EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Can you answer please and kindly show detailed human working.

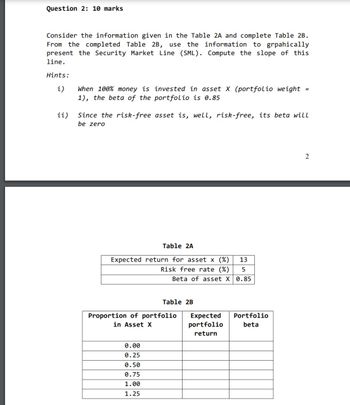

Transcribed Image Text:Question 2: 10 marks

Consider the information given in the Table 2A and complete Table 2B.

From the completed Table 2B, use the information to grpahically

present the Security Market Line (SML). Compute the slope of this

line.

Hints:

i)

ii)

When 100% money is invested in asset X (portfolio weight

1), the beta of the portfolio is 0.85

Since the risk-free asset is, well, risk-free, its beta will

be zero

Table 2A

Expected return for asset x (%) 13

Risk free rate (%)

5

Beta of asset X 0.85

Table 2B

Proportion of portfolio

in Asset X

0.00

0.25

0.50

0.75

1.00

1.25

Expected Portfolio

portfolio

beta

return

2

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Can you please answer and kindly show detailed human working.arrow_forwardQuestion 1 Fill the parts in the above table that are shaded in yellow. You will notice that there are nineline items. Question 2Using the data generated in the previous question (Question 1);a) Plot the Security Market Line (SML) b) Superimpose the CAPM’s required return on the SML c) Indicate which investments will plot on, above and below the SML? d) If an investment’s expected return (mean return) does not plot on the SML, what doesit show? Identify undervalued/overvalued investments from the grapharrow_forwardBaghibenarrow_forward

- Consider the information given in the Table 2A and complete Table 2B. From the completed Table 2B, use the information to grpahically present the Security Market Line (SML). Compute the slope of this line.Hints: i) When 100% money is invested in asset X (portfolio weight = 1), the beta of the portfolio is 0.85ii) Since the risk-free asset is, well, risk-free, its beta will be zeroarrow_forwardConsider the information given in the Table 2A and complete Table 2B. From the completed Table 2B, use the information to grpahically present the Security Market Line (SML). Compute the slope of this line. Hints: i) When 100% money is invested in asset X (portfolio weight = 1), the beta of the portfolio is 0.85ii) Since the risk-free asset is, well, risk-free, its beta will be zeroarrow_forwardConsider following information on a risky portfolio, risk-free asset and the market index. What is the T2 of the risky portfolio? Risky portfolio Risk-free asset Market index Average return 8.2% 2% 6% Std. Dev. 26% 20% Residual std. dev. 10% Alpha 1.4% Beta 1.2arrow_forward

- 1. calculate the beta of the portfolio below consisting of assets x, y and z. discuss the meaning of the number calculated and include in your answer what type of investor is likely to invest in this portfolio. Asset Weight (Wi) Beta (βi) X 0.30 0.09 Y 0.50 0.90 Z 0.20 0.16arrow_forwardConsider the information given in the Table 2A and complete Table 2B. From the completed Table 2B, use the information to graphically present the Security Market Line (SML). Compute the slope of thisline.Hints:i) When 100% money is invested in asset X (portfolio weight = 1), the beta of the portfolio is 0.85ii) Since the risk-free asset is, well, risk-free, its beta will be zeroarrow_forwardYou are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: 8p 1.70 1.30 0.85 1.00 Portfolio X Y Z Market Risk-free Rp 11.5% 10.5 7.2 10.9 4.6 R-squared op 38.00% 33.00 23.00 28.00 0 Assume that the correlation of returns on Portfolio Y to returns on the market is 0.76. What percentage of Portfolio Y's return is driven by the market? Note: Enter your answer as a decimal not a percentage. Round your answer to 4 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning