FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

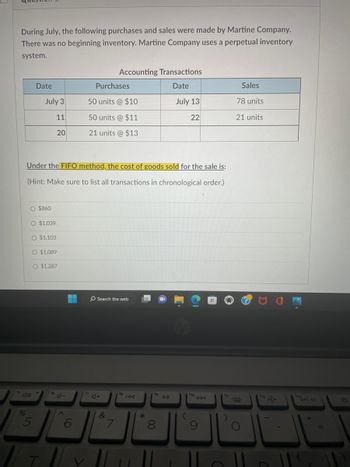

Transcribed Image Text:During July, the following purchases and sales were made by Martine Company.

There was no beginning inventory. Martine Company uses a perpetual inventory

system.

%

Date

July 3

11

O $860

O $1,039

Under the FIFO method, the cost of goods sold for the sale is:

(Hint: Make sure to list all transactions in chronological order.)

5

20

O $1,103

O $1,089

Y

O $1,287

4-

A

▬

Purchases

50 units @ $10

50 units @ $11

21 units @ $13

Accounting Transactions

Date

July 13

22

Search the web

A+

&

7

fa

IAA

*

fg

0

DII

(hp

DDI

Sales

78 units

21 units

prt sc

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Under the weighted-average method, the ending inventory is:

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Under the weighted-average method, the ending inventory is:

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information applies to the questions displayed below.]Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date Activities Units Acquired at Cost Units Sold at Retail March 1 Beginning inventory 120 units @ $51.40 per unit March 5 Purchase 235 units @ $56.40 per unit March 9 Sales 280 units @ $86.40 per unit March 18 Purchase 95 units @ $61.40 per unit March 25 Purchase 170 units @ $63.40 per unit March 29 Sales 150 units @ $96.40 per unit Totals 620 units 430 units 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, units sold include 75 units from beginning inventory, 205 units from the March 5 purchase, 55 units from the March 18 purchase, and 95 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and final answers to nearest…arrow_forwardWarnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Units Sold at Retail Units Acquired at Cost 100 units @ $50 per unit 400 units@ $55 per unit Date Mar. Mar. Mar. Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales Activities 1 Beginning inventory 5 Purchase 9 Sales 420 units @ $85 per unit 120 units @ $60 per unit 200 units @ $62 per unit 160 units @ $95 per unit Totals 820 units 580 units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 340 units from the March 5 purchase; the March 29 sale consisted of 40 units from the March 18 purchase and 120 units from the March 25 purchase. es Complete this question by einering your answers in the tabs below. Perpetual FIFO Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to…arrow_forwardPlz explain in detailarrow_forward

- Required Information [The following information applies to the questions displayed below.] Wernerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Activities Units Sold at Retail Units Acquired at Cost 100 units e $67.00 per unit 400 units e $72.00 per unit Date 1 Beginning iventory Mar. Mar. 5 Purchase Mar, 9 Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales 428 units e $182.00 per unit 120 units e $77.00 per unit 200 units e $79.00 per unit 168 unitse $112.80 per unit Totals 82e units 588 units 4. Compute gross profit esmed by the company for each of the four costing methods. For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 340 units from the March 5 purchese; the March 29 sale consisted of 40 units from the March 18 purchase and 120 units from the March 25 purchose. (Round welghted average cost per unit to two decimals and final answers to nearest whole…arrow_forwardThe following are the transactions for the month of July. Units Unit Cost Unit Selling Price July 1 Beginning Inventory 55 $ 10 July 13 Purchase 275 11 July 25 Sold (100 ) $ 14 July 31 Ending Inventory 230 Calculate cost of goods available for sale and ending inventory, then sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used. How would i creat a FIFO periodic table?arrow_forwardplease answer complete question otherwise skip it, please answer in text formarrow_forward

- Give me correct answer with explanation vkarrow_forwardSuppose that Pharoah has the following inventory data: July 1 Beginning inventory 25 units at $5.00 5 Purchases 101 units at $5.50 14 Sale 67 units 21 Purchases 50 units at $6.00 30 Sale 47 units Assuming that a perpetual inventory system is used, what is the cost of goods sold on a LIFO basis for July? O $650.50 ○ $980.50 O $330.00 O $485.00arrow_forwardVikrambhaiarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education