education