FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

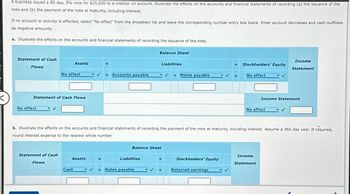

Transcribed Image Text:A business issued a 90-day, 9% note for $25,000 to a creditor on account. Illustrate the effects on the accounts and financial statements of recording (a) the issuance of the

note and (b) the payment of the note at maturity, including interest.

If no account or activity is affected, select "No effect" from the dropdown list and leave the corresponding number entry box blank. Enter account decreases and cash outflows

as negative amounts.

a. Illustrate the effects on the accounts and financial statements of recording the issuance of the note.

Statement of Cash

Flows

No effect

Statement of Cash Flows

Statement of Cash

Assets

No effect

Flows

Assets

Cash

= Accounts payable

✓

Balance Sheet

Liabilities

Liabilities

Balance Sheet

Notes payable

✓ +Notes payable

b. Illustrate the effects on the accounts and financial statements of recording the payment of the note at maturity, including interest. Assume a 360-day year. If required,

round interest expense to the nearest whole number.

+

Stockholders' Equity

✓

Retained earnings

+

+

Stockholders' Equity

No effect

No effect

Income

Statement

Income Statement

Income

Statement

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer correctly, 1 and 4 are incorrectarrow_forwardPlease do not give solution in image format thankuarrow_forwardQuestion Content Area Cash and accounts receivable for Adams Company are provided below: Current Year PriorYear Cash $76,835 $63,500 Accounts receivable (net) 48,794 78,700 Based on this information, what is the amount and percentage of increase or decrease that would be shown with horizontal analysis? Enter a decrease using a minus sign before the amount and the percentage. Account Dollar Change Percent Change Cash $fill in the blank 1 fill in the blank 2 % Accounts Receivable $fill in the blank 4 fill in the blank 5 %arrow_forward

- Please correct answer and don't use hend raitingarrow_forwardPlease no image upload without plagiarismarrow_forwardPlace an X' in the appropriate columns for each of the following situations to indicate how amounts are classified and how or whether cash is affected: Effect on Cash Operating Investing Financing Activity Inflow (+) Situation Outflow No Activity Activity () Effect a. Paying off accounts payable with cash. b. Retirement of common stock with cash. e. Issuance of bonds for |cash. |d. Acquired land by issuing | common stock. e. Paid cash for inventory. E Collection of accounts receivable with customer cash.arrow_forward

- For each independent situation below, indicate whether the transactions would be included in the statement of cash flows or not. No = Not included Yes= Included Transaction Included Sold items on account Wrote check to pay utilities Received cash investment by owner Recorded wages owed to employees Received bill for advertisingarrow_forwardPlease don't give image format and no chatgpt answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education