FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

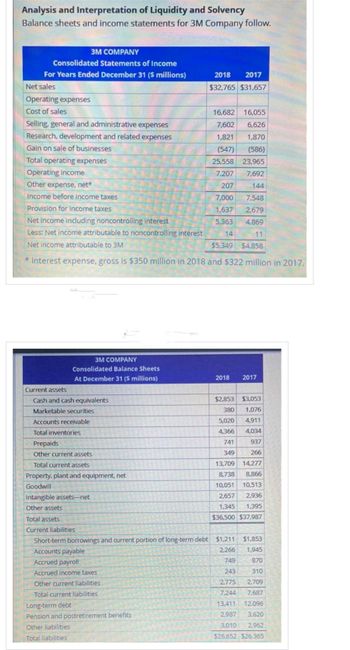

Transcribed Image Text:Analysis and Interpretation of Liquidity and Solvency

Balance sheets and income statements for 3M Company follow.

3M COMPANY

Consolidated Statements of Income

For Years Ended December 31 ($ millions)

Net sales

Operating expenses

Cost of sales

Selling, general and administrative expenses

Research, development and related expenses

Gain on sale of businesses

Total operating expenses

16,682 16,055

7,602 6,626

1,821

1,870

(547)

(586)

25,558 23,965

Operating income

7,207

7,692

Other expense, net*

207

144

Income before income taxes

7,000

7,548

Provision for income taxes

1,637

2,679

Net income including noncontrolling interest

5,363

4,869

Less: Net income attributable to noncontrolling interest

14

11

Net income attributable to 3M

$5,349

$4,858

* Interest expense, gross is $350 million in 2018 and $322 million in 2017.

Current assets

3M COMPANY

Consolidated Balance Sheets

At December 31 ($ millions)

Cash and cash equivalents

Marketable securities

Accounts receivable

Total inventories

Prepaids

Other current assets

Total current assets

Property, plant and equipment, net

Goodwill

Intangible assets-net

Other assets

Total assets

Current liabilities

2018 2017

$32,765 $31,657

Long-term debt

Pension and postretirement benefits

Other liabilities

Total liabilities

2018

2017

$2,853 $3,053

380 1,076

5,020

4,911

4,366 4,034

741

937

349

266

13,709

8,738

10,051 10,513

2,657 2,936

1,345 1,395

$36,500 $37,987

14,277

8,866

Short-term borrowings and current portion of long-term debt $1,211

$1,853

Accounts payable

2,266

1,945

Accrued payroll

749

870

Accrued income taxes

243

310

Other current liabilities

2.775 2,709

Total current liabilities

7,244 7,687

13,411

12,096

2,987

3,620

3,010 2,962

$26,652 $26.365

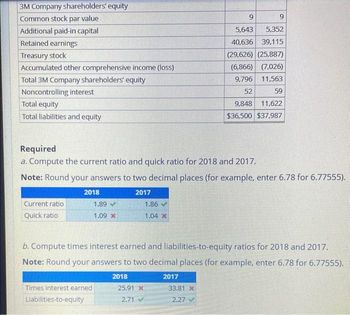

Transcribed Image Text:3M Company shareholders' equity

Common stock par value

Additional paid-in capital

Retained earnings

Treasury stock

Accumulated other comprehensive income (loss)

Total 3M Company shareholders' equity

Noncontrolling interest

Total equity

Total liabilities and equity

Required

a. Compute the current ratio and quick ratio for 2018 and 2017.

Note: Round your answers to two decimal places (for example, enter 6.78 for 6.77555).

2017

Current ratio

Quick ratio

2018

1.89

1.09 x

Times interest earned

Liabilities-to-equity

1.86

1.04 *

b. Compute times interest earned and liabilities-to-equity ratios for 2018 and 2017.

Note: Round your answers to two decimal places (for example, enter 6.78 for 6.77555).

2018

25.91 X

2.71 ✓

9

9

5,643

5,352

40,636 39,115

(29,626) (25,887)

(6,866) (7,026)

9,796 11,563

52

59

9,848 11,622

$36,500 $37,987

2017

33.81 x

2.27

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Here are comparative financial statement data for Vaughn Company and Mary Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities $ Long-term liabilities Common stock, $10 par Retained earnings (a) Vaughn Company Dollars 2022 $1,842,000 1,040,730 268,932 9,210 53,418 323,500 $314,800 520,500 501,500 64,000 109,000 497,500 173,500 $ 2021 74,800 Vaughn Company 91,000 497,500 153,000 Dollars I Condensed Income Statement Percent % 2022 % Mary Company $561,000 297,330 77.979 3,927 Prepare a vertical analysis of the 2022 income statement data for Vaughn Company and Mary Company. (Round percentages to 1 decimal place, e.g. 12.1%) 83,200 6,732 30,600 138,300 125,400 34,000 28,600 Vaughn Company 2021 4 $78,600 117,000 117,000 39,900 $ 24,200 Condensed Income Statement 34,200 Percent Dollars % % % % % % % % % $ Mary Company…arrow_forwardProvided below are the financial statements for J Ltd.: Income statement Balance Sheet Net sales $984 2021 2020 Assets Cost of goods sold $752 Current assets $452 $354 Depreciation $27 Long-term assets $389 $374 EBIT $205 Total assets $841 $728 Interest expense $25 Liabilities and shareholders' equity Current liabilities $247 $164 Income before taxes $180 Long-term debt $157 $145 Taxes $27 Shareholders' equity $437 $419 Net income $153 Total liabilities and shareholders' equity $841 $728 Calculate economic value added (EVA), assuming cost of capital is 7.5%. (Round all the intermediate calculations and the final answer to 2 decimal places) $131.95 $135.70 $98.40 $129.70arrow_forwardComparative financial statement data for Blossom Company and Oriole Company, two competitors, appear below. All balance sheet data are as of December 31, 2022. Net sales. Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities Long-term liabilities Net cash common by operating activities Capital expenditures Dividends paid on common stock Weighted-average common shares outstanding Blossom Company Oriole Company 2022 Net Income $2,592,000 1,692,000 407,520 9,980 $ 122,500 496,600 766,000 95,500 157,020 198,720 129,600 51,840 80,000 2022 $892,800 489,600 141,120 4,240 51,840 213,840 201,160 (a) Compute the net income and earnings per share for each company for 2022. (Round Earnings per share to 2 decimal places, eg $2.78) Earnings per share 48,600 58,470 51,840 28,800 21,600 50,000arrow_forward

- Below are the Income Statement and Balance Sheet for Palmer Corporation for the years ended 2020 and 2021. Calculate the liquidity ratios in the table to the right for the year ended 2021. Palmer Corporation Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $5,750,900 $4,894,800 Cost of goods sold 3,646,700 3,195,600 Gross profit 2,104,200 1,699,200 Selling expenses 775,500 688,700 Administrative expenses 863,900 815,200 Total operating expenses 1,639,400 1,503,900 Income from operations 464,800 195,300 Other income 102,500 84,600 Income before income tax 567,300 279,900 Income tax expense 200,600 101,200 Net income $366,700 $178,700 Palmer Corporation…arrow_forwardUramilabenarrow_forwardReturn on Assets Ratio and Asset Turnover Ratio Northern Systems reported the following financial data (in millions) in its annual report: Previous Year Current Year Net Income $9,050 $7,500 Net Sales 52,350 37,200 Total Assets 58,734 68,128 If the company’s total assets are $55,676 at the beginning of the previous year, calculate the company’s: (a) return on assets (round answers to one decimal place - ex: 10.7%) (b) asset turnover for both years (round answers to two decimal places) Previous Year Current Year a. Return on Assets Ratio Answer Answer b. Asset Turnover Ratio Answer Answerarrow_forward

- Identify and Compute NOPAT Following is the income statement for Lowe's Companies Inc. LOWE'S COMPANIES INC. Consolidated Statement of Earnings Twelve Months Ended (In millions) Net sales Cost of sales Gross margin Expenses Selling, general and administrative Depreciation and amortization Operating income Interest expense, net Pretax earnings Income tax provision Net earnings Feb. 1, 2019 $114,094 77,442 36,652 27,861 2,363 6,428 998 5,430 1,728 $3,702 Compute its net operating profit after tax (NOPAT) for the 12 months ended February 1, 2019, assuming a 22% total statutory tax rate. Note: Round your answer to the nearest whole dollar (millions). $ 5,014 Xarrow_forwardSelected data from Decco Company are presented below: Total assets $1,600,000 Average assets 2,000,000 Net income 380,000 Net sales 1,500,000 Average common stockholders' equity 1,000,000 Instructions Calculate the following profitability ratios from the above information. 1. Profit margin. 2. Asset turnover. 3. Return on assets.arrow_forwardSales MOSS COMPANY Income Statement For Year Ended December 31, 2021 Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense Income before taxes Income taxes expense Net income $ 549,000 357,600 191,400 128,500 49,000 13,900 8,100 $ 5,800 MOSS COMPANY Selected Balance Sheet Information At December 31 2021 2020 Current assets Cash $ 91,150 $ 33,300 Accounts receivable 31,500 45,000 66,500 55,400 Current liabilities 43,400 32,200 2,700 3,500 Inventory Accounts payable Income taxes payable Use the information above to calculate cash flows from operating activities using the indirect method. Note: Amounts to be deducted should be indicated by a minus sign. Cash flows from operating activities: Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities $ 49,000 49,000 $ 49,000arrow_forward

- Selected data from the financial statements of Rags to Riches are provided below: Current Year Prior Year Accounts Receivable $120,000 $ 76,000 Inventory 24,000 32,000 Total Assets 900,000 760,000 Net Sales 760,000 540,000 Cost of Goods Sold 320,000 420,000 Which of the following would result from vertical analysis of the company's income statement? a. The accounts receivable turnover ratio is 7.76 in the current year. b. Gross profit is 57.9% of net sales for the current year. c. Net sales are 84.4% of total assets for the current year. d. Cost of goods sold decreased by $50,000 or 23.8% duringarrow_forwardLydex Company’s financial statements for the last two years are as follows: Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: Cash $ 1,020,000 $ 1,260,000 Marketable securities 0 300,000 Accounts receivable, net 2,940,000 2,040,000 Inventory 3,660,000 2,100,000 Prepaid expenses 270,000 210,000 Total current assets 7,890,000 5,910,000 Plant and equipment, net 9,640,000 9,110,000 Total assets $ 17,530,000 $ 15,020,000 Liabilities and Stockholders' Equity Liabilities: Current liabilities $ 4,070,000 $ 3,100,000 Note payable, 10% 3,700,000 3,100,000 Total liabilities 7,770,000 6,200,000 Stockholders' equity: Common stock, $75 par value 7,500,000 7,500,000 Retained earnings 2,260,000 1,320,000 Total stockholders' equity 9,760,000 8,820,000 Total liabilities and stockholders' equity $ 17,530,000 $ 15,020,000 Lydex Company Comparative Income Statement and Reconciliation This…arrow_forwardAnalysis and Interpretation of ProfitabilityBalance sheets and income statements for 3M Company follow. 3M COMPANY Consolidated Statements of Income For Years ended December 31 ($ millions) 2018 2017 Net sales $32,765 $31,657 Operating expenses Cost of sales 16,682 16,055 Selling, general and administrative expenses 7,602 6,626 Research, development and related expenses 1,821 1,870 Gain on sale of businesses (547) (586) Total operating expenses 25,558 23,965 Operating income 7,207 7,692 Other expense, net* 207 144 Income before income taxes 7,000 7,548 Provision for income taxes 1,637 2,679 Net income including noncontrolling interest 5,363 4,869 Less: Net income attributable to noncontrolling interest 14 11 Net income attributable to 3M $ 5,349 $ 4,858 *Interest expense, gross $350 million in 2018 and $322 million in 2017. 3M COMPANY Consolidated Balance Sheets At December 31 ($ millions, except per share amount) 2018 2017…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education