ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

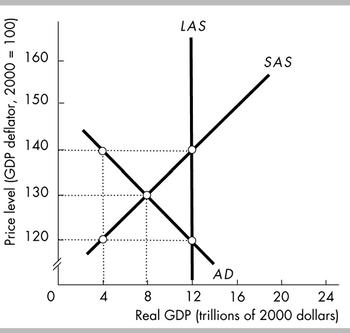

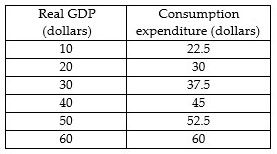

In the above figures, supposed that there is no import or proportional tax. To pull the economy back to the long-run equilibrium, the government can cut taxes by $ trillion.

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

Transcribed Image Text:Price level (GDP deflator, 2000 = 100)

160

150

140

130

120

0

4

LAS

AD

SAS

8

12

16 20 24

Real GDP (trillions of 2000 dollars)

Transcribed Image Text:Real GDP

(dollars)

10

20

30

40

50

60

Consumption

expenditure (dollars)

22.5

30

37.5

45

52.5

60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- In 2018, the Government of the Federated Republic of Coconut Islands had a budget surplus of $20 million dollars. Suppose that in the same year, the total amount of government expenditures was $324 millions. What was the government's tax revenues in that year?arrow_forwardWhich is considered expansionary fiscal policy? a)a tax increase for wealthy individuals b)an increase in national defense spending c)regulations raising emission standards on trucks d)an increase in the money supplyarrow_forwardHelp me pleasearrow_forward

- Question 3 pleasearrow_forwardQUESTION 13 The tax rates embodied in the federal personal income tax are such that a rising absolute amount, but a declining proportion, of income is paid in taxes. the marginal and average tax rates are equal, making the tax progressive. the average tax rate rises more rapidly pan does the marginal tax rate as income rises. the marginal tax rate is higher than the average tax rate, causing the average tax rate to rise as income rises. QUESTION 14arrow_forwardAggregate Supply and Aggregate Demand show the relationship between economic output (GDP) and price levels in the macro-economy at a given point in time. Define the terms ‘Aggregate Demand’ and ‘Aggregate Supply.’ State TWO (2) monetary and TWO (2) fiscal policies that government can adopt, to effect change in Aggregate Demand.arrow_forward

- Given an MPC of .8 and an increase in government spending of 5 The aggregate supply curve will shift to the right by 20 The aggregate supply curve will shift to the left by 20 The aggregate supply curve will shift to the right by 5 The aggregate supply curve will shift to the left by 5 None of the abovearrow_forwardIn an economy such that: C = 200 + 0.80 (Y – T) Md = 0.20 Y - 10 R I = 40 - 20 R Ms = 200 + BP X = 30 - 0.05 Y BP = X + K T = 100 K = 20 + 10R G = 150 Determine the equilibrium levels of Y and R. If T increases to $150, what are the new Y and R? What is the tax multiplier?arrow_forwardI need help with this question pleasearrow_forward

- please answer the following question: 1. Which of the following sources of revenue is used to fund government spending?A) corporate contributionsB) political party contributionsC) taxationD) aggregate supplyarrow_forwardWhich of the following can tax cuts influence? a. aggregate demand and aggregate supply b. aggregate demand but not aggregate supply c. aggregate supply but not aggregate demand d. neither aggregate demand nor aggregate supplyarrow_forwardDescribe the three distinct terms to describe the tax rates?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education