ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

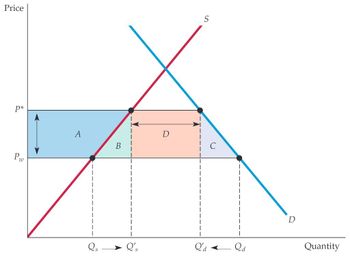

Please solve fast Interpret the figure presented below in the context of Competitive Markets and International Trade (~300 words with APA Style refences)

Transcribed Image Text:Price

p*

Pw

A

B

Q's

D

S

D

Quantity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 1A. Define and explain the theory of comparative advantage (use an example ifnecessary).B. Discuss limitations of comparative advantage (Include in your answer at leastfive key limitations to this theory).C. Spencer Grant is a New York-based investor. He has been closely following hisinvestment in 100 shares of Vaniteux, a French firm that went public in Februaryof 2010. When he purchased his 100 shares at €17.25 per share, the euro wastrading at $1.360/€. Currently, the share is trading at €28.33 per share, and thedollar has fallen to $1.4170/€.a If Spencer sells his shares today, what percentage change in the share pricewould he receive?What is the percentage change in the value of euro versus the dollar overthis same period?What would be the total return Spencer would earn on his shares if he soldthem at these rates?arrow_forward50D- 50D- If the price of 1 tonne of wheat was 20 apples, who would benefit from trade? If the price was 1 tonne of wheat for 40 apples, who would benefit from trade?arrow_forwardIn international trade, political risks arise when the provider is unable to meet the contractual obligations or when there are disputes over the conditions and terms stated in the contract. True False If your answer is false, give the good answer: course: export of servicesarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardProblem 19-03 (algo) The following hypothetical production possibilities tables are for China and the United States. Assume that before specialization and trade the optimal product mix for China is alternative D and for the United States is alternative S. China Production Possibilities ok Product A B D E F Apparel 80,000 64,000 int Chemicals (tons) 0 32 48,000 64 32,000 96 16,000 128 160 rences Product Apparel Chemicals (tons) U.S. Production Possibilities R 240,000 0 S T 192,000 144,000 48 96 U 96,0000 144 W 48,000 0 192 240 Instructions: Enter your answers as whole numbers. a. Are comparative-cost conditions such that the two countries should specialize? Yes If so what product should each produce?arrow_forwardFor all questions, refer to the graph on the reverse side. Use this graph for 1 – 4. The graph represents the market for coffee. Estimation may be necessary, so show work. Assuming the market outcome, and a world price of $6.50 calculate the following: Price = $6.50 Qddom = 60 units Qsdom = 160 units Imports or exports = Qs is greater than Qd so the country ia an exporter. Export is 100 units Redo all parts of #1 assuming a world price of $3.50. Redo all parts of #1 assuming a world price of $3.50 and a tariff of $0.50. Redo all parts of #1 assuming a world price of $3.50 and a quota of 60.arrow_forward

- Please solve it fast i will give double upvotesarrow_forwardlescription is incorrect ( ) A According to the overlapping demand theory, the intra-industry trade between countries with large income gap will be less. 0307 The theory of comparative advantage helps to explain the intra-industry trade between developed countries. The smaller the difference of factor endowments between two countries, the greater proportion of intra-industry trade should be.arrow_forwardQ)Why does russia have the comparative advantage in oil? Explanation it correctly and in detailarrow_forward

- [Basic static analysis of trade] Construct a simple model of the (wholesale) market for wheat globally, and in Australia. Provide a brief but clear explanation to accompany your diagrams, and reflect on what access to international trade means for Australian farmers, food manufacturers (e.g. bakeries) and food consumers (i.e. households).arrow_forwardGains and Losses from Trade in the Specific-Factors Model - End of Chapter Problem Home produces two goods, computers and wheat, for which capital is specific to computers, land is specific to wheat, and labor is mobile between the two industries. Home has 100 workers and 100 units of capital but only 10 units of land. a. Suppose that when Home opens up to international trade, the price of computers rises. In the accompanying diagram, shift the appropriate curve to show this change, holding the price of wheat constant. b. The increase in the price of computers causes the Wage amount of labor used in wheat production a given quantity of labor 0 W The amount of labor used in computer production the change in the wage. L --> LLL" curve to shift vertically by PMPLC P_MPL W W <-C .... while the The vertical shift of the P MPL curve atarrow_forward1) Discuss some of the complex problems brought by the modern food industry upon agricultural workers and our planet as illustrated in the documentary you viewed this week: "Seed: The Untold Story". 2) Do you think the Covid-19 pandemic has exposed some of the problems in the way our global food chain functions? What are two of these problems and your proposed solutions to them?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education