FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:← → C

doctors

Chapter 2 Homework: Riley Slo x WP NWP Assessment Player Ul Ap x A Player

education.wiley.com/was/ui/v2/assessment-player/index.html?launchid=4131ffcd-b4b1-4c03-9899-2873266f84cf#/question/9

BAR

b bartleby w wiley connect MYOCC

I

CPO →bofa workjam (ulta)

workjam

← Chapter 2 Homework

Question 10 of 10 < >

Current assets

Total assets

Current liabilities

Long-term liabilities

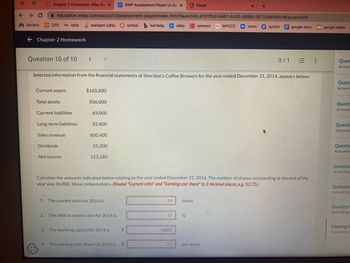

Selected information from the financial statements of Sheridan's Coffee Brewers for the year ended December 31, 2014, appears below:

Sales revenue

(ulta) school

school b bartleby

Dividends

Net income

$165,600

506,000

69,000

82,800

800,400

55,200

123,280

1. The current ratio for 2014 is

2. The debt to assets ratio for 2014 is

3. The working capital for 2014 is

Calculate the amounts indicated below relating to the year ended December 31, 2014. The number of shares outstanding at the end of the

year was 36,800. Show computations. (Round "Current ratio" and "Earnings per share" to 2 decimal places, e.g. 52.75.)

$

4. The earnings per share for 2014 is $

.24

57

96000

3.7

times

X

%

+

per share

zoom a quizletgoogle docs

0/1 =

google slides

Ques

Accour

Quest

Account

Quest

Accounti

Questi

Accountin

Questio

Accountin

Questio

Accounting

Question

Accounting

Question

Accounting

Viewing C

Accounting D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected financial information for CraneCorporation as of December are presented below. 2014 2013 Current assets $104,640 $80,080 Current liabilities 43,680 36,400 Stockholders’ equity 124,800 110,240 Total assets 312,000 280,800 Net sales and net income for 2014 were $468,000 and $37,440 respectively. Dividends of $4,160 were declared for common stockholders and $6,240for preferred shareholders in 2014. Preferred stockholders' equity is equal to 10% of total stockholders' equity.Compute the indicated ratios at December 31, 2014, or for the year ended December 31, 2014, as appropriate. (Round answers to 2 decimal places, e.g. 2.12.) 1. Return on assets enter percentages rounded to 2 demical places % 2. Profit margin enter percentages rounded to 2 demical places % 3. Payout ratio enter percentages rounded to 2 demical places % 4. Debt assets ratio enter percentages…arrow_forwardFinancial information for Kurzen INC. is presented below. December 31, 2017 December 31, 2016 Current assets $125,000 $100,000 Plant assets (net) 396,000 330,000 Current liabilities 91,000 70,000 Long - term liabilities 133,000 95,000 Common stock, $1 par 161,000 115,000 Retained earnings 136,000 150,000 Instructions: Prepare a schedule showing a horizontal analysis for 2017 using 2016 as the base year?arrow_forwardProblem 13-2A (Algo) Ratios, common-size statements, and trend percents LO P1, P2, P3 (The following information applies to the questions displayed below.] Selected comparative financial statements of Korbin Company follow. KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 2019 $ 442,035 266,105 175,930 62,769 39,783 $ 338,635 212,324 126,311 46,732 29,800 76,532 49,779 10, 205 Sales $ 235,000 Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes 150,400 84,600 31,020 19,505 50,525 34,075 102,552 73,378 13,648 Income tax expense 6,917 Net income $ 59,730 $ 39,574 $ 27,158 KORBIN COMPANY Comparative Balance Sheets December 31 2021 2020 2019 Assets $ 55,578 $ 37,199 $ 49,726 4,570 56,095 Current assets Long-term investments Plant assets, net 900 104,820 95,143 Total assets $ 160,398 $ 133,242 $ 110,391 Liabilities and Equity $ 19,318 $ 23,418 68,000 8,500 60, 480 Current liabilities $ 19,853 Common…arrow_forward

- Consolidated Statements of Changes in Shareholders' Equity ($ in thousands) Share Capital Contributed Surplus Retained Earnings AOCI(1) Total Balance at January 31, 2015 $ 167,460 $ 2,831 $ 140,527 $ 18,465 $ 329,283 Net earnings for the year — – 69,779 – 69,779 Other comprehensive income (Note 12) – – 4,583 11,953 16,536 Other comprehensive income of equity investee – – (15) – (15) Comprehensive income – – 74,347 11,953 86,300 Equity settled share-based payments – 124 – – 124 Dividends (Note 19) – – (58,210) – (58,210) Issuance of common shares (Note 15) 450 (335) – – 115 450 (211) (58,210) – (57,971) Balance at January 31, 2016 $167,910 $ 2,620 $156,664 $ 30,418 $357,612 Balance at January 31, 2014 $ 166,069 $ 3,528 $ 145,762 $ 7,081 $ 322,440 Net earnings for the year — – 62,883 – 62,883 Other comprehensive income (Note 12) – – (11,968) 11,384 (584) Other comprehensive income of equity investee – – 30 – 30 Comprehensive income – – 50,945 11,384…arrow_forwardssarrow_forwardYou have been provided with the following extracts of the financial statements of Provision Ltd for the year ended 31 December 2018. Statement of financial position for the year ended 31 December 2018 Non-current assets Current assets Inventories Trade receivables Cash Total assets Equity and Liabilities Shareholders equity and reserves Contributed equity (ordinary shares) Retained income Preference shares - Non-current liabilities Loan Current liabilities Trade payables Dividends payable Inland Revenue Total equity and liabilities Note 1 S S SSS S $ SSS S SSS S S S 2018 328,000 S 498,000 S 170,000 S 90,000 $ 62,000 $ 55,000 18,000 $ 5,000 $ 2017 80,000 $ 48,000 $ 12,000 $ 20,000 $ 286,000 170,000 110,000 418,000 $ 290,000 170,000 $ 198,000 $ 50,000 $ S S 456,000 110,000 130,000 50,000 100,000 66,000 44,000 10,000 12,000 498,000 S 456,000 Extract from the statement of profit and loss for the year ended 31 December 2018: Gross revenue S 375,000 Cost of sales $ 217,000 S 158,000 Net…arrow_forward

- QUESTION I Below are the balances available for Delima Berhad as at 31 December 2015: Statement of Financial Position of Delima Berhad as 31 December 2015 RM 170,000,000 115,000,000 150,000,000 435,000,000 Non-current assets Current assets (except cash at hank) Cash at bank Issued share capital 100,000,000 ordinary shares Retained profits Non-current liability 50,000,000 5% redeemable preference shares Current liabilities Additional information: On 1 January 2016, the directors decided on the following matters 100,000,000 3. To redeem 5% redeemable preference shares at a premium of 10% 240,000,000 55,000,000 20,000,000 435,000,000 1. To issue bonus shares of one (1) ordinary shares for every ten (10) shares held to the existing shareholders. 2. To repurchase 2,000,000 ordinary shares at RM1.50 each for cancellation. (u 4 To issue 30,000,000 ordinary shares at RMI. The application were paid and fully subscribed Required: a) Prepare journal entries to record above transactions b) Prepare…arrow_forwardHelparrow_forwardHarrow_forward

- Financial statement data for the current year for Hanz Corp. are as follows: Line Item Description Amount Net income $5,700,000 Preferred dividends $70,000 Average number of common shares outstanding 200,000 The earnings per share for the current year are? a.$28.15 b.$28.50 c.$28.85 d.$0.35arrow_forwardBalance Sheet Jack and Jill Corporation's year-end 2009 balance sheet lists current assets of $257,000, fixed assets of $807,000, current liabilities of $188,000, and long-term debt of $293,000. What is Jack and Jill's total stockholders' equity? Multple Cholce $583.000 $1,064,000 $481,000 There Is not enough Information to calculate total stockholder's equity. Prev 1 of 8 Score answer> 9:43 AM 42°F Mostly sunny ype here to search 11/5/2021 21 DELLarrow_forwardwhat is the the quick ratio for both yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education