ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

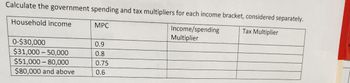

Transcribed Image Text:**Title: Understanding Government Spending and Tax Multipliers by Income Bracket**

**Concept Summary:**

This table demonstrates the values of the marginal propensity to consume (MPC), as well as the income/spending multiplier and the tax multiplier for different household income brackets. Analyzing these multipliers helps in assessing the economic impact of fiscal policies across different income levels.

**Table Explanation:**

| Household Income | MPC | Income/Spending Multiplier | Tax Multiplier |

|-----------------------|-----|----------------------------|----------------|

| $0–$30,000 | 0.9 | | |

| $31,000–$50,000 | 0.8 | | |

| $51,000–$80,000 | 0.75| | |

| $80,000 and above | 0.6 | | |

**Key Terms:**

- **MPC (Marginal Propensity to Consume):** This is the proportion of additional income that a household is likely to spend on consumption. A higher MPC suggests that economic stimuli in the form of cash would lead to more consumer spending.

- **Income/Spending Multiplier:** This metric is derived from the MPC and influences how much additional economic activity is generated from an increase in spending or investment.

- **Tax Multiplier:** This indicates the effect of tax changes on the overall economy. It represents how changes in taxation influence overall spending patterns and economic output.

**Note:**

The column for income/spending and tax multipliers is yet to be filled out. Calculating these multipliers requires further analysis using the MPC values given for each income bracket. Understanding these concepts aids in crafting fiscal policies that target specific income groups to optimize economic stability and growth.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The initial population of a town is 5 000, and it grows with a doubling time of 8 years. What will the population be in 12 years?arrow_forward1. Calculate the per capita value for each situation to two decimal places. a)Number of new cars sold in Ontario in 2017: 312 000. Number of Ontario drivers: 1 200 00 b) Gross federal government debt in 2017: $618 790 000 000.Canada's population: 33 100 00 Gini Index for Ontario, 1995–2005 2. The graph shows the Gini Index for Ontario, 50 which is a measure between 0 and 100 of the 45 degree of inequality in the distribution of 40.0 39.6 39 2 40 37.7 38.2 income. A Gini Index of close to 0 indicates 39.1 39.2 39.4 35 that most members of the population receive close to the same income. A Gini Index of close to 100 indicates that a few people in the population receive most of the income. 25 20 a) By what factor has the index changed from 3 15 1995 to 2005? 10 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Year b) What was the percent change in the Gini Index from 1995 to 2004° 3. A study stated that 85% of Canadian college graduates 22 to 24 years of age are employed…arrow_forwardQ10. Part part ii drop down boxes both give the options: A: Overestimate B: Underestimate C: Accurate estimatearrow_forward

- Tract 1 123 2 3 4 Group A Group B 25 50 75 100 25 25 25 25 Calculate the dissimilarly index for this county.arrow_forward12. According to the insolation curves, the average daily solar radiation varies the least over the period of a year at the location. polar b. middle latitude a. c. equatorial с.arrow_forward(Ch7) If the mean time between in-flight aircraft engine shutdowns is 12,500 operating hours, what is the 90 percentile on the distribution of the number of hours until the next shutdown? (hint: convert the mean time between events to the mean events per hour λ, then apply inverse exponential) Question 7Select one: a. 20,180 hours b. 18,724 hours c. 23,733 hours d. 28,782 hoursarrow_forward

- The populations of Abu Dhabi (National, Non-National, and Total) and UAE are shown in the following table Year Abu Dhabi UAE Nationals Non-nationals Total 1980 89880 361,056 1985 114090 430,054 1990 185944 556,389 1995 218716 719,836 2000 282,396 846,267 2005 343237 1,049,207 1,016,789 1,350,433 1,811,457 2,350,192 3,050, 127 4,481,976 What are the average annual population growth rates in Abu Dhabi (National Non-National, Total) and in the UAE during 1980-1985, 1985-1990, 1990-1995, 1995-2000 and 2000-2005? Only give the answer for the underlined groups.arrow_forwardAccording to the climate graph, what is the range of temperature recorded in the city of Yakutsk? Yakutsk / Russia 100m °C 62° 05'N / 129° 45'E mm T=-10.2 C P 213 mm 40 30 60 20 40 10 20 -10 -20 -30 -40 -50 JFMAMJJASOND osE A. 50-54 oC B. 55-590C C. 60-64 oC D. 65-69 oCarrow_forwardam. 153.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education