FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

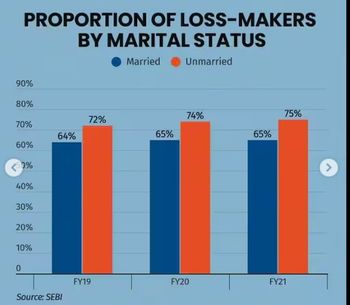

Transcribed Image Text:PROPORTION OF LOSS-MAKERS

BY MARITAL STATUS

Married

Unmarried

90%

80%

72%

70%

64%

65%

60%

<50%

40%

30%

20%

10%

0

Source: SEBI

74%

75%

65%

FY19

FY20

FY21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Sh11arrow_forwardkeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress3false еВook Problem 10-25 (LO. 2) For calendar year 2020, Jean was a self-employed consultant with no employees. She had $80,000 of net profit from consulting and paid $7,000 in medical insurance premiums on her policy covering 2020. How much of these premiums may Jean deduct as a deduction for AGI? As an itemized deduction? If an amount is zero, enter "0". Self-employed persons can deduct % of their medical insurance premiums as a deduction for AGI in 2020. Thus, Jean may deduct $ as a deduction - AGI and she may deduct $ as an itemized deduction (subject to the AGI floor). Previous Check My Workarrow_forwardUse the table to calculate the amount of money that must be invested now at 16% annually, compounded quarterly, to obtain $1,400 in three years. Click the icon to view the $1 present value table. How much money must be invested at 16% annually, compounded quarterly, to obtain S1,400 in three years? 2$ (Round to the nearest cent as needed.)arrow_forward

- Market wages Home production Expenses (net of added income) Debt/funeral costs Spouse A $1,090,655 $870,655 $1,044,786 $348,262 O $428,957.20 80,000/year 12,000/year 50,000/year 220,000 Spouse B 20,000/year 40,000/year 50,000/year 220,000 How much life insurance should be purchased for Spouse B if using the expense approach, assuming 25 years and 3% rate? Please select the number closest to your answerarrow_forwardA company charges a net single premium of S6,000 for a life insurance policy with face amount $25,000. The force of interest for this policy is 4 Find the probability that the company makes a profit if Benefit paid at the moment of death and the survival function is So(t) = 1- for 0arrow_forwardExercise 10-12 (Algorithmic) (LO. 3) In 2023, Ivanna, who has three children under age 13, worked full-time while her spouse, Sergio, was attending college for nine months during the year. Ivanna earned $79,500 and incurred $8,625 of child care expenses. Click here to access the percentage chart to us for this problem. Determine Ivanna and Sergio's child and dependent care credit. 1,200 $arrow_forward

- E6arrow_forwardQuestion 56 The probability that a 37-year-old white male will live another year is .99828. What premium would an insurance company charge to break even on a one-year $1 million term life insurance policy? Break-even $_______arrow_forwardndex.html?deploymentid=60338517901669990751687760&eISBN=9780357517642&nbld=3626933&snap... ☆ MINDTAP ework Quantitative Problem 2: You and your wife are making plans for retirement. You plan on living 25 years after you retire and would like to have $80,000 annually on which to live. Your first withdrawal will be made one year after you retire and you anticipate that your retirement account will earn 10% annually. $ a. What amount do you need in your retirement account the day you retire? Do not round intermediate calculations. Round your answer to the nearest cent. Hide Feedback b. Assume that your first withdrawal will be made the day you retire. Under this assumption, what amount do you now need in your retirement account the day you retire? Do not round intermediate calculations. Round your answer to the nearest cent. $ Incorrect f6 Check My Work Feedback Review the PVAN definition and its equation. 6 Understand the difference between an ordinary annuity and an annuity due. Be…arrow_forward

- Sh16arrow_forwardAn asset used in a four-year project falls in the five-year MACRS class (MACRS Table) for tax purposes. The asset has an acquisition cost of $7,700,000 and will be sold for $1,820,000 at the end of the project. If the tax rate is 24 percent, what is the aftertax salvage value of the asset? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Aftertax salvage valuearrow_forwardRosa Burnett needs $6,000 in three years to make the down payment on a new car. How much must she invest today if she receives 2.5% interest annually, compounded annually? Click the icon to view the present value of $1.00 table. She must invest $ (Round to the nearest cent as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education