FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:D l.

3:56

Done a1961caa318d9983..._¿JWIÇ̟IJI

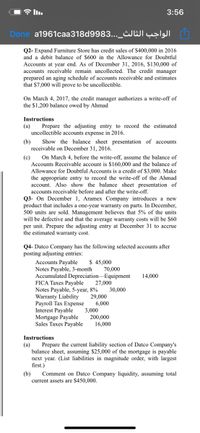

Q2- Expand Furniture Store has credit sales of $400,000 in 2016

and a debit balance of $600 in the Allowance for Doubtful

Accounts at year end. As of December 31, 2016, $130,000 of

accounts receivable remain uncollected. The credit manager

prepared an aging schedule of accounts receivable and estimates

that $7,000 will prove to be uncollectible.

On March 4, 2017, the credit manager authorizes a write-off of

the $1,200 balance owed by Ahmad

Instructions

(а)

Prepare the adjusting entry to record the estimated

uncollectible accounts expense in 2016.

(b)

Show the balance sheet presentation of accounts

receivable on December 31, 2016.

(c)

On March 4, before the write-off, assume the balance of

Accounts Receivable account is $160,000 and the balance of

Allowance for Doubtful Accounts is a credit of $3,000. Make

the appropriate entry to record the write-off of the Ahmad

account. Also show the balance sheet presentation of

accounts receivable before and after the write-off.

Q3- On December 1, Aramex Company introduces a new

product that includes a one-year warranty on parts. In December,

500 units are sold. Management believes that 5% of the units

will be defective and that the average warranty costs will be $60

per unit. Prepare the adjusting entry at December 31 to accrue

the estimated warranty cost.

Q4- Datco Company has the following selected accounts after

posting adjusting entries:

Accounts Payable

$ 45,000

Notes Payable, 3-month

70,000

Accumulated Depreciation-Equipment

14,000

FICA Taxes Payable

27,000

Notes Payable, 5-year, 8%

29,000

6,000

3,000

200,000

16,000

30,000

Warranty Liability

Payroll Tax Expense

Interest Payable

Mortgage Payable

Sales Taxes Payable

Instructions

(а)

Prepare the current liability section of Datco Company's

balance sheet, assuming $25,000 of the mortgage is payable

next year. (List liabilities in magnitude order, with largest

first.)

(b)

Comment on Datco Company liquidity, assuming total

current assets are $450,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the ending balance of Allowance for Doubtful Accounts at December 31, 2018, after all entries and adjusting entries are posted? Also what the net realizable value of accounts receivable at December 31, 2018?arrow_forwardGive me correct answer with explanationarrow_forwardAB Co made a credit sale to DE Co for $200,000 on July 19x9. It is known that at the end of 19x9 there was an outstanding receivable of $47,000. Managementestimates that $25,000 will be uncollectible.In July 19x9 the collections department stated that a receivable of $5,000 was written off frombookkeeping because it is impossible to receive payment from DE Co. Unexpectedly monthOctober 19x9 DE Co pays its outstanding debt. Requested:Prepare the adjusting entries and the journals needed to record the above transactions properlythe backup method as well as the direct deletion method!arrow_forward

- Can you also send me how to do this one? 2. Refer to the data below for XYZ Corporation. Credit sales during 2018 850,000 Accounts Receivable—January 1, 2018 334,000 Collections from credit customers during 2018 725,000 Estimated uncollectible accounts based on an aging analysis 13,200 Customer accounts written off as uncollectible during 2018 12,000 Allowance for doubtful accounts 1,700(after write-off of uncollectible accounts) Answer the following questions using the above data: A. What is the balance of Accounts Receivable at December 31, 2018? B. If the aging approach is used to estimate bad debts, what should the balance in Allowance for Doubtful Accountsbe after the bad debts adjustment? C. If the aging approach is used to estimate bad debts, what amount should be recorded as bed debts expense for2018?arrow_forwardA company must decide between scrapping or reworking units that do not pass Inspection. The company has 10,000 defective units that have already cost $132,000 to manufacture. The units can be sold as scrap for $31,000 or reworked for $45,000 and then sold for $85,000. (a) Prepare a scrap or rework analysis of Income effects. (b) Should the company sell the units as scrap or rework them? (a) Scrap or Rework Analysis Revenue from scrapped/reworked units Cost of reworked units Income Incremental income (b) The company should: Scrap Reworkarrow_forwardProvide both Answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education