FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:es

C

raw

ill

!

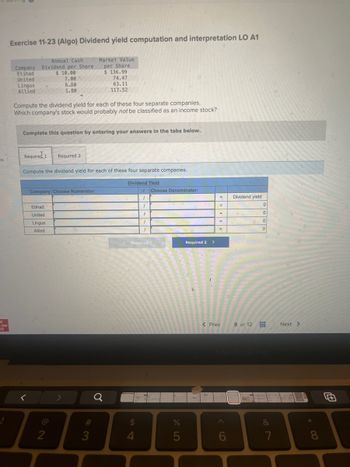

Exercise 11-23 (Algo) Dividend yield computation and interpretation LO A1

Annual Cash

Company Dividend per Share

Etihad

$ 10.00

United

Lingus

Allied

7.00

6.50

1.80

Compute the dividend yield for each of these four separate companies.

Which company's stock would probably not be classified as an income stock?

Complete this question by entering your answers in the tabs below.

Company Choose Numerator:

Etihad

United

Lingus

Allied

Required 1 Required 2

Compute the dividend yield for each of these four separate companies.

2

Market Value

per Share

#

$136.99

74.47

63.11

117.52

3

Q

Dividend Yield

54

$

1 Choose Denominator:

1

<Required 1

4

1

F

1

1

%

5

Required 2 >

=

=

=

=

=

< Prev

Dividend yield

8 of 12

0

0

0

0

&

7

Next >

* 00

8

Transcribed Image Text:es

ic

raw

lill

1

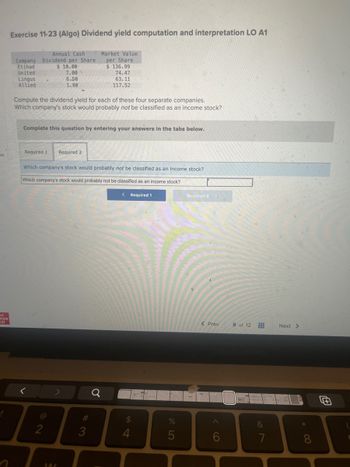

Exercise 11-23 (Algo) Dividend yield computation and interpretation LO A1

Annual Cash

Company Dividend per Share

$ 10.00

Etihad

United

Lingus

Allied

Compute the dividend yield for each of these four separate companies.

Which company's stock would probably not be classified as an income stock?

7.00

6.50

1.80

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

2

Which company's stock would probably not be classified as an income stock?

Which company's stock would probably not be classified as an income stock?

< Required 1

>

Market Value

per Share

$ 136.99

74.47

63.11

117.52

144

#3

Q

$

4

%

5

Required 2 >

< Prev

A

8 of 12

&

7

Next >

UF

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- In what situation should a firm pay a stock dividend?arrow_forwardIn computing Earnings per share when there are preference shares, the total net income after tax is reduced by the dividend in arrears of cumulative preference shares. a. TRUE b. FALSEarrow_forwardplease explain it without plagaiarisnarrow_forward

- When it comes to the market value of a company, is it true or not that it equals the number of outstanding shares multiplied by the most recent transaction price per share.arrow_forwardDiscuss the 4 types of dividends. Which of the 4 is used most often, and why? What may happen to a company’s share price when dividends are announced or paid? Why do you think this is so?arrow_forwardthe ratio of dividends per share to earnings per share is known as the dividends yield (T/F)arrow_forward

- 1. What percentage of total liabilities and stockholders’ equity is stockholders’ equity? What kinds of stock does the company have?arrow_forwardWhich of the following best describes the market capitalization of a company? Select one: a. it represents the total value of the company b. it is the product of the numbers of shares and the price per share c. it represents the total wealth associated with the company's earnings d. it is the most someone would pay for the stockarrow_forwardEarnings per share is a factor used to determine dividends. Select one: True Falsearrow_forward

- How are dividends per share for common stock used in the calculation of the following? O A. O B. O c. OD. Dividends per share payout ratio Numerator Numerator Denominator Denominator Earnings per share Numerator Not used Not used Denominatorarrow_forwardUltimately what determines the value of a share of common stock? Which would be more appropriate for evaluating your company's stock price, a constant or non-constant growth model, and why?arrow_forwardWhich of the following is true about dividends: Group of answer choices Increasing dividends can impact retained earnings. Dividends must always be paid if the company makes profit. Dividends are split equally between stockholders and bondholders. Dividends paid reduce the net income that is reported on a company's income statement.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education