Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

A 111.

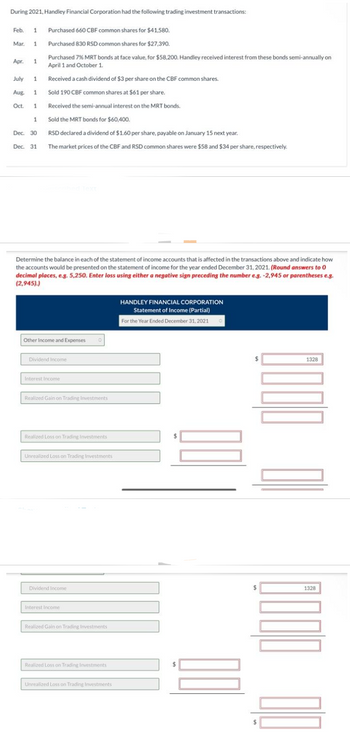

Transcribed Image Text:During 2021, Handley Financial Corporation had the following trading investment transactions:

Feb. 1 Purchased 660 CBF common shares for $41,580.

Mar. 1

Purchased 830 RSD common shares for $27,390.

Purchased 7% MRT bonds at face value, for $58,200. Handley received interest from these bonds semi-annually on

April 1 and October 1.

Received a cash dividend of $3 per share on the CBF common shares.

Sold 190 CBF common shares at $61 per share.

Received the semi-annual interest on the MRT bonds.

Sold the MRT bonds for $60,400.

RSD declared a dividend of $1.60 per share, payable on January 15 next year.

Dec. 31 The market prices of the CBF and RSD common shares were $58 and $34 per share, respectively.

Apr. 1

July

1

Aug 1

Oct. 1

1

Dec. 30

Determine the balance in each of the statement of income accounts that is affected in the transactions above and indicate how

the accounts would be presented on the statement of income for the year ended December 31, 2021. (Round answers to O

decimal places, e.g. 5,250. Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g.

(2,945).)

Other Income and Expenses

Dividend Income

Interest Income

Realized Gain on Trading Investments

Realized Loss on Trading Investments

Unrealized Loss on Trading Investments

Dividend Income

Interest Income

Realized Gain on Trading Investments

Realized Loss on Trading Investments

Unrealized Loss on Trading Investments

HANDLEY FINANCIAL CORPORATION

Statement of Income (Partial)

For the Year Ended December 31, 2021

0000

1328

GOOD DO

1328

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Frost Company has accumulated the following information relevant to its 2019 earningsper share. 1. Net income for 2019: 150,500. 2. Bonds payable: On January 1, 2019, the company had issued 10%, 200,000 bonds at 110. The premium is being amortized in the amount of 1,000 per year. Each 1,000 bond is currently convertible into 22 shares of common stock. To date, no bonds have been converted. 3. Bonds payable: On December 31, 2017, the company had issued 540,000 of 5.8% bonds at par. Each 1,000 bond is currently convertible into 11.6 shares of common stock. To date, no bonds have been converted. 4. Preferred stock: On July 3, 2018, the company had issued 3,800 shares of 7.5%, 100 par, preferred stock at 108 per share. Each share of preferred stock is currently convertible into 2.45 shares of common stock. To date, no preferred stock has been converted and no additional shares of preferred stock have been issued. The current dividends have been paid. 5. Common stock: At the beginning of 2019, 25,000 shares were outstanding. On August 3, 7,000 additional shares were issued. During September, a 20% stock dividend was declared and issued. On November 30, 2,000 shares were reacquired as treasury stock. 6. Compensatory share options: Options to acquire common stock at a price of 33 per share were outstanding during all of 2019. Currently, 4,000 shares may be acquired. To date, no options have been exercised. The unrecognized compens Frost Company has accumulated the following information relevant to its 2019 earnings ns is 5 per share. 7. Miscellaneous: Stock market prices on common stock averaged 41 per share during 2019, and the 2019 ending stock market price was 40 per share. The corporate income tax rate is 30%. Required: 1. Compute the basic earnings per share. Show supporting calculations. 2. Compute the diluted earnings per share. Show supporting calculations. 3. Indicate which earnings per share figure(s) Frost would report on its 2019 income statement.arrow_forwardTama Companys capital structure consists of common stock and convertible bonds. At the beginning of 2019, Tama had 15,000 shares of common stock outstanding; an additional 4,500 shares were issued on May 4. The 7% convertible bonds have a face value of 80,000 and were issued in 2016 at par. Each 1,000 bond is convertible into 25 shares of common stock; to date, none of the bonds have been converted. During 2019, the company earned net income of 79,200 and was subject to an income tax rate of 30%. Required: Compute the 2019 diluted earnings per share.arrow_forward2. Calculate the carrying value per share of Heritage's investment as reflected in the investment account on January 4, 2025. (Round your answer to 2 decimal places.) S Carrying value per share 3.Calculate the change in Heritage's equity from January 2, 2023, through January 5, 2025, resulting from its investment in Port. Equity 8.42 decreases by S 144.800arrow_forward

- How would I Debit and Credit for the transactions shown? Oct. 1 Purchased $90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of $375. The bonds are classified as a held-to-maturity long-term investment. 7 Sold, at $38 per share, 2,600 shares of treasury common stock purchased on Jun. 8. 14 Received a dividend of $0.60 per share from the Solstice Corp. investment on Jun. 1. 29 Sold 1,000 shares of Solstice Corp. at $45, including commission. 31 Recorded the payment of semiannual interest on the bonds issued on May 1 and the amortization of the premium for six months. The amortization is determined using the straight-line method. Dec. 31 Accrued interest for three months on the Dream Inc. bonds purchased on Oct. 1. 31 Pinkberry Co. recorded total earnings of $240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. 31 The fair value for Solstice…arrow_forwardOn January 1, 2021, Jason Corp. purchased 5-year bonds with a face value of P10,000,000 and a stated interest rate of 12% per year collectible every December 31. The bonds were acquired to yield 11%. These bonds were classified based on business model of collecting contractual cash flows and to sell. On December 31, 2021 and December 31, 2022, the bonds were quoted at 104 and 102, respectively. At what amount should the investment be reported in its December 31, 2022 statement of financial position? Group of answer choices P10,200,000 P10,400,000 P10,000,000 P10,150,000arrow_forwardBerk Company engaged in the following investment transactions during the current year. April 1 July 1 Bought 40,000 of the 100,000 outstanding shares of Apex Company for $400,000. During the year, Apex Company reported net income of $30,000, and paid dividend of $10,000. Bought a $270 million bond with 8% interest rate. The market interest rate was 6% for bonds of similar risk and maturity. Berk paid $310 million for the bonds. The company will receive interest semiannually on June 30 and December 31. The fair value of the bonds at December 31 was $240 million. Dec 31 Required: 1. Beck has significance influence over Apex's management. On December 31, how much would Berk report as the value of its investment in Apex on the balance sheet? 2. Berk intends to actively trade the bond investment. a. Prepare the journal entries related to the bond on July 1 and on December 31. b. On December 31, how much would Berk report as the value of the bond on The balance sheet Please avoid…arrow_forward

- On January 1, Jim Shorts Corporation issued bonds for $580 million. This bond issue was originally issued at premium. During the same year, $1,500,000 of the bond premium was amortized. On a statement of cash flows prepared using the indirect method, Jim Shorts Corporation should report: O that $1.5 million to be added to net income O An investing activity of $580 million. O A financing activity of $300 million. O that $1.5 million to be deducted from net incomearrow_forwardThe Sombrero Company began operations on January 1, 2018. As at December 31, 2019 the partial balance sheet of Sombrero Company reflected the following balances: Long-term bank loans: $ 800,000 Bonds payable — 10%, convertible par value $500,000, net of discount: $480,000 Preferred shares — $2 dividend, no-par value, cumulative, 100,000 shares authorized, 10,000 shares outstanding: $100,000 Preferred shares — $5 dividend, no-par value, noncumulative, convertible, 500,000 shares authorized, 100,000 shares outstanding: $400,000 Conversion rights: $150,000 Common shares — no-par value; 1,000,000 authorized, 500,000 issued: $1,500,000 Additional information 1. Net income for the 2019 was $950,000. 2. No dividends were declared in 2018. 3. Dividends in the amount of $600,000 were declared in 2019. 4. Each $1,000 bond is convertible into 100 common shares. Interest expense on the bonds for the year was $22,000. 5. The conversion rate on the preferred shares is one…arrow_forwardOn September 1, Indigo Corporation had the following investments classified as held for trading purposes: $71,000,6% FMC Co, bond, purchased previously by indigo at 101. Interest on the bond is payable semi-annually on January 1 and July 13 $130,000 3% Government of Canada bond, previously purchased by indigo at 98. interest on the bond is payable semi-annually on March 31, and September 30. During the month of September, the following transactions took places Sept. 1: Sept. 30 Sept. 30 Sept. 30 Purchased $63,000 4% Alpha inc. bond at 99. Interest is payable annually on August 31. Received interest on Government of Canada bond. Data Sold the Government of Canada bond at 97. Fair value on FMC Co. bond is $74,550 and fair value of Alpha Inc. bond is $61,740. Record the transactions that occurred in September and prepare any adjusting entries required at September 30. indigo Corporation is a public company and has a September 30 year end. (Credit account titles are automatically indented…arrow_forward

- Penta Company purchased 1,000 bonds of Gone Company in 2018 for $810 per bond and classified the investment as securities available-for-sale. The value of these holdings was $272 per bond on December 31, 2019, and $421 per bond on December 31, 2020. During 2021, Penta sold all of its Gone bonds at $390 per bond. In its 2021 income statement, Penta would report: 53 Multiple Choice A trading gain of $31,000 and an unrealized holding loss of $390,00. A loss on the sale of investments of $420,000. A realized gain of $31,00O. A recognition of unrealized holding losses of $272,00o. 7 of 16 Next >arrow_forwardIn 2019, its first year of operations, Brighton Finance Corporation, based in London, UK, had the following transactions regarding its investments (currency in British pound, £): May 1 Purchased 600 Clifford Ltd. common shares for £60 per share. This investment is held for trading purposes. June 1 Purchased 1,000 bonds of Gladstone Inc. at face-value price of £100 each. These bonds bear interest at 6%, which is paid semi-annually on November 30 and May 31 each year. They were also purchased for trading purposes. July 1 Purchased 4,000 Waterloo Corporation common shares for £70 per share. This represents 25% of the issued common shares. Because of this investment, the directors of Waterloo have invited a Brighton’s executive to sit on their board. Sep. 1 Received a £1-per-share cash dividend from Waterloo Corporation. Nov. 1 Sold 200 Clifford Ltd. common shares for £63 per share. Nov. 30 Interest on the Gladstone Inc. bonds was received.…arrow_forwardThe following information relates to the debt securities investments of Sunland Company. 1. On February 1, the company purchased 10% bonds of Gibbons Co. having a par value of $324,000 at 100 plus accrued interest. Interest is payable April 1 and October 1. 2. On April 1, semiannual interest is received. 3. On July 1, 9% bonds of Sampson, Inc. were purchased. These bonds with a par value of $186,000 were purchased at 100 plus accrued interest. Interest dates are June 1 and December 1. 4. On September 1, bonds with a par value of $60,000, purchased on February 1, are sold at 99 plus accrued interest. 5. On October 1, semiannual interest is received. 6. On December 1, semiannual interest is received. 7. On December 31, the fair value of the bonds purchased February 1 and July 1 are 95 and 93, respectively. (a)Prepare any journal entries you consider necessary, including year-end entries (December 31), assuming these are available-for-sale securities.…arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning