ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

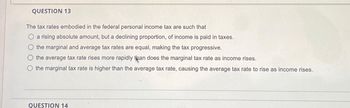

Transcribed Image Text:QUESTION 13

The tax rates embodied in the federal personal income tax are such that

a rising absolute amount, but a declining proportion, of income is paid in taxes.

the marginal and average tax rates are equal, making the tax progressive.

the average tax rate rises more rapidly pan does the marginal tax rate as income rises.

the marginal tax rate is higher than the average tax rate, causing the average tax rate to rise as income rises.

QUESTION 14

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- TRUE - OR - FALSE The distinctive characteristic of a progressive tax is that the dollars paid in taxes rise as income rises. O True O Falsearrow_forwardA Moving to another question will save this response. Question 23 Fiscal policy can move us to equilibrium at Full Employment by O a. these are all possible fiscal policies to bring us to full employment. O b. bailing out troubled industries with special subsidies like the "paycheck protection" during the pandemic. O c. making changes in G, net government spending. O d. changing tax rates people have to pay. A Moving to another question will save this response. tab 1 Q ABA 2 W E R Tarrow_forward2arrow_forward

- 5. Study Questions and Problems #5 True or False: The marginal tax rate is calculated using additional income, while the average tax rate is calculated using total income. True O Falsearrow_forwardIf the government wants to increase the tax revenue they collect from sellers, then it should O Tax goods that have low elasticity of demand and high elasticity of supply. O Tax goods that have high elasticity of demand and supply. Tax goods that have high elasticity of demand and low elasticity of supply. O Tax goods that have low elasticity of demand and supply.arrow_forwardToday the federal government collects nearly O $1 billion a year in tax revenues. O $500 billion a year in tax revenues. O $1 trillion a year in tax revenues. O $4 trillion a year in tax revenues.arrow_forward

- TRUE - OR - FALSE A federal budget surplus occurs when government expenditures exceed tax revenues. O True O Falsearrow_forward9. When a sales tax is imposed on sellers, we can imagine a hypothetical supply curve shifted to the left such that the vertical distance between the original supply curve and the new (supply + tax) curve equals the sales tax divided by the price elasticity of demand. sales tax multiplied by the price elasticity of demand. sales tax multiplied by the price elasticity of supply. amount of the sales tax.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education