FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please explain proper steps by Step and Do Not Give Solution In Image Format And Fast Answering Please ? And Thanks In Advance

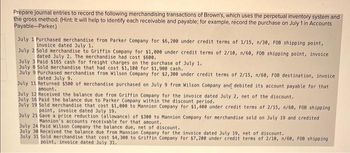

Transcribed Image Text:Prepare journal entries to record the following merchandising transactions of Brown's, which uses the perpetual inventory system and

the gross method. (Hint: It will help to identify each receivable and payable; for example, record the purchase on July 1 in Accounts

Payable-Parker)

July 1 Purchased merchandise from Parker Company for $6,200 under credit terms of 1/15, n/30, FOB shipping point,

invoice dated July 1.

July 2 Sold merchandise to Griffin Company for $1,000 under credit terms of 2/10, n/60, FOB shipping point, invoice

dated July 2. The merchandise had cost $600.

July 3 Paid $165 cash for freight charges on the purchase of July 1.

July 8 Sold merchandise that had cost $1,100 for $1,900 cash.

July 9 Purchased merchandise from Wilson Company for $2,300 under credit terms of 2/15, n/60, FOB destination, invoice

dated July 9.

July 11 Returned $500 of merchandise purchased on July 9 from Wilson Company and debited its account payable for that

amount.

July 12 Received the balance due from Griffin Company for the invoice dated July 2, net of the discount.

July 16 Paid the balance due to Parker Company within the discount period.

July 19 Sold merchandise that cost $1,000 to Mannion Company for $1,400 under credit terms of 2/15, n/60, FOB shipping

point, invoice dated July 19.

July 21 Gave a price reduction (allowance) of $300 to Mannion Company for merchandise sold on July 19 and credited

Mannion's accounts receivable for that amount.

July 24 Paid Wilson Company the balance due, net of discount.

July 30 Received the balance due from Mannion Company for the invoice dated July 19, net of discount.

July 31 Sold merchandise that cost $4,300 to Griffin Company for $7,200 under credit terms of 2/10, n/60, FOB shipping

point, invoice dated July 31.

Transcribed Image Text:Book

Ask

point, invoice dated July 31.

General

Requirement Journali

General

Ledger

Trial Balance

Schedule of

Receivables

Schedule of

Payables

Requirement

Income.

Statement

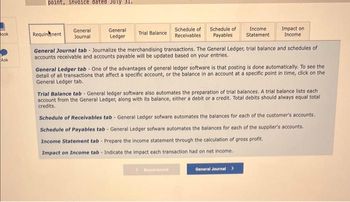

General Journal tab - Journalize the merchandising transactions. The General Ledger, trial balance and schedules of

accounts receivable and accounts payable will be updated based on your entries.

Impact on

Income

General Ledger tab - One of the advantages of general ledger software is that posting is done automatically. To see the

detail of all transactions that affect a specific account, or the balance in an account at a specific point in time, click on the

General Ledger tab.

Trial Balance tab - General ledger software also automates the preparation of trial balances. A trial balance lists each

account from the General Ledger, along with its balance, either a debit or a credit. Total debits should always equal total

credits.

Schedule of Receivables tab - General Ledger sofware automates the balances for each of the customer's accounts.

Schedule of Payables tab - General Ledger sofware automates the balances for each of the supplier's accounts.

Income Statement tab - Prepare the income statement through the calculation of gross profit.

Impact on Income tab - Indicate the impact each transaction had on net income.

General Journal >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please avoid answers in image format thank youarrow_forwardHello i have attached two pictures. They are both used together to answer the question. The first picture is the information to use too answer the question plus the spreadsheet. The second attachment is the questions I HAVE DONE ALREADY PLEASE DO NOT ANSWER 1,2 or 3 as i have answered it already. I hope it is understandable and whoever answer this can please explain how they got the answers. I need the help I need help on question 4,5,6 4. Prepare a direct labor cost budget for march 5. Prepare a factory overhead cost budger for march 6. Prepare a cost of good sold budget for march. Work in process at the beginning of march is estimated to be $15,300, and work in process at the end of march is desire to be $14,800 please answer thesearrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Please fast answering please and Do Not Give Solution In Image Format And explain proper steps by Step and thanks in advancearrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- In the image you can look at the question . Is asking me to choose the correct answer below and fill in the answer box to complete your choice . How can I solve this type of question ?arrow_forwardPlease respond via a memo on your thoughts of the GAAP article bellow:arrow_forwardCan you explain what I might be missing throughly please? I have it correct but it claims that it's not complete. What am I missing?arrow_forward

- Please correct and incorrect option explain and correct answerarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education