FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

CLOSING ENTRIES AND POST-CLOSING

work sheet in Problem 6-7A for Megaffin's Repairs. The trial balance

amounts (before adjustments) have been entered in the ledger accounts

provided in the working papers. If you are not using the working papers

that accompany this book, set up ledger accounts and enter these

balances as of January 31, 20--. A chart of accounts is provided attached.

REQUIRED

1. Journalize (page 10) and post the

2. Journalize (page 11) and post the closing entries.

3. Prepare a post-closing trial balance.

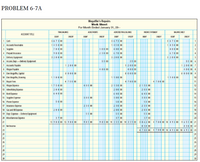

Transcribed Image Text:PROBLEM 6-7A

Megaffin's Repairs

Work Sheet

For Month Ended January 31, 20--

AL SALANI

AONUSIMUNIS

ARSID IRAL BALANE

INOME STATEMENT

MLANE SHLT

ACCOUNT TITLE

DEST

CREDT

DENT

CHEDE

DET

CRED

DEBT

CREDT

DEBT

CPEDIT

1 Cash

2 Accounts Recelvable

3 Sepplies

3673 00

1450 00

70 0 00

90 0 00

3200 00

3673 00

1450 00

673 00

1450 00

300 00

230 00

400 0

670 00

3200 00

400 00

670 00

3200 0

4 Prepak Insurance

5 Delvery Equipment

6 Accum. Depr.-Dethvery Equpnent

7 Accounts Payable

8 Wages Payable

9 Don Megan, Capital

10 Dan Meguma, Drawing

55 00

55 00

1200 00

400 00

8000 00

55 00 6

1200 00 7

400 008

1200 00

400 00

8000 00

8000 009

1100 00

1100 00

1100 00

11 Repair Fees

12 Wages Expense

470000

4700 00

4700 00

11

1750 00

200 00

640 00

2150 00

200 00

640 00

300 00

5000

230 00

200 00

SS00

2150 00

200 0

640 00

300 00

00 00

12

13 Advertising Expeme

14 Rent Experse

13

14

15 Supplies Expese

300 00

15

16 Phone Expeme

50 00

50 00

16

230 00

17 irsurance Bxpense

18 Gas and ONI Expense

19 Depr. Exponse-Dowery tqupnent

20 Miscellanesus Epense

21

22 Netincorne

230 00

17

200 00

200 00

18

5500

19

E7 00

37 00

13 90 0 00 13 9o 00

37 00

985 00 14 35 5 00 14 355 00 862 00 47 00 00 10 493 00 9655 00 21

8 38 00 22

985 00

838 00

23

4700 00 470 00 10 493 00 10 4 9 3 00 23

24

24

26

27

26

27

29

30

30

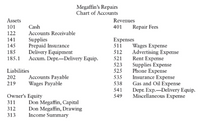

Transcribed Image Text:Megaffin's Repairs

Chart of Accounts

Assets

Revenues

101

Cash

401

Repair Fees

122

Accounts Receivable

Supplies

Prepaid Insurance

Delivery Equipment

Accum. Depr.–Delivery Equip.

141

Expenses

511

145

185

Wages Expense

Advertising Expense

Rent Expense

Supplies Expense

Phone Expense

Insurance Expense

Gas and Oil Expense

Depr. Exp.-Delivery Equip.

Miscellaneous Expense

512

185.1

521

523

Liabilities

525

Accounts Payable

Wages Payable

202

535

219

538

541

Owner's Equity

311

549

Don Megaffin, Capital

Don Megaffin, Drawing

Income Summary

312

313

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following are the job cost related accounts for the law firm of Cullumber Associates and their manufacturing equivalents: Law Firm Accounts Supplies Salaries and Wages Payable Operating Overhead Service Contracts in Process Cost of Completed Service Contracts Cost data for the month of March follow. 1. 2. 3. 4. 5. 6. Manufacturing Firm Accounts Raw Materials Factory Wages Payable Manufacturing Overhead Work in Process Cost of Goods Sold Purchased supplies on account $2,400. Issued supplies $1,680 (60% direct and 40% indirect). Assigned labor costs based on time cards for the month which indicated labor costs of $89,600 (80% direct and 20% indirect). Operating overhead costs incurred for cash totaled $51,200. Operating overhead is applied at a rate of 90% of direct labor cost. Work completed totaled $96,000.arrow_forwardHello, can you help me with questions 7,8, and 9 please, thanks!arrow_forwardRequirements Sheet in Workbook Requirement 1—Prepare the Journal Entries in the General Journal Journal Entries Requirement 2—Post Journal Entries to the General Ledger General Ledger Requirement 3—Prepare a Trial Balance Trial Balance Requirement 4—Prepare the Adjusting Entries Adjusting Entries Requirement 5—Post Adjusting Entries to the General Ledger General Ledger Requirement 6—Prepare an Adjusted Trial Balance Adjusted Trial Balance Requirement 7—Prepare the Financial Statements Financial Statements Requirement 8—Prepare the Closing Entries Closing Entries Requirement 9—Post Closing Entries to the General Ledger General Ledger Requirement 10—Prepare the Post Closing Trial Balance Post-Closing Trial Balance During its first month of operation, the Quick Tax Corporation, which specializes in tax preparation, completed the following transactions. July 1 Began business by making a deposit in a company…arrow_forward

- Complete this questions by entering your answers in the tabs below. Required 1 Required 2 Prepare the December 31 closing entries. The account number for Income Summary is 901. View transaction list Journal entry worksheet View general Journalarrow_forward.arrow_forwardCeradyne Limited accepts a three-month, 7%, $43,600 note receivable in settlement of an account receivable on April 1, 2018. Interest is due at maturity. Prepare the journal entries required by Ceradyne Limited to record the issue of the note on April 1, and the settlement of the note on July 1, assuming the note is honoured and that no interest has previously been accrued. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) te Account Titles and Explanation < Debit C Prepare the journal entries required by Ceradyne Limited to record the issue of the note on April 1, and the settlement of the note on July 1, assuming that the note is dishonoured, but eventual collection is expected. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education