FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

ku.0

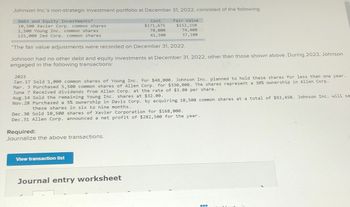

Transcribed Image Text:Johnson Inc.'s non-strategic investment portfolio at December 31, 2022, consisted of the following:

Debt and Equity Investments*

10,500 Xavier Corp. common shares

1,500 Young Inc. common shares

125,000 Zed Corp. common shares

Cost

$171,675

78,000

41,500

Fair Value

$152,250

74,400

37,100

*The fair value adjustments were recorded on December 31, 2022.

Johnson had no other debt and equity investments at December 31, 2022, other than those shown above. During 2023, Johnson

engaged in the following transactions:

2023

Jan.17 Sold 1,000 common shares of Young Inc. for $48,000. Johnson Inc. planned to hold these shares for less than one year.

Mar. 3 Purchased 5,500 common shares of Allen Corp. for $330,000. The shares represent a 30% ownership in Allen Corp.

June 7 Received dividends from Allen Corp. at the rate of $3.00 per share.

Aug.14 Sold the remaining Young Inc. shares at $32.00.

Nov. 28 Purchased a 5% ownership in Davis Corp. by acquiring 10,500 common shares at a total of $93,450. Johnson Inc. will se

these shares in six to nine months.

Dec. 30 Sold 10,500 shares of Xavier Corporation for $168,000.

Dec. 31 Allen Corp. announced a net profit of $282,500 for the year.

Required:

Journalize the above transactions.

View transaction list

Journal entry worksheet

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education