FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

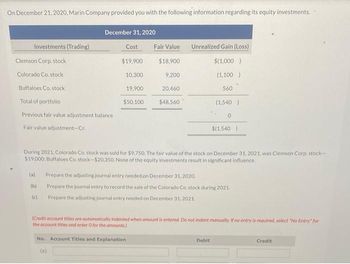

Transcribed Image Text:On December 21, 2020, Marin Company provided you with the following information regarding its equity investments.

December 31, 2020

Investments (Trading)

Cost

Fair Value

Unrealized Gain (Loss)

Clemson Corp. stock

$19,900

$18,900

$(1,000)

Colorado Co. stock

10,300

9,200

(1,100)

Buffaloes Co. stock

19,900

20,460

560

Total of portfolio

$50,100

$48,560

(1,540)

Previous fair value adjustment balance

0

Fair value adjustment-Cr.

$(1,540)

During 2021, Colorado Co. stock was sold for $9.750. The fair value of the stock on December 31, 2021, was Clemson Corp. stock-

$19,000; Buffaloes Co. stock-$20.350. None of the equity investments result in significant influence.

(a)

Prepare the adjusting journal entry needed on December 31, 2020.

(b)

Prepare the journal entry to record the sale of the Colorado Co. stock during 2021.

(c)

Prepare the adjusting journal entry needed on December 31, 2021.

(Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for

the account titles and enter O for the amounts)

No. Account Titles and Explanation

Debit

Credit

(8)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Otto Corporation has the following trading portfolio of stock investments on December 31, 20XX. Security A; Cost is $17,000 and Fair Value is $16,000; Security B; Cost is $22,000 and Fair Value is $26,000; Security C; Cost is $34,000 and Fair Value is $29,000. Instructions: prepare the adjusting entry for Otto Corporation on December 31, 20XX to report the portfolio at fair value.arrow_forwardplease do not give answers in image format thank youarrow_forwardPlease help me with correct answer thankuarrow_forward

- Here is the trial balance of MAEMBE Ltd as at 30 April 2024 DR CR TZS TZS Share capital: authorised and issued 200,000.0 Stock as at 30 April 2023 102,994.0 Debtors 227,219.0 Creditors 54,818.0 8% debentures 40,000.0 Fixed assets replacement reserve 30,000.0 General reserve 15,000.0 Profit and loss account as at 30 April 2023 12,411.0 Debenture interest 1,600.0 Equipment at cost 225,000.0 Motor vehicles at cost 57,200.0 Bank 4,973.0 Cash 62.0 Sales 880,426.0 Purchases 419,211.0 Returns inwards 18,400.0 Carriage inwards 1,452.0 Wages and salaries 123,289.0 Rent, business rates and insurance 16,240.0 Discounts allowed 3,415.0 Directors’ remuneration 82,400.0 Provision for depreciation at 30 April 2023: Equipment 32,600.0 Motor vehicles 18,200.0 TOTAL 1,283,455.0 1,283,455.0 Given the following information as at 30 April 2024, draw up a profit and loss account and balance sheet for the year to that date: (i) Stock TZS 111,317. (ii) The share…arrow_forwardKramer Company's trading debt investments portfolio is as follows: Catlett Corp. Lyman, Inc. OGOO Cost €250,000 245,000 A. €0. B. €30,000 Loss. C. €10,000 Gain. D. €10,000 Loss. €495,000 December 31, 2022 Fair Value €200,000 265,000 €465,000 Unrealized Gain (Loss) ? ? What amount should be reported as a loss or gain in Kramer's 2022 income statement, if the old balance of unrealized gain or loss in the previous year december 31, 2021 was €40,000 loss? ?arrow_forwardOn December 21, 2020, Grouper Company provided you with the following information regarding its equity investments. December 31, 2020 Investments (Trading) Cost Fair Value Unrealized Gain (Loss) Clemson Corp. stock $21,600 $20,700 $(900 ) Colorado Co. stock 10,700 9,600 (1,100 ) Buffaloes Co. stock 21,600 22,200 600 Total of portfolio $53,900 $52,500 (1,400 ) Previous fair value adjustment balance 0 Fair value adjustment—Cr. $(1,400 ) During 2021, Colorado Co. stock was sold for $10,140. The fair value of the stock on December 31, 2021, was Clemson Corp. stock—$20,790; Buffaloes Co. stock—$22,110. None of the equity investments result in significant influence. (a) Prepare the adjusting journal entry needed on December 31, 2020. (b) Prepare the journal entry to record the sale of the Colorado Co. stock during 2021. (c) Prepare the adjusting journal entry needed on December 31,…arrow_forward

- ku.1arrow_forwardOn December 21, 2020, Buffalo Company provided you with the following information regarding its equity investments. December 31, 2020 Investments (Trading) Cost Fair Value Unrealized Gain (Loss) Clemson Corp. stock $ 19,200 $ 18,300 $( 900 ) Colorado Co. stock 9,500 8,600 ( 900 ) Buffaloes Co. stock 19,200 19,800 600 Total of portfolio $ 47,900 $ 46,700 ( 1,200 ) Previous fair value adjustment balance 0 Fair value adjustment—Cr. $( 1,200 ) During 2021, Colorado Co. stock was sold for $ 9,150. The fair value of the stock on December 31, 2021, was Clemson Corp. stock—$ 18,400; Buffaloes Co. stock—$ 19,690. None of the equity investments result in significant influence. (a) Prepare the adjusting journal entry needed on December 31, 2020. (b) Prepare the journal entry to record the sale of the Colorado Co. stock during 2021. (c) Prepare the adjusting journal entry needed on…arrow_forwardDo not give answer in imagearrow_forward

- How do I determine how the firm is financing investment in assets? Based on Lowe's 2019 balance sheet Long-term Debt – $16,768mil Common Stock, $.50 par value $381mil Preferred Stock, $5 par value, none issued What would this mean to an investor?arrow_forwardshshsh not use ai pleasearrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education