ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

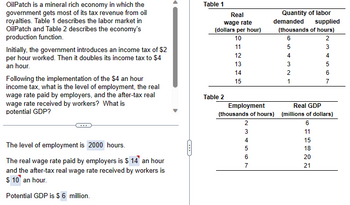

Transcribed Image Text:OilPatch is a mineral rich economy in which the

government gets most of its tax revenue from oil

royalties. Table 1 describes the labor market in

OilPatch and Table 2 describes the economy's

production function.

Initially, the government introduces an income tax of $2

per hour worked. Then it doubles its income tax to $4

an hour.

Following the implementation of the $4 an hour

income tax, what is the level of employment, the real

wage rate paid by employers, and the after-tax real

wage rate received by workers? What is

potential GDP?

The level of employment is 2000 hours.

The real wage rate paid by employers is $ 14 an hour

and the after-tax real wage rate received by workers is

$ 10 an hour.

Potential GDP is $ 6 million.

C

Table 1

Real

wage rate

(dollars per hour)

10

11

Table 2

12

13

14

15

Employment

(thousands of hours)

2

134567

Quantity of labor

demanded

supplied

(thousands of hours)

2

6

5

4

3

2

1

Real GDP

(millions of dollars)

6

11

15

18

34567

20

21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- By law, the government splits the levy of the FICA tax equally between workers and firms.(a) Using a supply and demand diagram, draw the labor market and label the equilibriumwage and employment level assuming FICA did not exist. Then, on the same graph,draw how the imposition of FICA alters labor market outcomes. Make sure to carefullylabel equilibrium wages, wages paid, wages received, and employment.(b) If the government splits the levy of the FICA tax evenly between workers and firms, thenhow is it that some researchers claim that workers pay approximately 90% of payrolltaxes?(c) Assume that labor unions lobby the government to have the entire levy of FICA shifted tofirms. Will workers ultimately be happy under this new tax structure? Why or why not?arrow_forwardThe incidence of a tax: - refers to who writes the check to the government. - is a measure of the revenue the government receives from it. - is a measure of the deadweight loss generated by the tax. - refers to who really bears the burden of the tax.arrow_forwardParliament is interested in financing the cost of their proposed childcare programme by imposing a payroll tax on workers. Some members of parliament are worried that workers will pay the entire burden of this payroll tax and propose for this tax to be imposed on firms. Address the concerns of the members of the Parliament in your report (100 words)arrow_forward

- There are two individuals in a society. The federal income tax in this society is such that that the first $20,000 of income is taxed at 10% and income above that is taxed at 30%. The federal government allows taxes paid to local governments to be deducted. James earns a gross income of $40,000, and Jane earns a gross income of $65,000. Out of his income, James pays $1,000 in local taxes; out of her income, Jane pays $20,000 in local taxes. Which of the following statements is true? a. The federal tax system is proportional. b. James’ total (local + federal) tax bill is greater than Jane’s total tax bill. c. The federal tax system is regressive d. The federal tax system is progressive.arrow_forwardThere is a question that requires students to "explain how the tax rates apply to individuals in Australia and the alternative from flat tax rates that apply to companies. Students will also be required to explain generally how capital gains are dealt with as statutory income. Students are expected to be able to reflect on what they have learnt about the tax system as it is in 2024 especially in regard to the overall fairness between the rich and poor. Your reflection should show that you now understand the main principles in the tax system and can make a personal reflection appropriate for post graduate level students." How do you answer this type of question? what is the format? what are the things that need to be covered?arrow_forwardWhich of the following government spending categories falls into the discretionary category SNAP payments (suuplemental nutrition assistance program, colloquially known as food stamps) medicaid payments O salaries of employees of the Bureau for Economic Analysis O social security paymentsarrow_forward

- In a hypothetical economy, Clancy earns $37,000, Eileen earns $74,000, and Hubert earns $111,000 in annual income. The following table shows the annual taxable income and tax liability for these three single individuals. For example, Clancy, who earns $37,000, owes $9,250 in taxes. Use the tax liability figures provided to complete the following table by computing the average tax rate for Clancy, Eileen, and Hubert with an annual income of $37,000, $74,000, and $111,000, respectively. Taxable Income Tax Liability Average Tax Rate Taxable Income (Dollars) (Dollars) (Percent) Clancy 37,000 9,250 Eileen 74,000 11,100 Hubert 111,000 11,100 The income tax system for this country isarrow_forwardReduction and elimination of corporate income taxes (CIT) and the economic result: Examples from North Carolina and Ohio The corporate income tax (CIT) is levied by federal and state governments on business profits, which are revenues (what a business makes in sales) minus costs (the cost of doing business). State-level corporate income tax rates vary across the country. Six states (Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming) levy no corporate income tax, while the remaining states and the District of Columbia do tax corporate profits. Note: Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. Lowering the CIT: North Carolina North Carolina’s tax environment is one of the nation’s most competitive. As of 2021, the state boasted the nation’s third-lowest effective tax rates for newly established firms and fifth-lowest rates for mature firms. Just eight years ago, North…arrow_forwardOne of the issues that is debated in virtually every election is whether to raise the federal minimum wage, which stood at $7.25 per hour in 2015. Suppose that you are married with a child, working a 40-hour week in a minimum wage job. Assume that you pay taxes of about 10 percent of your total pay and that you work an average of 8 hours per day, 20 days each month. Your take-home pay (after taxes) is S a month. (Enter your response as an integer.)arrow_forward

- macro question 8arrow_forwardFRONT PAGE State Lotteries: A Tax on the Uneducated and the Poor Americans now spend over $85 billion a year on lottery tickets. That's more than we spend on sporting events, books, video games, movies, and music combined. That spending works out to about $650 a household. Poor people are proportionally the biggest buyers of lottery tickets. Households with less than $25,000 of income spend $1,100 a year on lottery tickets. By contrast, households with more than $50,000 of income buy only $300 of lottery tickets each year. Education also affects lottery spending: 2.7 percent of high school dropouts are compulsive lottery players, while only 1.1 percent of college grads play compulsively. Because lottery games are a sucker's game to start with-payouts average less than 60 percent of sales-lotteries are effectively a regressive tax on the uneducated and the es poor. Source: Research on lottery sales. According to Front Page Economics, what percentage of income is spent on lottery tickets…arrow_forwardSuppose Janet is a single parent with one child, and she is trying to determine the effect of transfer benefits and taxes on her implicit marginal tax rate (and thus her incentive to work). The following table shows the transfer benefits and income taxes at various income levels in the economy in which Janet resides. Compute the spendable income level Janet would have at each level of earned income and enter these values in the last column of the table. Earned Income from Work (Dollars) Transfer Benefits Income and Employment Taxes (Dollars) (Dollars) 0 Spendable Income (Dollars) 9.954 0 9,954 6,000 8.800 272 772 1,424 2.225 2,656 12.000 18,000 24,000 30,000 7,389 5,384 2.697 1,033 If Janet's income from work increased from $18,000 to $24.000, her implicit marginal tax rate would be If Janet's income from work increased from $24,000 to $30.000, her implicit marginal tax rate would bearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education