FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

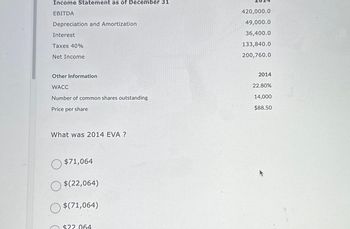

Transcribed Image Text:Income Statement as of December 31

EBITDA

Depreciation and Amortization

Interest

Taxes 40%

Net Income

Other Information

WACC

Number of common shares outstanding

Price per share

What was 2014 EVA?

$71,064

$(22,064)

$(71,064)

$22.064

420,000.0

49,000.0

36,400.0

133,840.0

200,760.0

2014

22.80%

14,000

$88.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 8 images

Knowledge Booster

Similar questions

- Debt Management Ratios Trina's Trikes, Inc. reported a debt-to-equity ratio of 1.94 times at the end of 2018. If the firm's total debt at year-end was $10.60 million, how much equity does Trina's Trikes have? Multiple Choice $5.46 million $20.56 million $10.60 million $1.94 millionarrow_forwardrehensive Problem 2- St of Cash Flows and Ratios Algo C. Klein Inc. C. Klein Inc. Income Statement Comparative Balance Sheets December 31, 2018 and 2017 For years ended December 31, 2017 and 2018 2018 2017 Change 2018 2017 $469,000 $422,000 (303,000) (248,000) 166,000 174,000 Current assets: Sales (all on credit) Cost of goods sold Gross margin Cash $52.260 34,000 $37,900 $14,360 Accounts receivable (net) 28,000 6,000 Inventory Prepaid expenses 44,000 42,000 2100 2,000 -1,200 900 Depreciation expense Other operating 5631 36,000 51,000 Other current assets 1310 2000 -690 102,000 85,000 Totol current assets 132,470 112,000 20,470 expenses Total operating 138,000 136,000 expenses ok Operating income 28.000 38,000 Long-term Investments 75,000 52,000 23,000 Other income (expenses) Plant assets 302,000 253,000 49,000 nces Interest expense (4,700) (3,500) Less: accumulated (76,800) (51,000) 25,800 depreciation Gain on sale of 4,900 3,400 Total plant assets 225,200 202,000 23,200 investments…arrow_forwardYou have been provided with the following extracts of the financial statements of Provision Ltd for the year ended 31 December 2018. Statement of financial position for the year ended 31 December 2018 Non-current assets Current assets Inventories Trade receivables Cash Total assets Equity and Liabilities Shareholders equity and reserves Contributed equity (ordinary shares) Retained income Preference shares - Non-current liabilities Loan Current liabilities Trade payables Dividends payable Inland Revenue Total equity and liabilities Note 1 S S SSS S $ SSS S SSS S S S 2018 328,000 S 498,000 S 170,000 S 90,000 $ 62,000 $ 55,000 18,000 $ 5,000 $ 2017 80,000 $ 48,000 $ 12,000 $ 20,000 $ 286,000 170,000 110,000 418,000 $ 290,000 170,000 $ 198,000 $ 50,000 $ S S 456,000 110,000 130,000 50,000 100,000 66,000 44,000 10,000 12,000 498,000 S 456,000 Extract from the statement of profit and loss for the year ended 31 December 2018: Gross revenue S 375,000 Cost of sales $ 217,000 S 158,000 Net…arrow_forward

- Ggharrow_forwardWeighted Average Cost of Capital The December 31, 2018, partial financial statements taken from the annual report for AT&T Inc. (T ) follow. Consolidated Statements of Income Dollars in millions except per share amounts 2018 2017 Operating revenues Service $152,345 $145,597 Equipment 18,411 14,949 Total operating revenues 170,756 160,546 Operating expenses Equipment 19,786 18,709 Broadcast, programming and operations 26,727 21,159 Other cost of services (exclusive of depreciation and amortization show separately below) 32,906 37,942 Selling, general and administrative 36,765 35,465 Abandonment of network assets 46 2,914 Depreciation and amortization 28,430 24,387 Total operating expenses 144,660 140,576 Operating income 26,096 19,970 Other income (expense): Interest expense (7,957) (6,300) Equity in net income of affiliates (48) (128)…arrow_forwardH6. Earnings Per Share Financial statement data for years ending December 31 for Jardine Company are shown below. 2016 2015 Net income $415,500 $331,000 Preferred dividends $63,000 $63,000 Average number of common shares outstanding 50,000 shares 40,000 shares a. Determine the earnings per share for 2016 and 2015. Round your answers to two decimal places. 2016 $fill in the blank 1 per share 2015 $fill in the blank 2 per share b. Does the change in the earnings per share from 2015 to 2016 indicate a favorable or an unfavorable trend? Show proper calculationarrow_forward

- Total assets Notes payable (6% interest) Common stock Preferred 2.5% stock, $100 par (no change during year) Retained earnings 20Y7 $5,200,000 2,500,000 250,000 Return on total assets December 31 20Y6 $5,000,000 2,500,000 250,000 500,000 1,222,000 500,000 1,574,000 < The 20Y7 net income was $411,000, and the 20Y6 net income was $462,500. No dividends on common stock were declared between 201 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7. 20Y7 a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity for the years 20Y6 and 20Y7. Round percentages to one decimal place. 19.13 % X % 20Y5 $4,800,000 2,500,000 250,000 Return on stockholders' equity Return on common stockholders' equity h The profitability ratios indicate that the company's profitability has deteriorated % 500,000 750,000 20Y6 94.0 X % % % ✓. Because the return on commonarrow_forwardProblem:arrow_forwardCorporations: Organization, Stock Transactions, and Dividend Samuels, Inc. reported net income for 2011 is $105,000. During 2011 the company had 5,000 shares of $100 par, 5% preferred stock and 20,000 of $5 par common stock outstanding. Samuel 75. earnings per share for 2011 is $4.00 b. $5.25 a. $6.50 d. $5.00 c. OBJ: LO: 13-08 DIF: KEY: Bloom's: Application Moderate ANS: A PTS: 1 BUSPROG: Analytic NAT: 76. Sabas Company has 20.000 shares ofSIONarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education