FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

E6

Transcribed Image Text:70

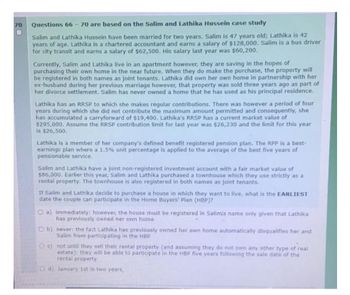

Questions 66-70 are based on the Salim and Lathika Hussein case study

Salim and Lathika Hussein have been married for two years. Salim is 47 years old; Lathika is 42

years of age. Lathika is a chartered accountant and earns a salary of $128,000. Salim is a bus driver

for city transit and earns a salary of $62,500. His salary last year was $60,200.

Currently, Salim and Lathika live in an apartment however, they are saving in the hopes of

purchasing their own home in the near future. When they do make the purchase, the property will

be registered in both names as joint tenants. Lathika did own her own home in partnership with her

ex-husband during her previous marriage however, that property was sold three years ago as part of

her divorce settlement. Salim has never owned a home that he has used as his principal residence.

Lathika has an RRSP to which she makes regular contributions. There was however a period of four

years during which she did not contribute the maximum amount permitted and consequently, she

has accumulated a carryforward of $19,400. Lathika's RRSP has a current market value of

$295,000. Assume the RRSP contribution limit for last year was $26,230 and the limit for this year

is $26,500.

Lathika is a member of her company's defined benefit registered pension plan. The RPP is a best-

earni plan where a 1.5% unit percentage is applied the average of the bes five years of

pensionable service.

Salim and Lathika have a joint non-registered investment account with a fair market value of

$86,000. Earlier this year, Salim and Lathika purchased a townhouse which they use strictly as a

rental property. The townhouse is also registered in both names as joint tenants.

If Salim and Lathika decide to purchase a house in which they want to live, what is the EARLIEST

date the couple can participate in the Home Buyers' Plan (HBP)?

Oa) immediately: however, the house must be registered in Salim's name only given that Lathika

has previously owned her own home

Ob) never: the fact Lathika has previously owned her own home automatically disqualifies her and

Salim from participating in the HBP

O c) not until they sell their rental property (and assuming they do not own any other type of real

estate): they will be able to participate in the HBP five years following the sale date of the

rental property

Od) January 1st in two years,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education