Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

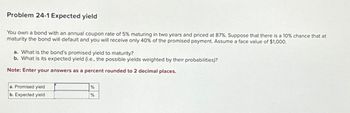

Transcribed Image Text:Problem 24-1 Expected yield

You own a bond with an annual coupon rate of 5% maturing in two years and priced at 87%. Suppose that there is a 10% chance that at

maturity the bond will default and you will receive only 40% of the promised payment. Assume a face value of $1,000.

a. What is the bond's promised yield to maturity?

b. What is its expected yield (.e., the possible yields weighted by their probabilities)?

Note: Enter your answers as a percent rounded to 2 decimal places.

a. Promised yield

b. Expected yield

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 18 YIELD TO MATURITY AND YIELD TO CALL Kempton Enterprises has bonds outstanding with a $1,000 face value and 10 years left until maturity. They have an 11% annual coupon payment, and their current price is $1,185. The bonds may be called in 5 years at 109% of face value (Call price = $1,090). What is the yield to maturity? What is the yield to call if they are called in 5 years? Which yield might investors expect to earn on these bonds? Why? The bond’s indenture indicates that the call provision gives the firm the right to call the bonds at the end of each year beginning in Year 5. In Year 5, the bonds may be called at 109% of face value, but in each of the next 4 years, the call percentage will decline by 1%. Thus, in Year 6, they may be called at 108% of face value; in Year 7, they may be called at 107% of face value; and so forth. If the yield curve is horizontal and interest rates remain at their current level, when is the latest that investors might expect the firm to call the…arrow_forwardProblem 6-23 Real Returns (LO3) Suppose that you buy a TIPS (inflation-indexed) bond with a 2-year maturity and a (real) coupon of 4.4% paid annually. If you buy the bond at its face value of $1,000, and the inflation rate is 8.60% in each year. a. What will be your cash flow in year 1? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Cash flow b. What will be your cash flow in year 2? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Cash flow c. What will be your real rate of return over the two-year period? Note: Enter your answer as a percent rounded to 1 decimal place.arrow_forward#7arrow_forward

- Question 22: A 10-year corporate bond has coupon rate equal to 5.5%. This bond has a par value equal to 100, pays annual coupons on November 17, and matures on November 17, 2033. Because of the credit risk associated with the payments of this bond, the market is discounting its cash flows using yields that are 3 percentage points higher than the yields required from credit- risk-free government bonds. As a result, this corporate bond has a yield to maturity equal to 6.711%. A. What is the price of the 10-year corporate bond? B. Using the first-order linear approximation, what would be the percentage change in the price of this 10-year corporate bond if its yield to maturity decreases by 0.5 percentage points?arrow_forwardman.3arrow_forwardR2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education