FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

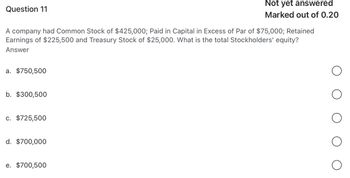

Transcribed Image Text:Question 11

Not yet answered

Marked out of 0.20

A company had Common Stock of $425,000; Paid in Capital in Excess of Par of $75,000; Retained

Earnings of $225,500 and Treasury Stock of $25,000. What is the total Stockholders' equity?

Answer

a. $750,500

b. $300,500

c. $725,500

d. $700,000

e. $700,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Knowledge Check 01 Total Assets for a company are $700,000: Accounts Payable is $75,000, Bonds Payable is $225,000; Common Stock is $300,000 and Retained Earnings is $100,000. The common-size percent for Accounts Payable is 0933% 0933.3% - 10.7% - 100.7%arrow_forward# 4 Category Prior year Current year Accounts payable 41,400 45,000 Accounts receivable 115,200 122,400 Accruals 16,200 13,500 Additional paid in capital 200,000 216,660 Cash ??? ??? Common Stock @ par value 37,600 42,000 COGS 131,400 174,268.00 Depreciation expense 21,600 22,844.00 Interest expense 16,200 16,594.00 Inventories 111,600 115,200 Long-term debt 135,000 139,107.00 Net fixed assets 379,291.00 399,600 Notes payable 59,400 64,800 Operating expenses (excl. depr.) 50,400 60,963.00 Retained earnings 122,400 136,800 Sales 255,600 335,919.00 Taxes 9,900 19,451.00 What is the current year's cash balance? Submit Answer format: Number: Round to: 0 decimal places.arrow_forward#6 O Category Prior year Current year Accounts payable 41,400 45,000 Accounts receivable 115,200 122,400 Accruals 16,200 13,500 Additional paid in capital 200,000 216,660 Cash ??? ??? Common Stock @ par value 37,600 42,000 COGS 131,400 178,670.0 Depreciation expense 21,600 22,842.00 Interest expense 16,200 16,309.00 Inventories 111,600 115,200 Long-term debt 135,000 139,952.0 Net fixed assets 376,220.00 399,600 Notes payable 59,400 64,800 Operating expenses (excl. 50,400 60,519.00 depr.) Retained earnings 122,400 136,800 Sales 255,600 337,653.0 Тахes 9,900 18,772.00 What is the current year's entry for long-term debt on a common-sized balance sheet? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) unanswered not submitted Attempts Remaining: Infinityarrow_forward

- A9arrow_forwardQuestion 8 Your Corporation had 50,000 shares of $3 par value common stock authorized, 30,000 shares issued and 20,000 shares outstanding, when the board of directors declared a cash dividend of $1.50 per share. What is the dollar amount of the cash dividend? $90,000 $45,000 $30,000 $28,000 $60,000arrow_forwardhello, I need help pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education