Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Question

Kindly give me the steps one by one how to do its and the calculation of the answers

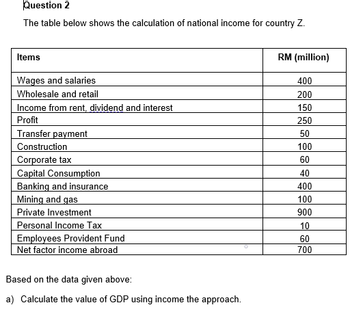

Transcribed Image Text:Question 2

The table below shows the calculation of national income for country Z.

Items

Wages and salaries

RM (million)

400

Wholesale and retail

200

Income from rent, dividend and interest

150

Profit

250

Transfer payment

50

Construction

100

Corporate tax

60

Capital Consumption

Banking and insurance

Mining and gas

Private Investment

Personal Income Tax

Employees Provident Fund

Net factor income abroad

40

400

100

900

10

60

700

Based on the data given above:

a) Calculate the value of GDP using income the approach.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- please help me solvearrow_forwardlearn-us-east-1-prod-fleet01-xythos.content.blackboardcdn.com Bb https://.. a SD Bb Bb Bb 1. From the time of George Washington's presidency to the present, the percentage of the average American's income that goes to pay taxes A. has decreased from about 20 percent to about 10 percent. has decreased from about 50 percent to about 25 percent. C. has remained constant at about 10 percent. D. has risen from less than 2 percent to above 45 percent. Е. В. has risen from less than 5 percent to above 25 percent. 2. According to the textbook, which of the following statements is (are) correct for the United States? (x) The individual income tax and the payroll tax are the two largest sources of revenue for the U.S. federal government. (y) Corporate income taxes and excise taxes make up more than 30 percent of the tax revenue for the U.S. federal government. (z) In general, the two most important taxes for state and local governments in the U.S are sales taxes and property taxes. А. (x), (y)…arrow_forwardUse the 2019 U.S. federal tax rates in the table to calculate answers to the questions below. Give all answers to two decimals. V Taxable Income $0-$9,700 $9,701-$39,475 $39,476-$84,200 $84,201-160,725 $160,726-$204,100 $204,101-$510,300 Over $510,300 1st attempt Tax rate 10% 222335 12 24 37 See Hinarrow_forward

- Agricultural price supports result in governments holding large inventories of agricultural products. Why do you think the government cannot simply give the products away to poor people?arrow_forwardWhat is deflation?arrow_forwardCalculate the average and marginal tax rates inthe following table, and indicate whether the taxis progressive, proportional, or regressive. Whatobservation can you make concerning the relationshipbetween marginal and average tax rates?arrow_forward

- Using the information provided on the income tax systems in two hypothetical countries, Country A and Country B, complete the following tables.Country ACountry BTaxable Income (Dollars) Tax Liability (Dollars) Taxable Income(Dollars) Tax Liability (Dollars )20,0002,000.0020, 000$2,00040, 00010, 000.0040,000 $4,00060,00024,000.0060, 000$6,000Complete the following table by deriving the marginal tax rates in the income ranges of $20,000 to $40,000 and $40,000 to $ 60,000 for each country.Taxable Income Range Country A Marginal Tax Rate Country B Marginal Tax Rate( Dollars)(Percent)(Percent) 20,000 to 40,00040,000 to 60,000Complete the following table by deriving the average tax rates at each income level for each country.Taxable Income (Dollars)(Percent) Country A Average Tax Rate Country B Average Tax Rate(Percent )20,00040, 00060,000arrow_forwardTyped plzxz And Asap I vll upvotearrow_forward1arrow_forward

- Please answer correct calculation asap plz Don't answer by pen paper plzarrow_forwardQuestion Arrange the following revenues in the federal government, from greatest to least. (1 being the greatest, 6 being the least.) Column A 1. 2. 3. 4. 5. 6. Individual Income Taxes Social Security and Medicare Taxes Corporate Income Taxes Excise Taxes Miscellaneous Revenue Customs Duties Column B a. 4 Select the three correct answers. O a Medicare and Medicaid Ob military and defense Uc state and local governments. Ud Federal Bureau of Investigation De education and transportation A f Social Security b. 2 c. 5 d. 1 e. 6 f. 3 Questio Which items are part of mandatory spending in the federal government?arrow_forward"Discuss the Impact of Taxes on Household Savings in the United States"arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Microeconomics (MindTap Course List)EconomicsISBN:9781305971493Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...

Economics

ISBN:9781285165875

Author:N. Gregory Mankiw

Publisher:Cengage Learning