FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

i need the answer quickly

Transcribed Image Text:Innovative Tech Incorporated (ITI) has been using the percentage of credit sales method to estimate bad debts. During November, ITI

sold services on account for $100,000 and estimated that 1/4 of 1 percent of those sales would be uncollectible.

Required:

1. Prepare the November adjusting entry for bad debts.

2. Starting in December, ITI switched to using the aging method. At its December 31 year-end, total Accounts Receivable is $91,100,

aged as follows: (1) 1 to 30 days old, $76,000; (2) 31 to 90 days old, $11,000; and (3) more than 90 days old, $4,100. The average rate

of uncollectibility for each age group is estimated to be (1) 11 percent, (2) 22 percent, and (3) 44 percent, respectively. Prepare a

schedule to estimate an appropriate year-end balance for the Allowance for Doubtful Accounts.

3. Before the end-of-year adjusting entry is made, the Allowance for Doubtful Accounts has a $1,650 credit balance at December 31.

Prepare the December 31 adjusting entry.

4. Show how the various accounts related to accounts receivable should be shown on the December 31 balance sheet.

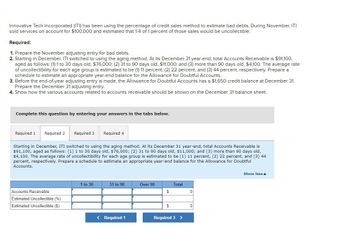

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3 Required 4

Starting in December, ITI switched to using the aging method. At its December 31 year-end, total Accounts Receivable is

$91,100, aged as follows: (1) 1 to 30 days old, $76,000; (2) 31 to 90 days old, $11,000; and (3) more than 90 days old,

$4,100. The average rate of uncollectibility for each age group is estimated to be (1) 11 percent, (2) 22 percent, and (3) 44

percent, respectively. Prepare a schedule to estimate an appropriate year-end balance for the Allowance for Doubtful

Accounts.

Accounts Receivable

Estimated Uncollectible (%)

Estimated Uncollectible ($)

1 to 30

31 to 90

Over 90

Total

$

0

$

0

< Required 1

Required 3 >

Show less▲

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education