FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:es

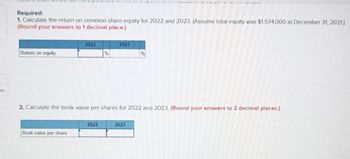

Required:

1. Calculate the return on common share equity for 2022 and 2023. (Assume total equity was $1,574,000 at December 31, 2021.)

(Round your answers to 1 decimal place.)

Return on equity

2022

Book value per share

%

2022

2023

2. Calculate the book value per shares for 2022 and 2023. (Round your answers to 2 decimal places.)

%

2023

Transcribed Image Text:ent 10-Ch 12 i

aces

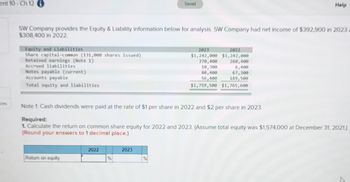

Equity and Liabilities

Share capital-common (131,000 shares issued)

Retained earnings (Note 1)

Accrued liabilities

Notes payable (current)

Accounts payable

Total equity and liabilities

SW Company provides the Equity & Liability information below for analysis. SW Company had net income of $392,900 in 2023 a

$308,400 in 2022.

Return on equity

2022

%

Saved

2023

Note 1: Cash dividends were paid at the rate of $1 per share in 2022 and $2 per share in 2023.

Required:

1. Calculate the return on common share equity for 2022 and 2023. (Assume total equity was $1,574,000 at December 31, 2021.)

(Round your answers to 1 decimal place.)

%

2023

2022

$1,242,000 $1,242,000

370,400

10,300

80,400

56,400

Help

260,400

6,400

67,300

189,500

$1,759,500 $1,765,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- rehensive Problem 2- St of Cash Flows and Ratios Algo C. Klein Inc. C. Klein Inc. Income Statement Comparative Balance Sheets December 31, 2018 and 2017 For years ended December 31, 2017 and 2018 2018 2017 Change 2018 2017 $469,000 $422,000 (303,000) (248,000) 166,000 174,000 Current assets: Sales (all on credit) Cost of goods sold Gross margin Cash $52.260 34,000 $37,900 $14,360 Accounts receivable (net) 28,000 6,000 Inventory Prepaid expenses 44,000 42,000 2100 2,000 -1,200 900 Depreciation expense Other operating 5631 36,000 51,000 Other current assets 1310 2000 -690 102,000 85,000 Totol current assets 132,470 112,000 20,470 expenses Total operating 138,000 136,000 expenses ok Operating income 28.000 38,000 Long-term Investments 75,000 52,000 23,000 Other income (expenses) Plant assets 302,000 253,000 49,000 nces Interest expense (4,700) (3,500) Less: accumulated (76,800) (51,000) 25,800 depreciation Gain on sale of 4,900 3,400 Total plant assets 225,200 202,000 23,200 investments…arrow_forwardPlease do not give solution in image format thankuarrow_forwardQUESTION I Below are the balances available for Delima Berhad as at 31 December 2015: Statement of Financial Position of Delima Berhad as 31 December 2015 RM 170,000,000 115,000,000 150,000,000 435,000,000 Non-current assets Current assets (except cash at hank) Cash at bank Issued share capital 100,000,000 ordinary shares Retained profits Non-current liability 50,000,000 5% redeemable preference shares Current liabilities Additional information: On 1 January 2016, the directors decided on the following matters 100,000,000 3. To redeem 5% redeemable preference shares at a premium of 10% 240,000,000 55,000,000 20,000,000 435,000,000 1. To issue bonus shares of one (1) ordinary shares for every ten (10) shares held to the existing shareholders. 2. To repurchase 2,000,000 ordinary shares at RM1.50 each for cancellation. (u 4 To issue 30,000,000 ordinary shares at RMI. The application were paid and fully subscribed Required: a) Prepare journal entries to record above transactions b) Prepare…arrow_forward

- what is the the quick ratio for both yearsarrow_forwardA1 Pet Supply Company issued 20,000 shares of $1 par common stock for $40 per share during 2025. The company paid dividends of $48,000 and issued a long-term note payable for $440,000 during the year. What amount of cash flows from financing activities will be reported on the statement of cash flows? OA) $12,000 net cash inflow O B) $705,000 net cash outflow OC) $1,192,000 net cash inflow D) $352,000 net cash inflowarrow_forwardNeed Answer with This Question please provide this onearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education