FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

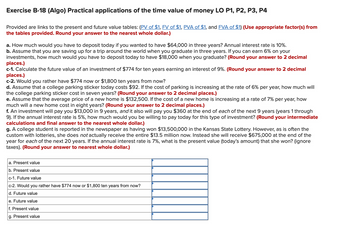

Transcribed Image Text:Exercise B-18 (Algo) Practical applications of the time value of money LO P1, P2, P3, P4

Provided are links to the present and future value tables: (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from

the tables provided. Round your answer to the nearest whole dollar.)

a. How much would you have to deposit today if you wanted to have $64,000 in three years? Annual interest rate is 10%.

b. Assume that you are saving up for a trip around the world when you graduate in three years. If you can earn 6% on your

investments, how much would you have to deposit today to have $18,000 when you graduate? (Round your answer to 2 decimal

places.)

c-1. Calculate the future value of an investment of $774 for ten years earning an interest of 9%. (Round your answer to 2 decimal

places.)

c-2. Would you rather have $774 now or $1,800 ten years from now?

d. Assume that a college parking sticker today costs $92. If the cost of parking is increasing at the rate of 6% per year, how much will

the college parking sticker cost in seven years? (Round your answer to 2 decimal places.)

e. Assume that the average price of a new home is $132,500. If the cost of a new home is increasing at a rate of 7% per year, how

much will a new home cost in eight years? (Round your answer to 2 decimal places.)

f. An investment will pay you $13,000 in 9 years, and it also will pay you $360 at the end of each of the next 9 years (years 1 through

9). If the annual interest rate is 5%, how much would you be willing to pay today for this type of investment? (Round your intermediate

calculations and final answer to the nearest whole dollar.)

g. A college student is reported in the newspaper as having won $13,500,000 in the Kansas State Lottery. However, as is often the

custom with lotteries, she does not actually receive the entire $13.5 million now. Instead she will receive $675,000 at the end of the

year for each of the next 20 years. If the annual interest rate is 7%, what is the present value (today's amount) that she won? (ignore

taxes). (Round your answer to nearest whole dollar.)

a. Present value

b. Present value

c-1. Future value

c-2. Would you rather have $774 now or $1,800 ten years from now?

d. Future value

e. Future value

f. Present value

g. Present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 5. Present value To find the present value of a cash flow expected to be paid or received in the future, you will the future value cash flow by (1+1)N What is the value today of a $42, 000 cash flow expected to be received 17 years from now based on an annual interest rate of 7% ? $13,296 $10,637 $132, 670 $20, 609 Your broker called carfier today and offered you the opportunity to invest in a security. As a friend, he suggested that you compare the current, or present value, cost of the security and the discounted value of its expected future cash flows before deciding whether or not to invest. The decision rule that should be used to decide whether or not to invest should be. Everything else being equal, you should invest if the discounted value of the security's expected future cash flows is greater than or equal to the current cost of the security. Everything else being equal, you should invest if the current cost of the security is greater than the present value of the security's…arrow_forwardCan I have an answer and solution for this one, please?arrow_forward1. 1: Time Value of Money: Introduction A dollar in hand today is worth -Select- ✓a dollar to be received in the future because if you had it now you could invest that dollar and Select- interest. Of all the techniques used in finance, none is more important than the concept of time value of money (TVM), also called -Select- analysis. Time value analysis has many applications including retirement planning, stock and bond valuation, loan amortization and capital budgeting analysis. Time value of money uses the concept of compound interest rather than simple interest.arrow_forward

- Investment A has a future value of $600. Investment B has a future value of $500. Both have the same present value. All else equal, which one has the higher interest rate? Select one: a. B b. A c. A=B Clear my choicearrow_forwardFuture Value of an Annuity Find the future value of the following annuities. The first payment in these annuities is made at the end of Year 1, so they are ordinary annuities. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM register, switch to Begin Mode, press FV, and find the FV of the annuity due.) Do not round intermediate calculations. Round your answers to the nearest cent. $600 per year for 10 years at 14%. $ $300 per year for 5 years at 7%. $ $600 per year for 5 years at 0%. $ Now rework parts a, b, and c…arrow_forwardPlease answer fastarrow_forward

- A ALEKS - Harley Biltoc - Learn O Exponential and Logarithmic Functions Finding the present value of an investment earning compound interest Explanation Check X www-awu.aleks.com S myPascoConnect C To help with his retirement savings, Pablo has decided to invest. Assuming an interest rate of 3.43% compounded quarterly, how much would he have to invest to have $128,900 after 16 years? Do not round any intermediate computations, and round your final answer to the nearest dollar. If necessary, refer to the list of financial formulas. MacBook Air 3/5 Portal Harley Ⓒ2023 McGraw Hill LLC. All Rights Reserved. Terms of Use | Privacy Center | Acces.arrow_forwardV A ALEKS-Harley Biltoc - Learn O Exponential and Logarithmic Functions Finding the present value of an investment earning compound interest www-awu.aleks.com $ myPascoConnect Ć 0/5 Portal Harley Lena is going to invest to help with a down payment on a home. How much would she have to invest to have $46,900 after 9 years, assuming an interest rate of 1.65% compounded annually? Do not round any intermediate computations, and round your final answer to the nearest dollar. If necessary, refer to the list of financial formulas.arrow_forwardWaiting periods. Fill in the number of periods for the following table,, using one of the three methods below: In (FV/PV) In (1 + r) a. Use the waiting period formula, n = b. Use the TVM keys from a calculator. c. Use the TVM function in a spreadsheet. Present Value 760.13 Future Value $ 1,585.01 Interest Rate 3% Number of Periods years (Round to the nearest whole number.)arrow_forward

- Terri Allessandro has an opportunity to make any of the following investments: The purchase price, the lump-sum future value, and the year of receipt are given below for each investment. Terri can earn a rate of return of 6% on investments similar to those currently under consideration. Evaluate each investment to determine whether it is satisfactory, and make an investment recommendation to Terri. The present value, PV Data table Investment A Purchase Price Future Value Year of Receipt $20,032 $28,000 5 B $402 $1,000 21 с $3,266 $7,000 11 D $4,173 $20,000 46 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Print Done ×arrow_forwardQuestions D, E, F, Garrow_forwardVijayarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education