Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

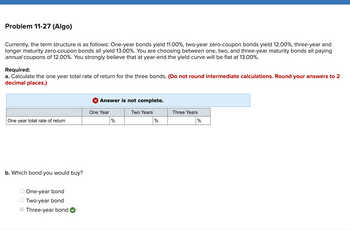

Transcribed Image Text:Problem 11-27 (Algo)

Currently, the term structure is as follows: One-year bonds yield 11.00%, two-year zero-coupon bonds yield 12.00%, three-year and

longer maturity zero-coupon bonds all yield 13.00%. You are choosing between one, two, and three-year maturity bonds all paying

annual coupons of 12.00%. You strongly believe that at year-end the yield curve will be flat at 13.00%.

Required:

a. Calculate the one year total rate of return for the three bonds. (Do not round intermediate calculations. Round your answers to 2

decimal places.)

One year total rate of return

b. Which bond you would buy?

One-year bond

Two-year bond

Three-year bond

X Answer is not complete.

One Year

%

Two Years

%

Three Years

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculate the yield on the following bonds: A. Cost $1,000, semiannual coupon payment 3%. Since 3% is semiannual, then double it to get 6% annual yield. Always calculate yield in terms of annual percentage. B. Cost $950, semiannual coupon payment 3%. Since 3% is semiannual, then double it to get 6% annual yield. Always calculate yield in terms of annual percentage.arrow_forwardGeneral Electric has just issued a callable (at par) 10- year, 5.7% coupon bond with annual coupon payments. The bond can be called at par in one year or anytime thereafter on a coupon payment date. It has a price of $ 102.15. a. What is the bond's yield to maturity? b. What is its yield to call? c. What is its yield to worst? Question content area bottom enter your response here %. (Round to two decimal places.)arrow_forwardArco Industries has a bond outstanding with 15 years to maturity, an 8.25% nominal coupon, semiannual payments, and a $1,000 par value. The bond has a 7.20% yield to maturity, but it can be called in 6 years at a price of $1,045. What is the bond's yield to call? Hint: Calculate the bond's price based on the YTM, and then use that price to find the YTC. Your answer should be between 4.08 and 10.64, rounded to 2 decimal places, with no special characters.arrow_forward

- Conceptual Overview: Explore the value of fixed-interest coupon bonds of different terms. This graph shows the value of 10% coupon bonds of different terms across differing market interest rates. Each bond pays INT = $100 at the end of each year and returns M = $1,000 at maturity. For comparison, the blue line depicts the value of a one-year bond. The term of the other bond in years may be changed using the slider. Drag on the graph to change the current market interest rate (rd) at which the bond (orange curve) is evaluated. ∑ t = 1 Y r s I N T ( 1 + r d ) + M ( 1 + r d ) = ∑ t = 1 1 5 $ 1 0 0 ( 1 + 0 . 1 0 0 ) + $ 1 0 0 0 ( 1 + 0 . 1 0 0 ) = 1 , 0 0 0 ∑ t=1 Yrs (1+r d ) t INT + (1+r d ) Yrs M =∑ t=1 15 (1+0.100) t $100 + (1+0.100) 15 $1000 =1,000 ∑t=1Yrs(1+rd)tINT+(1+rd)YrsM=∑t=115(1+0.000)t$100+(1+0.000)15$1000=2,500. 1. What is the value of a 15-year 10% $1,000 coupon bond when the market interest rate is 15%? $421$708$1,000$1,5192. What is the value of a 12-year 10% $1,000…arrow_forwardYou own a portfolio of risky, 10-year bonds with a contractual yield of 7%/year. You expect 4% of the bonds will default each year with a loss given default of 60%. What is the expected yield/year? (Your answer should be a % carried to 1 place.)arrow_forwardThe market price of a bond is $825.60, it has 15 years to maturity, a $1000 face value, and pays an annual coupon of $80. What is the yield to maturity? Please do not use Excel. I need help inputting this in my TI-84 Plus CE calculatorarrow_forward

- A treasury bond with $100 maturity face value has a $9 annual coupon, and 15 years left to maturity. What price will the bond sell for assuming that the 15 year yield to maturity in the market is 4%, 9%, and 14% respectively. (Show working out) Explain whether the price movements would have been greater or smaller if a 10 year bond had been used rather than a 15 year one without any further calculations.arrow_forwardWhat are the excel formulas and answers to Part A and Part B. Part A: (Left Side) KIMCHI CORPORATION's capital investment bonds have a maturity of 10 years with a face value of $1,000 and a semi-annual 10% coupon. They are callable in 3 years at $1150 and currently sell for $1,290. What is the nominal yield to maturity and the nominal yield to call? What return should investors expect to earn on these bonds. Part B: (Right Side) KIMCHI CORPORATION also has bonds with 5 years left to maturity with an annual coupon of 10%. What would be the yield to maturity at a current market price of $850? What would be the yield to maturity if the current market price would be $1,125? What would be the price of the bond to you if your cost of capital was 12%? What would be the price of the bond to you if your cost of capital was 8%?arrow_forwardSuppose you are considering two possible investment opportunities: a 12-year Treasury bond and a 7-year, AA-rated corporate bond. The current real risk-free rate is 3%, and inflation is expected to be 2% for the next 2 years, 3% for the following 4 years, and 4% thereafter. The maturity risk premium is estimated by this formula: MRP = 0.02(t - 1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.3%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. Corporate Bond Yield Rate Spread = DRP + LP U.S. Treasury 0.73 % — AAA corporate 0.93 0.20 % AA corporate 1.33 0.60 A corporate 1.75 1.02 What yield would you predict for each of these two investments? Round your answers to three decimal places. 12-year Treasury yield: 6.553%----->correct 7-year Corporate yield: ? %…arrow_forward

- A firm's bonds have a maturity of 8 years with a $1,000 face value, have an 8% semlannual coupon, are callable in 4 years at $1,048.54, and currently sell at a price of $1,094.91. What are their nominal yield to maturity and their nominal yield to call? Do not round Intermediate calculations. Round your answers to two decimal places. YTM: YTC: What return should investors expect to earn on these bonds? I. Investors would not expect the bonds to be called and to earn the YTM because the YTM is greater than the YTC. II. Investors would not expect the bonds to be called and to earn the YTM because the YTM is less than the YTC. III. Investors would expect the bonds to be called and to earn the YTC because the YTC is less than the YTM. IV. Investors would expect the bonds to be called and to earn the YTC because the YTC is greater than the YTM. -Select-arrow_forwardThe yield on a 1-year zero-coupon bonds is currently 7%; the YTM on 2 -year zeros is 8%. The treasury plans to issue a 2 -year maturity coupon bond, paying coupons once a year with a coupon rate of 9%. The face value of the bond is $100. (BKM 15.11) a) At what price will the bond sell? 15 p b) If the expectations theory of the yield curve is correct, what is the market expectation of the price that the bond will sell for next year? c) Recalculate your answer to b) if you believe in the liquidity preference theory and you believe the liquidity premium is 1%.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education