FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Problem 17-10 (Part Level Submission)

Waterway, Inc. had the following equity investment portfolio at January 1, 2020.

1,000 shares @ $16 each

880 shares @ $21 each

520 shares @ $9 each

Evers Company

$16,000

Rogers Company

18,480

Chance Company

4,680

Equity investments @ cost

39,160

Fair value adjustment

(7,150 )

Equity investments @ fair value

$32,010

During 2020, the following transactions took place.

On March 1, Rogers Company paid a $2 per share dividend.

On April 30, Waterway, Inc. sold 320 shares of Chance Company for $11 per share.

On May 15, Waterway, Inc. purchased 100 more shares of Evers Company stock at $17 per share.

1.

2.

3.

4.

At December 31, 2020, the stocks had the following price per share values: Evers $18, Rogers $20, and Chance $8.

During 2021, the following transactions took place.

On February 1, Waterway, Inc. sold the remaining Chance shares for $8 per share.

On March 1, Rogers Company paid a $2 per share dividend.

7.

5.

6.

On December 21, Evers Company declared a cash dividend of $3 per share to be paid in the next month.

8.

At December 31, 2021, the stocks had the following price per share values: Evers $20 and Rogers $22.

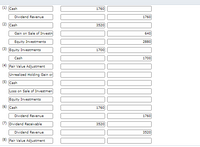

Transcribed Image Text:(1) Cash

1760

Dividend Revenue

1760

(2) Cash

3520

Gain on Sale of Investn

640

Equity Investments

2880

(3) Equity Investments

1700

Cash

1700

(4) Fair Value Adjustment

Unrealized Holding Gain or

(5) Cash

Loss on Sale of Investmen

Equity Investments

(6) Cash

1760

Dividend Revenue

1760

(7) Dividend Receivable

3520

Dividend Revenue

3520

(8) Fair Value Adjustment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SLC Corp. has the following portfolio of securities acquired for trading purposes and accounted for using the FV-NI model. SLC Inc. prepares financial statements every quarter. At Sept 30, 2021, the end of the company’s third quarter, the following information was reported: Investment Cost Fair Value 50,000 Common Shares – Seneca Inc. $215,000 $200,000 3,500 Preferred Shares – Loyalist Inc. $135,000 $140,000 2,000 Common Shares – Algonquin Inc. $180,000 $179,000 Transactions that occurred in the fourth quarter: Oct 8, 2021 The Seneca Shares were sold for $4.30 per share Nov 16, 2021 3,000 common shares of Humber Inc. were purchased at $44.50 per share SLC Inc. pays a 1% commission on purchase and sales of all securities. At the end of the fourth quarter, on December 31, 2021, the fair value of the shares were as follows: Investment Fair Value Loyalist Inc. $106,000 Algonquin Inc. $203,000 Humber Inc. $122,000 Instructions: Prepare the journal entries to record the sale, purchase and…arrow_forwardRancho Cucamonga, Inc. presents the following excerpts from its December 31, 2020 balance sheet: Long-Term Liabilities: Note payable, 8% $200,000 Bonds payable, 10% 1,000,000 Shareholders’ Equity Common stock, par 50,000 Additional paid-in-capital, common stock 350,000 Total contributed capital 400,000 Retained earnings 250,000 Total shareholders’ equity 650,000 The accounting department also conveys the following information: Risk-free rate of return - 3% Risk premium - 4.05% Tax rate – 30% Requirement: Compute Rancho Cucamonga’s weighted average cost of capital.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Oriole, Inc. had the following equity investment portfolio at January 1, 2020. Evers Company 970 shares @ $14 each $13,580 Rogers Company 910 shares @ $18 each 16,380 Chance Company 500 shares @ $9 each 4,500 Equity investments @ cost 34,460 Fair value adjustment (7,840 ) Equity investments @ fair value $26,620 During 2020, the following transactions took place. 1. On March 1, Rogers Company paid a $2 per share dividend. 2. On April 30, Oriole, Inc. sold 290 shares of Chance Company for $11 per share. 3. On May 15, Oriole, Inc. purchased 90 more shares of Evers Company stock at $17 per share. 4. At December 31, 2020, the stocks had the following price per share values: Evers $18, Rogers $17, and Chance $8. During 2021, the following transactions took place. 5. On February 1, Oriole, Inc. sold the remaining Chance shares for $8 per share. 6. On March 1, Rogers Company paid a $2 per share dividend.…arrow_forwardDo not give answer in imagearrow_forwardLarkspur Company has the following securities in its investment portfolio on December 31, 2020 (all securities were purchased in 2020): (1) 2,800 shares of Anderson Co. common stock which cost $50,400, (2) 10,800 shares of Munter Ltd. common stock which cost $604,800, and (3) 6,300 shares of King Company preferred stock which cost $270,900. The Fair Value Adjustment account shows a credit of $10,400 at the end of 2020. In 2021, Larkspur completed the following securities transactions. 1. On January 15, sold 2,800 shares of Anderson's common stock at $20 per share less fees of $2,160. 2. On April 17, purchased 900 shares of Castle's common stock at $33 per share plus fees of $2,030. On December 31, 2021, the market prices per share of these securities were Munter $65, King $40, and Castle $25. In addition, the accounting supervisor of Larkspur told you that, even though all these securities have readily determinable fair values, Larkspur will not actively trade these securities because…arrow_forward

- I need the answer as soon as possiblearrow_forwardOn December 21, 2020, Sweet Company provided you with the following information regarding its equity investments. December 31, 2020 Investments (Trading) Cost Fair Value Unrealized Gain (Loss) Clemson Corp. stock $19,300 $18,200 $(1,100 ) Colorado Co. stock 10,400 9,400 (1,000 ) Buffaloes Co. stock 19,300 19,930 630 Total of portfolio $49,000 $47,530 (1,470 ) Previous fair value adjustment balance 0 Fair value adjustment—Cr. $(1,470 ) During 2021, Colorado Co. stock was sold for $9,910. The fair value of the stock on December 31, 2021, was Clemson Corp. stock—$18,310; Buffaloes Co. stock—$19,830. None of the equity investments result in significant influence. (a) Prepare the adjusting journal entry needed on December 31, 2020. (b) Prepare the journal entry to record the sale of the Colorado Co. stock during 2021. (c) Prepare the adjusting journal entry needed on December 31,…arrow_forwardhrl.3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education