Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all working

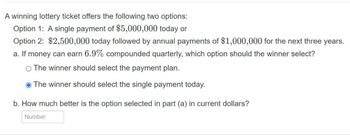

Transcribed Image Text:A winning lottery ticket offers the following two options:

Option 1: A single payment of $5,000,000 today or

Option 2: $2,500,000 today followed by annual payments of $1,000,000 for the next three years.

a. If money can earn 6.9% compounded quarterly, which option should the winner select?

O The winner should select the payment plan.

The winner should select the single payment today.

b. How much better is the option selected in part (a) in current dollars?

Number

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You have just won a two-part lottery! The first part will pay you $50,000 at the end of each of the next 20 years. The second part will pay you $1,000 at the end of each month over the same 20 year period. Assuming a discount rate of 9%, what is the present value of your winnings? use a HP 10bII+ to solve itarrow_forwardAs the winner of a lottery you are promised 15 payments of $0.98 million each year starting a year from now. If the discount rate is 0.095, what is the present value of your winnings? Instruction: Type ONLY your numerical answer in the unit of millions,arrow_forwardyou have just won the lottery and will receive $460,000 in one year. you will receive payments for 21 years, and the payments will increase 4 percent per year. if the appropriate discount rate is 11 percent, what is the present value of your winnings? Please explain how to solve using the financial calculator to show and explain steps thanksarrow_forward

- Imagine that you won $100 million in the lottery and were offered the choice between two payment plans: Plan A: Receive $61 million in a lump sum today Plan B: Receive an initial payment of $1.5 million today and annual payments that increase by 5% annually over the next 29 years (30 payments total) a. Determine the net present value of each plan without discounting. Which plan is the better option? b. Assuming an interest rate of 4%, determine the future value of each plan at the end of the 29 years with discounting. Which plan is the better option?arrow_forwardYou have just won the lottery and will receive $580,000 in one year. You will receive payments for 28 years, which will increase 3 percent per year. The appropriate discount rate is 11 percent. Required: What is the present value of your winnings? $51,626,112 $6,102,947 $6,357,236 $31,217 $51,626,112 Only typed answer and give fastarrow_forwardPlease correct answer and don't use hand ratingarrow_forward

- You have just won the lottery and will receive $1,000,000 in one year. You will receive payments for 35 years and the payments will increase by 4 percent per year. If the appropriate discount rate is 8 percent, what is the present value of (Do not round intermediate calculations and round your answer to 2 decimal places, 32.16.) your winnings? e.g., Present valuearrow_forwardLottery A pays $1,000 today and Lottery B pays $1,750 at the end of five years. If the discount rate is 5%, which lottery should you choose? ( Please show a detailed process) Lottery B, because its present value is $1,371 which is more than that of Lottery A. Lottery A, because its future value is $1,276. C.Lottery B, because it pays $1,750 which is more than $1,000 from Lottery A. Either option gives the same value over time.arrow_forwardThe prize in last week’s lottery was estimated to be worth $90 million. If you were lucky enough to win, the payment will be $3.6 million per year over the next 25 years. Assume that the first installment is received immediately. If interest rates are 6%, what is the present value of the prize? If interest rates are 6%, what is the future value after 25 years? How would your answers change if the payments were received at the end of each year? How would your answers change if the interest rate was higher?arrow_forward

- Consider the following three options: (1) receive a one-time payment $102 now, (2) receive a one-time benefit of $115 in 5 years (from now), (3) receive $2 every year forever. If the yearly discount rate is 2%, which option would yield the most revenue? O option 3 O option 2 O option 1 O options 1 and 3arrow_forwardYou have just won a two-part lottery! The first part will pay you $50,000 at the end of each of the next 20 years. The second part will pay you $1,000 at the end of each month over the same 20 year period. Assuming a discount rate of 7%, what is the present value of your winnings? $658,683 $567,572 $529,303 $610,462 $495,048arrow_forwardAssume you win a lottery that will pay you $10,000 immediately, plus $20,000 one year from now, $30,000 two years from now, $40,000 three years from now, and $75,000 four years from now. You’re curious about how much the lottery commission might offer you as an immediate lump sum instead. What is the minimum amount you should consider accepting today instead? Use a 5% annual discount rate. Please remember that we are ignoring taxation and other considerations and basing this only on the math itself.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education