Microeconomic Theory

12th Edition

ISBN: 9781337517942

Author: NICHOLSON

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Give every answer steps and take a like

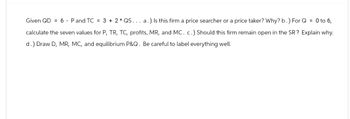

Transcribed Image Text:Given QD 6 Pand TC = 3 + 2 * QS... a.) Is this firm a price searcher or a price taker? Why? b.) For Q = 0 to 6,

calculate the seven values for P, TR, TC, profits, MR, and MC. c.) Should this firm remain open in the SR? Explain why.

d.) Draw D, MR, MC, and equilibrium P&Q. Be careful to label everything well.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Short-run supply and long-run equilibrium Consiber the competitive market for rhodium. Assume that no matter how many firms operate in the induatry, every firm is identical and faces the same marpinal cost (MC), averapt total cost (ATC), and average variable cost (AVC ) curves plotted in the following praph. The following graph plots the market demand curve for thodium. If there were 10 firms in this market, the short-run equilibrium price of rhodium would be per pound. At that price, firms in this industry would. Therefore, in the long run, firms would the rhodium market. Because you know that competitive firms earn economic profit in the long run, you know the long-run equilibrium price must be per pound. From the graph, you can see that this means there will be firms operating in the rhodium industry in long-run equilibrium. True or False: Assuming implicit costs are positive, each of the firms operating in this industry in the long run earns positive accounting profit. True Falsearrow_forward3. Technology for producing q gives rise to the cost function c(q) = aq+ bq². The market demand for q is p = a - Bq. (a) If a > 0, if b 0 and b 0 and b >0, what is the long run equilibrium market price and number of firms? Explain.arrow_forward(Please attempt thus question if you will provide Solution for both questions below...thanks) 1) If a firm wanted to reduce the annual EOQ cost as a percentage of the annual purchase cost by 50 percent, how would the demand rate have to change? A) Decrease by 50 percent. B) Remain unchanged. C) Increase by 50 percent. D) Double. E) Quadruple. Select correct option and explain answer with Calculation. 2) A firm evaluates its EOQ quantity to equal 180 cases, but it chooses an order quantity of 200 cases. Relative to the order quantity of 180 cases, the order quantity of 200 cases has A) higher ordering cost and higher holding cost. B) higher ordering cost and lower holding cost. C) lower ordering cost and higher holding cost D) lower ordering cost and lower holding cost.arrow_forward

- Complete the following table. Note that the firm in question is profit-maximizing in a competitive market. Units of output Average Revenue 90 Average Total Cost $6 $6 Group of answer choices A.) x=$6,y=$3,z=$270 B.) x=$3,y=$6,z=$0 C.) x=$6,y=$3,z=$0 D.) x=$3,y=$6,z=$270 Fixed Marginal Cost Cost 270 X Average Variable Profit Cost y Zarrow_forward4.5 Show that the long-run equilibrium number of firms is indeterminate when all firms in the industryshare the same constant returns-to-scale technology and face the same factor prices.4.7 Technology for producing q gives rise to the cost function c(q) = aq + bg. The market demand forqisp =a - Bq.(a) If a>0, if b < 0, and if there are J firms in the industry, what is the short-run equilibriummarket price and the output of a representative firm?b) Ifa> 0 and b <0, what is the long-run equilibrium market price and number of firms? Explain.() Ifa>0and b > 0, what is the long-un equilibrium market price and number of firms? Explain.arrow_forward4. Assume that a firm acts as a price taker. Regardless of the demand, it sells each unit of its product for $5. a) Assume that the firmd marginal cost is given by MC = 0:2q + 3. What is the level of output q that maximizes profit? b) Assume the total cost is given by T C = 0.1q^2 + 3q + 10. Calculate the firms profit. c) Graph these results and label firms supply curve.arrow_forward

- Identification. Answer the following questions below. QUESTIONS: 1.) What are the ways to cut firm's production costs? 2.) What determines the firm's market power or competitive advantage? 3.) Graphically, in a purely competitive market, demand is equal to what? 4.) Using curves, graphically, a firm will shutdown if what? 5.) What is an output at which the firm makes a normal profit but noteconomic profit?arrow_forwardMondi Company produces party boxes that are sold in bundles of 1000 boxes. The market is highly competitive, with boxes currently selling for R100 per thousand. The company has a total and marginal cost curve given by: TC = 3,000,000 + 0.001Q2 MC = 0.002Q Q is measured in thousand box bundles per year. [5] a. Determine Mondi's profit maximizing quantity. b. Calculate if the firm is earning a profit or a loss? c. Based on the analysis above, should Mondi Company operate or shut down in the shortrun?arrow_forward2. Consider a market with 90 firms, each firm has a short-run total cost function as follows: TC(q) = 5q2, and a marginal cost function: MC(q) = 10q. Market demand is given by equation Qd(p) = 200 - p. a. Solve for the short-run equilibrium outcome: P*, Q* and q*. b. What is one firm's economic profit in this market? c. Consider a different market structure, where there is only one firm, interpreted as a monopolist, and then critically discuss the impact on equilibrium price and quantity. Discuss total surplus for these two types of market structures.arrow_forward

- If the wool industry is perfectly competitive, the market demand curve for wool is and an individual wool producer's demand curve is O horizontal; horizontal O downward sloping; horizontal O downward sloping; downward sloping O horizontal: downward sloping tv MacBook Pro F8 F9 딤 F3 D00 F4 F7 F6 F5 $4 & %24 %23arrow_forwardSolve all this question......you will not solve all questions then I will give you down?? upvote..arrow_forwarda) What is the profit maximising condition in a market with perfect competition?b) Explain what is meant by abnormal profit? What is the adjustment process from short-run abnormal profit to long-run equilibrium in a perfectly competitive market?c) Please find below Pricing options for firm A and B, along with individual payoffs (Firm A’s payoff/Firm B’s payoff)Firm BFirm APrice £2 Price £1Price £2 £20,000/£20,000 £10,000/£24,000Price £1 £24,000/£10,000 £12,000/£12,000Assume you are the pricing manager at Firm A;i) What is your payoff for a ‘maximin’ strategy?ii) What is your payoff for a ‘maximax’ strategy?iii) Does a dominant strategy exist within this prisoners’ dilemma?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you