FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

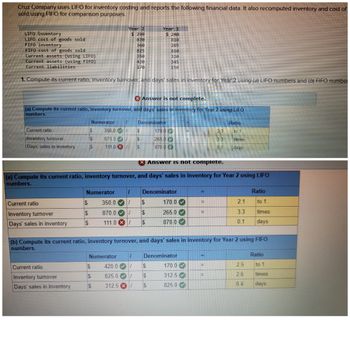

Transcribed Image Text:Cruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of

sold using FIFO for comparison purposes.

LIFO inventory

LIFO cost of goods sold

FIFO inventory

FIFO cost of goods sold

Current assets (using LIFO)

Current assets (using FIFO)

Current liabilities

1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO number

Current ratio

Inventory turnover

Days' sales in inventory

Answer is not complete.

(a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO

numbers.

Current ratio

Inventory turnover

Days' sales in inventory

Current ratio

Inventory turnover

Days' sales in inventory

$

$

$

$

Year 2

$ 290

870

360

825

350

420

170

Numerator 1 Denominator

350.0 / $

$

870.0

111.0 X

$

$

$

Numerator 1

350.0 /

(a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO

numbers.

Denominator

170.0

265.0

870.0

Numerator

$

$

$

Year 1

$240

810

265

810

320

345

150

870.0 / $

111.0/ $

1

420.0/

825.01

312.5/

170.0

265.0

870.0

X Answer is not complete.

$

$

$

Denominator

=

(b) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using FIFO

numbers.

170.0

312.5

825.0

=

=

21

3.3

0.1

Ħ

=

Ratio

to 1

times.

days

=

2.1

3.3

0.1

Ratio

to 1

2.5

2.6

0.4

times

days

Ratio

to 1

times

days

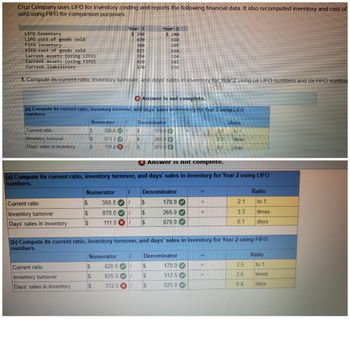

Transcribed Image Text:Cruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of

sold using FIFO for comparison purposes.

LIFO inventory

LIFO cost of goods sold

FIFO inventory

FIFO cost of goods sold

Current assets (using LIFO)

Current assets (using FIFO)

Current liabilities

1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO number

Current ratio

Inventory turnover

Days' sales in inventory

Answer is not complete.

(a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO

numbers.

Current ratio

Inventory turnover

Days' sales in inventory

Current ratio

Inventory turnover

Days' sales in inventory

$

$

$

$

Year 2

$ 290

870

360

825

350

420

170

Numerator 1 Denominator

350.0 / $

$

870.0

111.0 X

$

$

$

Numerator 1

350.0 /

(a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO

numbers.

Denominator

170.0

265.0

870.0

Numerator

$

$

$

Year 1

$240

810

265

810

320

345

150

870.0 / $

111.0/ $

1

420.0/

825.01

312.5/

170.0

265.0

870.0

X Answer is not complete.

$

$

$

Denominator

=

(b) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using FIFO

numbers.

170.0

312.5

825.0

=

=

21

3.3

0.1

Ħ

=

Ratio

to 1

times.

days

=

2.1

3.3

0.1

Ratio

to 1

2.5

2.6

0.4

times

days

Ratio

to 1

times

days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Given the following information, how much is the Inventory, beginning? Inventory end. P162,000 Net purchases, P216,000 Cost of goods sold, P144,000.arrow_forwardBrief Exercise 6-17 (Algo) Calculate inventory ratios (LO6-7) Use the following information: Net sales $215,000 Cost of goods sold 152,000 Beginning inventory 48,000 Ending inventory 38,000 a. Calculate the inventory turnover ratio.b. Calculate the average days in inventory.c. Calculate the gross profit ratio.arrow_forwardA 95.arrow_forward

- 2arrow_forwardPA11. LO 10.3 Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG). Number of Units Unit Cost Sales 240 Beginning inventory Sold $100 160 $140 Purchased Sold 520 103 400 142 Purchased Sold Ending inventory 400 110 370 144 230 Compare the calculations for gross margin for A76 Company, based on the results of the perpetual inventory calculations using FIFO, LIFO, and AVG.arrow_forwardOn the basis of the data shown below: Item InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) A13Y 144 $22 $27 TX24 274 11 7 Determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9.arrow_forward

- On the basis of the data shown below: Item InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) Raven 10 1,200 $115 $112 Dove 23 6,500 17 22 Determine the value of the inventory at the lower of cost or market. (Note: Apply lower of cost or market to each inventory item, as shown in Exhibit 9.)Exhibit 9arrow_forwardPlease do not give solution in image format thankuarrow_forwardLower-of-Cost-or-Market Method On the basis of the data shown below: Item InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) IA17 80 $39 $42 O5T4 150 20 16 Determine the value of the inventory at the lower of cost or market by applying lower of cost or market to each inventory item, as shown in Exhibit 9. $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education