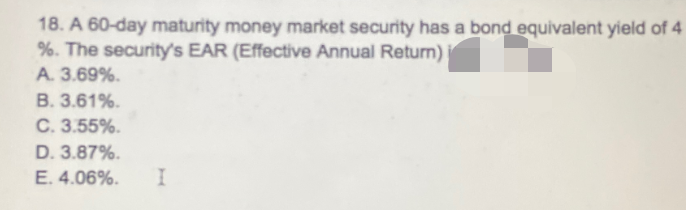

18. A 60-day maturity money market security has a bond equivalent yield of 4 %. The security's EAR (Effective Annual Return) A. 3.69%. B. 3.61%. C. 3.55%. D. 3.87%. E. 4.06%. I

18. A 60-day maturity money market security has a bond equivalent yield of 4 %. The security's EAR (Effective Annual Return) A. 3.69%. B. 3.61%. C. 3.55%. D. 3.87%. E. 4.06%. I

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter4: Bond Valuation

Section: Chapter Questions

Problem 12P: Bond Yields and Rates of Return A 10-year, 12% semiannual coupon bond with a par value of 1,000 may...

Related questions

Question

Transcribed Image Text:18. A 60-day maturity money market security has a bond equivalent yield of 4

%. The security's EAR (Effective Annual Return)

A. 3.69%.

B. 3.61%.

C. 3.55%.

D. 3.87%.

E. 4.06%.

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning