Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Rosa Burnett needs $6,000 in three years to make the down payment on a new car. How much must she invest today if she receives 2.5% interest annually,

compounded annually?

Click the icon to view the present value of $1.00 table.

She must invest $

(Round to the nearest cent as needed.)

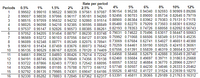

Transcribed Image Text:Rate per period

Periods

4%

5%

6%

8%

10%

12%

0.5%

0.99502 0.99010 0.98522 0.98039 0.97561 0.97087 0.96154 0.95238 0.94340 0.92593 0.90909 0.89286

0.99007 0.98030 0.97066 0.96117 0.95181 0.94260 0.92456 0.90703 0.89000 0.85734 0.82645 0.79719

0.98515 0.97059 0.95632 0.94232 0.92860 0.91514 0.88900 0.86384 0.83962 0.79383 0.75131 0.71178

0.98025 0.96098 0.94218 0.92385 0,90595 0.88849 0.85480 0.82270 0.79209 0.73503 0.68301 0.63552

0.97537 0.95147 0.92826 0.90573 0.88385 0.86261 0.82193 0.78353 0.74726 0.68058 0.62092 0.56743

0.97052 0.94205 0.91454 0.88797 0.86230 0.83748 0.79031 0.74622 0.70496 0.63017 0.56447 0.50663

0.96569 0.93272 0.90103 0.87056 0.84127 0.81309 0.75992 0.71068 0.66506 0.58349 0.51316 0.45235

0.96089 0.92348 0.88771 0.85349 0.82075 0.78941 0.73069 0.67684 0.62741 0.54027 0.46651 0.40388

0.95610 0.91434 0.87459 0.83676 0,80073 0.76642 0.70259 0.64461 0.59190 0.50025 0.42410 0.36061

0.95135 0.90529 0.86167 0.82035 0.78120 0.74409 0.67556 0.61391 0.55839 0.46319 0.38554 0.32197

0.94661 0.89632 0.84893 0.80426 0.76214 0.72242 0.64958 0.58468 0.52679 0.42888 0.35049 0.28748

0.94191 0.88745 0.83639 0.78849 0.74356 0.70138 0.62460 0.55684 0.49697 0.39711 0.31863 0.25668

0.93722 0.87866 0.82403 0.77303 0.72542 0.68095 0.60057 0.53032 0.46884 0.36770 0.28966 0.22917

0.93256 0.86996 0.81185 0.75788 0.70773 0.66112 0.57748 0.50507 0.44230 0.34046 0.26333 0.20462

0.92792 0.86135 0.79985 0.74301 0.69047 0.64186 0.55526 0.48102 0.41727 0.31524 0.23939 0.18270

0.92330 0.85282 0.78803 0.72845 0.67362 0.62317 0.53391 0.45811 0.39365 0.29189 0.21763 0.16312

1%

1.5%

2%

2.5%

3%

1

2

3

4.

6.

7

8

10

11

12

13

14

15

16

Expert Solution

arrow_forward

Step 1

Workings:

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ingrid wants to buy a $17,000 car in 8 years. How much money must she deposit at the end of each quarter in an account paying 5.3% compounded quarterly so that she will have enough to pay for her car? How much money must she deposit at the end of each quarter? $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardAmanda is going to invest to help with a down payment on a home. How much would she have to invest to have $23,400 after 9 years, assuming an interest rate of 1.79% compounded annually? Do not round any intermediate computations, and round your final answer to the nearest dollar. If necessary, refer to the list of financial formulas.arrow_forwardCarol wants to invest money in an investment account paying 10% interest compounding semi-annually. Carol would like the account to have a balance of $53,000 three years from now. How much must Carol deposit to accomplish her goal? Note: Use tables, Excel, or a financial calculator. Round your final answer to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, and PVA of $1).arrow_forward

- The Fergusons want to purchase their first home and need $14,300 for a down payment. They can save $1,025 per quarter. If they deposit this amount in an account paying 3% interest compounded quarterly, how long will it be before they can purchase a home? (Solution should be entered in years accurate to the hundredths decimal place)arrow_forwardRosie is buying a car for $25,500; She is Scheduled to make 7 annual instalments. Given an interest rate of 8%, what is the annual payment? (can you also show me the formula that you are using thanks)arrow_forwardCarol wants to invest money in an investment account paying 6% interest compounding semi-annually. Carol would like the account to have a balance of $53,000 four years from now. How much must Carol deposit to accomplish her goal? Note: Use tables, Excel, or a financial calculator. Round your final answer to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, and PVA of $1).arrow_forward

- Ingrid wants to buy a $20,000 car in 8 years. How much money must she deposit at the end of each quarter in an account paying 5.5% compounded quarterly so that she will have enough to pay for her car? How much money must she deposit at the end of each quarter? $ (Round to the nearest cent as needed.)arrow_forwardTo help with a down payment on a home, Elsa is going to invest. Assuming an interest rate of 1.73% compounded annually, how much would she have to invest to have $36,800 after 7 years? Do not round any intermediate computations, and round your final answer to the nearest dollar. If necessary, refer to the list of financial formulas. $0 S oo E Darrow_forwardDebra Moore needs $20,000 3 years from now. How much should she invest today in order to reach her goal if she can earn an annual rate of 6% compounded semiannually? Round answers to the nearest dollar.arrow_forward

- Carol wants to invest money in an investment account paying 4% interest compounding semi-annually. Carol would like the account to have a balance of $56,000 three years from now. How much must Carol deposit to accomplish her goal? Note: Use tables, Excel, or a financial calculator. Round your final answer to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, and PVA of $1). Multiple Choice $28,000 $49,784 $49,726 $49,280arrow_forwardIf you desire to have $15,000 for a down payment for a house in six years, what amount would you need to deposit today? Assume that your money will earn 2 percent.arrow_forwardNeed help with the question pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning