FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

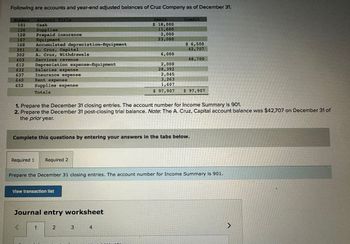

Transcribed Image Text:Following are accounts and year-end adjusted balances of Cruz Company as of December 31.

Number Account Title

101

Cash

126

Supplies

128 Prepaid insurance

167

Equipment

168 Accumulated depreciation-Equipment

301

A. Cruz, Capital

302

A. Cruz, Withdrawals

403

Services revenue

612

Depreciation expense-Equipment

622

Salaries expense

Insurance expense

637

640

652

Rent expense

Supplies expense

Totals

Required 1 Required 2

View transaction list

1. Prepare the December 31 closing entries. The account number for Income Summary is 901.

2. Prepare the December 31 post-closing trial balance. Note: The A. Cruz, Capital account balance was $42,707 on December 31 of

the prior year.

Journal entry worksheet

<

Complete this questions by entering your answers in the tabs below.

Debit

$ 18,000

11,600

2,000

23,000

1

Credit

Prepare the December 31 closing entries. The account number for Income Summary is 901.

2 3

$ 6,500

42,707

4

6,000

2,000

28,392

2,045

3,263

1,607

$ 97,907 $ 97,907

48,700

>

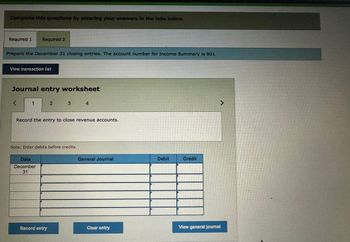

Transcribed Image Text:Complete this questions by entering your answers in the tabs below.

Required 1 Required 2

Prepare the December 31 closing entries. The account number for Income Summary is 901.

View transaction list

Journal entry worksheet

<

1

Record the entry to close revenue accounts.

2 3 4

Note: Enter debits before credits.

Date

December

31

Record entry

General Journal

Clear entry

Debit

Credit

>

View general Journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardwhat is the new way to solve this using income summary?arrow_forwardClosing Entries The adjusted trial balance prepared as of December 31 contains the following accounts. Use the information provided below to prepare journal entries to close the accounts using the Income Summary account. After these entries are posted, what is the balance in the Retained Earnings account? Debit Credit Service Fees Earned $91,000ccdefrtv Rent Expense $20, 800 Salaries Expense 52, 000 Supplies Expense 6, 000 Depreciation Expense S 11, 300 Retained Earnings $72,000 Dividends $10, 000arrow_forward

- The following adjusted trial balance contains the accounts and year-end balances of Cruz Company as of December 31. (1) Prepare the December 31 closing entries for Cruz Company. Assume the account number for Income Summary is 901. (2) Prepare the December 31 post-closing trial balance for Cruz Company. Note: The A. Cruz, Capital account balance was $47,600 on December 31 of the prior year.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. amount due for employee salaries, $4,800 actual count of supplies inventory, $ 2,300 depreciation on equipment, $3,000arrow_forwardGolden Eagle Company has the following balances at the end of November: November 30 Debit Credit Supplies Prepaid Insurance Salaries Payable $1,800 7,200 $10,600 Deferred Revenue The following information is known for the month of December: 1. Purchases of supplies for cash during December were $4,100. Supplies on hand at the end of December equal $3,300. 2. No insurance payments are made in December. Insurance expired in December is $1,800. 3. November salaries payable of $10,600 were paid to employees in December. Additional salaries for December owed at the end of the year are $15,600. 4. On December 1, Golden Eagle received $3,900 from a customer for rent for the period December through February. By the end of December, one month of rent has been provided. Required: For each item, (a) record any transaction during the month of December, and (b) prepare the related December 31 year-end adjusting entry. (If no entry is required for a particular transaction/event, select "No Journal…arrow_forward

- a. Prepare the closing entries for Donovan Co. taken from the following ledger information after adjustment on December 31, 2011 the end of the fiscal year. Accounts Payable $ 47,200 Accounts Receivable 64,300 Accumulated Depreciation 22,750 Administrative Expenses 75,500 Capital Stock 141,750 Cash 39,700 Cost of Merchandise Sold 545,000 Dividends 42,000 Interest Expense 9,000 Merchandise Inventory 93,250 Rent Revenue 7,500 Office Equipment 49,750 Sales 820,500 Selling Expenses 101,500 Depreciation Expenses 6,500 b. What inventory system does Donovan Company use? Periodic or Perpetual?arrow_forward1. Prepare the closing entries (use the income summary account). 2. Prepare the post-closing (December 31, 2018) trial balance. 3. Prepare the January 1, 2019 opening trial balance. SafetyFirst Corporation Adjusted Trial Balance 2018 December 31. Workbook last modified: August 11 Debit Credit Cash 950,000 Accounts Receivable 3,800,000 Allowance for Doubtful Accounts 750,000 Inventory 8,500,000 Prepaid Insurance Notes Receivable Equipment 16,250,000 Building 2,800,000 Land 800,000 Accumulated Depreciation: Equipment Accumulated Depreciation: Building Accounts Payable 7,000,000 900,000 5,600,000 Notes Payable (Short-Term) Salaries Payable Interest Payable Mortgage Payable (Long-Term) 2,770,000 Common Stock Par $ 0.10 280,000 Additional Paid-In Capital Retained Earnings Dividends 10,000,000 800,000 Sales (Revenue) 35,300,000 Rent Revenue Cost of Goods Sold (COGS) Selling Expense Administrative Expense 23,500,000 2,150,000 2,450,000 Interest Expense Loss on Disposition of Equipment Income…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education