FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

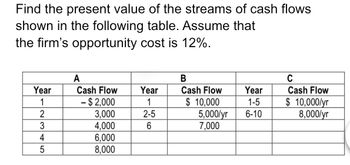

Transcribed Image Text:Find the present value of the streams of cash flows

shown in the following table. Assume that

the firm's opportunity cost is 12%.

A

B

C

Year

Cash Flow

Year

Cash Flow

Year

Cash Flow

1

-$2,000

1

$ 10,000

1-5

$ 10,000/yr

2345

5

2

3,000

2-5

5,000/yr

6-10

8,000/yr

4,000

6

7,000

6,000

8,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Compute NPV using excel. Discount rate - 10%arrow_forwardCalculate the HPR of the following investment, entered as a percentage (Example: if your answer is 14.5%, enter 14.5 and not 0.145) Period Cashflow 0 -14100 1 3300 2 3300 3 3100 4 2800arrow_forwardFind the NPV for the following cash flows assuming a WACC of 10%. YR CF 0 -15,000 1 6,000 2 4,000 3 2,000 4 3,000 5 2,000arrow_forward

- What is the yield on the following set of cashflows? Time Cashflow (£) t = 0 t=1 H 400 t=2 t = 3 -100 -120 t = 4 -140 t = 5 -160arrow_forward26. (ts) For the following set of cash flows, calculate the NPV, IRR, MIRR, Profitability Index and Payback Period. Assume the WACC is 8%. NPV: IRR: MIRR: Profitability Index Payback Period: Year Cash Flow 0 $ (580,000.00) 1 $ 120,000.00 2 $ 132,000.00 3 $ 139,920.00 4 $ 151,190.00 5 $ 145,150.00 6 $ 148,250.00 Is this project acceptable? Why or why not? Iarrow_forwardQ#03: Suppose you have cash flows as follows: End of Year Cash Flows ($) 1 8000 7000 3 6000 4 5000 Calculate present equivalent at i= 15% per year using gradient conversion factor.arrow_forward

- Consider the following cash flow year cash flow -1000 TL 2 +300 TL 3 +300 TL 4 +300 TL +300 TL Calculate the rate of return for an investment of 1000 TLarrow_forwardFor the cash flow given below, if i= 14% , the future value, F is closest to: F=? $ 4000 6 우 $ 5000 $ 7000arrow_forward6. Consider the following cash flow series, Aj=1,500 A2=3,000 A3=4,500 A4-6,000 As=7,500 A6=9,000 A=10,500 Ag=12,000 A9=13,500 A10=15,000 and Au=16,500 a. Determine the present worth and the future worth based on an interest rate of 15%. b. Determine the equivalent annual cost for the given cash flow series.arrow_forward

- H1. Accountarrow_forward3. The cash flows for three different alternatives are given in table below. If MARR is set at 8%, use incremental analysis between (Y and Z), (Y and X) to determine which is the best alternative? Data Alt. X Alt. Y Alt. Z Initial Cost, S Net Benefits/ Year, S 528 Life, Years 12,500 7,500 1,063 25 9,000 510 25 25arrow_forwardFor the given cash flows, suppose the firm uses the NPV decision rule. Year Cash Flow 0 –$ 148,000 1 64,000 2 75,000 3 59,000 a. At a required return of 12 percent, what is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. At a required return of 21 percent, what is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education