Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

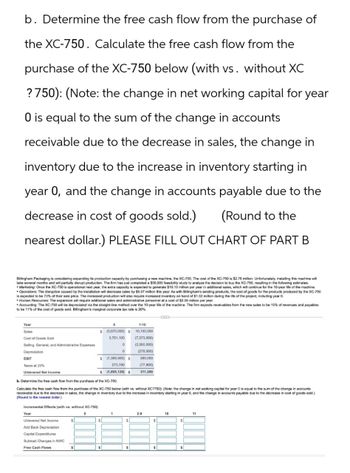

Transcribed Image Text:b. Determine the free cash flow from the purchase of

the XC-750. Calculate the free cash flow from the

purchase of the XC-750 below (with vs. without XC

? 750): (Note: the change in net working capital for year

0 is equal to the sum of the change in accounts

receivable due to the decrease in sales, the change in

inventory due to the increase in inventory starting in

year 0, and the change in accounts payable due to the

decrease in cost of goods sold.) (Round to the

nearest dollar.) PLEASE FILL OUT CHART OF PART B

Billingham Packaging is considering expanding its production capacity by purchasing a new machine, the XC-750. The cost of the XC-750 is $2.78 million. Unfortunately, installing this machine will

take several months and will partially disrupt production. The firm has just completed a $50,000 feasibility study to analyze the decision to buy the XC-750, resulting in the following estimates:

Marketing: Once the XC-750 is operational next year, the extra capacity is expected to generate $10.10 million per year in additional sales, which will continue for the 10-year life of the machine.

⚫Operations: The disruption caused by the installation will decrease sales by $5.07 million this year. As with Billingham's existing products, the cost of goods for the products produced by the XC-750

is expected to be 73% of their sale price. The increased production will also require increased inventory on hand of $1.02 million during the life of the project, including year 0.

Human Resources: The expansion will require additional sales and administrative personnel at a cost of $2.06 million per year.

Accounting: The XC-750 will be depreciated via the straight-line method over the 10-year life of the machine. The firm expects receivables from the new sales to be 15% of revenues and payables

to be 11% of the cost of goods sold. Billingham's marginal corporate tax rate is 20%.

Year

1-10

Sales

$ (5,070,000) $

Cost of Goods Sold

3,701,100

10,100,000

(7,373,000)

Selling, General, and Administrative Expenses

0

(2,060,000)

Depreciation

0

(278,000)

EBIT

$ (1,368,900) $

389,000

Taxes at 20%

Unlevered Net Income

273,780

$ (1,095,120) $

(77,800)

311,200

b. Determine the free cash flow from the purchase of the XC-750.

Calculate the free cash flow from the purchase of the XC-750 below (with vs. without XC?750): (Note: the change in net working capital for year 0 is equal to the sum of the change in accounts

receivable due to the decrease in sales, the change in inventory due to the increase in inventory starting in year 0, and the change in accounts payable due to the decrease in cost of goods sold.)

(Round to the nearest dollar.)

Incremental Effects (with vs. without XC-750)

Year

0

Unlevered Net Income

$

Add Back Depreciation

Capital Expenditures

Subtract Changes in NWC

Free Cash Flows

2-9

10

11

$

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Linkin Corporation is considering purchasing a new delivery truck. The truck has many advantages over the company’s current truck (not the least of which is that it runs). The new truck would cost $55,440. Because of the increased capacity, reduced maintenance costs, and increased fuel economy, the new truck is expected to generate cost savings of $8,400. At the end of 8 years, the company will sell the truck for an estimated $28,200. Traditionally the company has used a rule of thumb that a proposal should not be accepted unless it has a payback period that is less than 50% of the asset’s estimated useful life. Larry Newton, a new manager, has suggested that the company should not rely solely on the payback approach, but should also employ the net present value method when evaluating new projects. The company’s cost of capital is 8%.(a) Compute the cash payback period and the net present value of the proposed investment. Cash payback period 6.6 years Net present value $arrow_forwardBetter Mousetrap's research laboratories just purchased a new executive jet for its president. The jet is currently underutilized, and management is considering allowing other officers to use it. This move would save $15,500 per year in real terms in airline bills. Offsetting this benefit is the notion that the jet will have to be replaced a year sooner than originally planned. If the jet cost $1,050,000 and was originally expected to last eight years, should management allow other officers to use the jet? The real opportunity cost of is 15%. Yes, because the present value of saving, $64,486.51, is greater than the present value of cost, $57.966.48. No, because the present value of saving. $69.553.48 is less than the present value of cost, $87,038.26. No, because the present value of saving, $64.486.51, is less than the present value of cost, $76,492.59. No, because the present value of saving, $69,553.48, is Igreater than the present value of cost, $65,732.14.arrow_forwardSeattle Radiology Group plans to invest in a new CT scanner. The group estimates $1,500 net revenue per scan. Preliminary market assessments indicate that demand will be less than 5,000 scans per year. The group is considering a scanner (Scanner B) that would result in total fixed costs of $800,000 and would yield a profit of $450,000 per year at a volume of 5,000 scans. What is the estimated breakeven volume (in number of scans) for Scanner B?arrow_forward

- GSU Motor Works needs to select an assembly line for producing their new SUV. They have two options:• Option XYZ is a highly automated assembly line that has a large up-front cost but low maintenancecost over the years. This option will cost $114 million today with a yearly operating cost of $40million. The assembly line will last for 6 years and be sold for $48 million in 6 years.• Option GHI is a cheaper alternative with less technology, a longer life, but higher operating costs.This option will cost $168 million today with an annual operating cost of $32 million. Thisassembly line will last for 10 years and be sold for $23 million in 10 years.The firm’s cost of capital is 16%. Assume a tax rate of zero percent. The equivalent annual cost (EAC) for Option XYZ is $_______ million.The equivalent annual cost (EAC) for Option GHI is $_______ million.arrow_forwardRaghubhaiarrow_forwardeEgg is considering the purchase of a new distributed network computer system to help handle its warehouse inventories. The system costs $60,000 to purchase and install and $30,000 to operate each year. The system is estimated to be useful for 4 years. Management expects the new system to reduce the cost of managing inventories by $62,000 per year. The firm’s cost of capital (discount rate) is 10%. Required: 1. What is the net present value (NPV) of the proposed investment under each of the following independent situations? (Use the appropriate present value factors from Appendix C, TABLE 1 and Appendix C, TABLE 2.) 1a. The firm is not yet profitable and therefore pays no income taxes. 1b. The firm is in the 30% income tax bracket and uses straight-line (SLN) depreciation with no salvage value. Assume MACRS rules do not apply. 1c. The firm is in the 30% income tax bracket and uses double-declining-balance (DDB) depreciation with no salvage value. Given a four-year life, the DDB…arrow_forward

- Webmasters.com has developed a powerful new server that would be used for corporations' Internet activities. It would cost $10 million at Year 0 to buy the equipment necessary to manufacture the server. The project would require net working capital at the beginning of each year in an amount equal to 10% of the year's projected sales; for example, NWC = 10% (Sales). The servers would sell for $24,000 per unit, and Webmasters believes that variable costs would amount to $17,500 per unit. After Year 1, the sales price and variable costs will increase at the inflation rate of 3%. The company's nonvariable costs would be $1 million at Year 1 and would increase with inflation. The server project would have a life of 4 years. If the project is undertaken, it must be continued for the entire 4 years. Also, the project's returns are expected to be highly correlated with returns on the firm's other assets. The firm believes it could sell 1,000 units per year. The equipment would be depreciated…arrow_forwardYou have been asked to determine the most financially advantageous option for a new Product Packaging machine. It has been determined by the Marketing Department that product packaging actually makes a difference in the anticipated Yearly Revenue generated by this product and have been provided below. The director now wants an annual worth analysis performed on the two final designs based on a shortened project life of only 9 years. Compare the alternatives at the MARR of 10% per year. (all dollar values are in thousands) Packaging Packaging Machine Design Machine Design A B First Cost, $ -900 -1,500 AOC, $ per year -200 -300 Salvage value, $ (after 7 years of use) 200 Salvage value, $ (after 3 years of use) 100 Salvage value, $ (after 2 years of use) 20 50 Annual revenue, $ per year 800 900 Life, years 3 7 AW ($K per year) for one full life 268.312 312.967 cycle AW for a particle life of 2 years ($K 90.953 -240.476 per year) Assuming that the AW values for Designs A and B provided in…arrow_forwardFastCars is debating whether its next car model should be a gas or electric car. Due to factorylimitations, FastCars will only be able to introduce one new model in the next five years• Both models would have a five-year lifecycle, before they would need to be completelyredesigned. Thus FastCars will evaluate the project with a five-year time horizon• The gas model would have the following projected sales and cost of goods sold (in millions):Year 1 2 3 4 5Sales 14 17 19 19 15COGS 10 10 12 10 5 • The electric model would have the following projected sales and cost of goods sold (in millions):Year 1 2 3 4 5Sales 5 10 25 30 30COGS 4 7 15 15 12• Initial capital expenditures for retooling the factory will be 10 million dollars for the gas modeland 20 million dollars for the electric model. This cost will be depreciated fully using the straightline depreciation method over five years• A feasibility study was conducted that cost 1 million dollars and has already been paid for• The company’s…arrow_forward

- United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $125,000, and thereafter, the rent is expected to grow in line with inflation at 4% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $1.35 million. This could be depreciated for tax purposes straight-line over 10 years. However, Pigpen expects to terminate the project at the end of 8 years and to resell the plant and equipment in year 8 for $450,000. Finally, the project requires an immediate Investment in working capital of $375,000. Thereafter, working capital is forecasted to be 10% of sales in each of years 1 through 7. Year 1 sales of hog feed are expected to be $4.70 million, and thereafter, sales are forecasted to grow by 5% a year, slightly faster than the inflation rate. Manufacturing costs…arrow_forwardJamie Williams, the project manager of Arc Systems Ltd. is evaluating a proposal to install solarpanels on the roof of its factory. The panels will cost $150,000 per set. Depending on the price ofelectricity and the efficiency of the panels, the project will increase operating cash flows by either$50,000 per year or $75,000 per year. The useful life of the panels is 5 years. If early resultsindicate savings of $75,000 per year, four additional sets of panels will be installed immediatelyat the same cost with the same projected savings. The probability of either outcome is 50%. Usinga discount rate of 10%:Required:i. Compute the expected NPV of the project if the option to expand is NOT considered. ii. Compute the expected NPV of the project if the option to expand is considered. iii. Why is it important to consider real options in the capital budgeting process? GiveONE (1) specific example.arrow_forwardUnited Pigpen (UP) is considering a proposal to manufacture high protein hog feed. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year’s rental charge on the warehouse is $260,000, and thereafter the rent is expected to grow in line with inflation at 4% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $3.1 million. This could be depreciated for tax purposes over 10 years. However, UP expects to terminate the project at the end of eight years and to resell the plant and equipment in year 8 for $1,040,000. Finally, the project requires an initial investment in working capital of $910,000. Thereafter, working capital is forecasted to be 10% of sales in each of years 1 through 7. Year 1 sales of hog feed are expected to be $10.9 million, and thereafter sales are forecasted to grow by 5% a year, slightly faster than the inflation rate. Manufacturing costs are…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education