Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

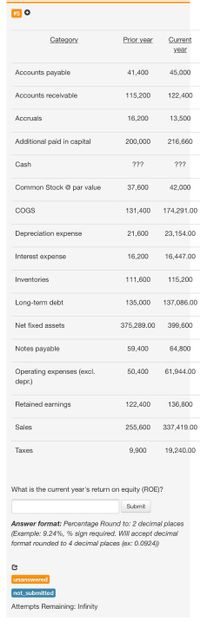

Transcribed Image Text:#5 O

Category

Prior year

Current

year

Accounts payable

41,400

45,000

Accounts receivable

115,200

122,400

Accruals

16,200

13,500

Additional paid in capital

200,000

216,660

Cash

???

???

Common Stock @ par value

37,600

42,000

COGS

131,400

174,291.00

Depreciation expense

21,600

23,154.00

Interest expense

16,200

16,447.00

Inventories

111,600

115,200

Long-term debt

135,000

137,086.00

Net fixed assets

375,289.00

399,600

Notes payable

59,400

64,800

Operating expenses (excl.

depr.)

50,400

61,944.00

Retained earnings

122,400

136,800

Sales

255,600

337,419.00

Taxes

9,900

19,240.00

What is the current year's return on equity (ROE)?

Submit

Answer format: Percentage Round to: 2 decimal places

(Example: 9.24%, % sign required. Will accept decimal

format rounded to 4 decimal places (ex: 0.0924))

unanswered

not_submitted

Attempts Remaining: Infinity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Balance Sheet December 31 Assets Cash Inventory Equipment Accounts receivable Less: Accumulated depreciation $ 21,000 520,000 142,500 $ 624,000 78,000 546,000 Total assets $ 1,229,500 Liabilities and Equity Liabilities Accounts payable Loan payable Taxes payable (due March 15) $ 355,000 11,000 88,000 454,000 Equity Common stock Retained earnings $ 474,500 301,000 775,500 Total liabilities and equity $ 1,229,500 To prepare a master budget for January, February, and March, use the following information. a. The company's single product is purchased for $30 per unit and resold for $58 per unit. The inventory level of 4,750 units on December 31 is more than management's desired level, which is 20% of the next month's budgeted sales units. Budgeted sales are January, 6,500 units; February, 9,000 units; March, 11,000 units; and April, 10,000 units. All sales are on credit. b. Cash receipts from sales are budgeted as follows: January, $233,100; February, $722,857; March, $519,245. c. Cash…arrow_forwardAa.1arrow_forwardYear Net Cash Flow Discount Factor Present Value (using the factor) Present Value (using Excel formula) 0 $ (3,500,000.00) 1 $(3,500,000.00) ($3,500,000.00) 1 $900,000.00 0.90909 $818, 181.00 $818, 181.82 2 $ 900,000.00 0.82645 $743,805.00 $743, 801.65 3 $900,000.00 0.75131 $676, 179.00 $676, 183.32 4 $ 900,000.00 0.68301 $614,709.00 $614,712.11 5 $900,000.00 0.62092 $558, 828.00 $558,829.19 Net Present Value $(88,298.00) $(88,291.91) 3. Now assume that inflation is estimated as a 5% increase each year (starting with Year 1) for the entire 5 years. Calculate the new net cash flow values for each year. Hint: You should start with 5% increase for Year 1 net cash flow.arrow_forward

- Accounts payable $509,000Notes payable $244,000Current liabilities $753,000Long-term debt $1,246,000Common equity $4,751,000Total liabilities and equity $6,750,000 What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for $1.4 million and finance it entirely with long-term debt, what would be the firm's new debt ratio?arrow_forwardDays' cash on hand Financial statement data for years ending December 31 for Newton Company follow: 20Y9 20Y8 Cash (end of year) $25,500 $24,250 Short-term investments (end of year) 8,270 9,460 Operating expenses 60,135 63,780 Depreciation expense 13,225 11,400 Determine the days’ cash on hand for 20Y8 and 20Y9. Assume 365 days in a year. Round all calculations to one decimal place. Days’ Cash on Hand 20Y8: fill in the blank 1 66 days 20Y9: fill in the blank 2 daysarrow_forwardYear Net Cash Flow Discount Factor Present Value (using the factor) Present Value (using Excel formula) 0 $ (3,500,000.00) 1 $ (3,500,000.00) ($3,500,000.00) 1 $ 900,000.00 0.90909 $ 818,181.00 $818,181.82 2 $ 900,000.00 0.82645 $ 743,805.00 $743,801.65 3 $ 900,000.00 0.75131 $ 676,179.00 $676,183.32 4 $ 900,000.00 0.68301 $ 614,709.00 $614,712.11 5 $ 900,000.00 0.62092 $ 558,828.00 $558,829.19 Net Present Value $ (88,298.00) $ (88,291.91) 3. Now assume that inflation is estimated as a 5% increase each year (starting with Year 1) for the entire 5 years. Calculate the new net cash flow values for each year. start with 5% increase for Year 1 net cash flow. Year Net Cash Flow 0 $…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education