FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

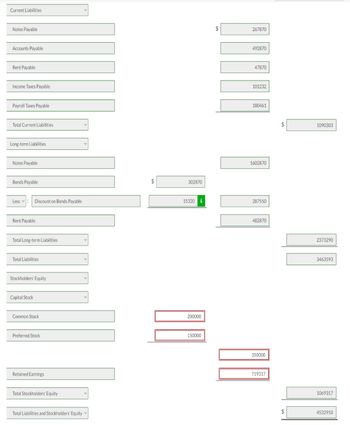

Transcribed Image Text:Current Liabilities

Notes Payable

Accounts Payable

Rent Payable

Income Taxes Payable

Payroll Taxes Payable

Total Current Liabilities

Long-term Liabilities

Notes Payable

Bonds Payable

Less :

Discount on Bonds Payable

Rent Payable

Total Long-term Liabilities.

Total Liabilities

Stockholders' Equity

Capital Stock

Common Stock

Preferred Stock

Retained Earnings

Total Stockholders' Equity

Total Liabilities and Stockholders' Equity v

$

302870

15320 i

200000

150000

$

"FOR

267870

492870

47870

101232

180461

1602870

287550

482870

350000

719317

$

$

1090303

2373290

3463593

1069317

4532910

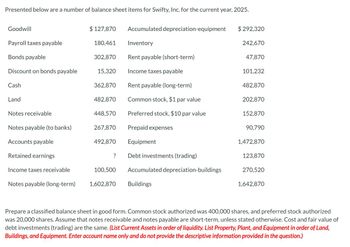

Transcribed Image Text:Presented below are a number of balance sheet items for Swifty, Inc. for the current year, 2025.

Goodwill

Payroll taxes payable

Bonds payable

Discount on bonds payable

Cash

Land

Notes receivable

Notes payable (to banks)

Accounts payable

Retained earnings

Income taxes receivable

Notes payable (long-term)

$ 127,870 Accumulated depreciation-equipment

Inventory

180,461

302,870

15,320

362,870

482,870

448,570

267,870

492,870

?

100,500

1,602,870

Rent payable (short-term)

Income taxes payable

Rent payable (long-term)

Common stock, $1 par value

Preferred stock, $10 par value

Prepaid expenses

Equipment

Debt investments (trading)

Accumulated depreciation-buildings

Buildings

$292,320

242,670

47,870

101,232

482,870

202,870

152,870

90,790

1,472,870

123,870

270,520

1,642,870

Prepare a classified balance sheet in good form. Common stock authorized was 400,000 shares, and preferred stock authorized

was 20,000 shares. Assume that notes receivable and notes payable are short-term, unless stated otherwise. Cost and fair value of

debt investments (trading) are the same. (List Current Assets in order of liquidity. List Property, Plant, and Equipment in order of Land,

Buildings, and Equipment. Enter account name only and do not provide the descriptive information provided in the question.)

Expert Solution

arrow_forward

Step 1 Introduction

Balance Sheet :— It is one of the financial statement that shows list of final ending balances of assets, liabilities and owner's equity.

Assets :— It is the resources owned by company.

Liabilities :— It is the obligation of company that will be paid in future.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The balance sheets for Mary Company showed the following information. Additional information concerning transactions and events during 2021 are presented below. Mary CompanyBalance Sheet December 31 2021 2020 Cash $ 31,209 $ 10,302 Accounts receivable (net) 43,733 20,503 Inventory 35,350 42,420 Long-term investments 0 15,150 Property, plant & equipment 238,865 151,500 Accumulated depreciation (38,077) (25,250) $311,080 $214,625 Accounts payable $ 17,170 $ 26,765 Accrued liabilities 21,210 17,170 Long-term notes payable 70,700 50,500 Common stock 131,300 90,900 Retained earnings 70,700 29,290 $311,080 $214,625 Additional data: 1. Net income for the year 2021, $61,610. 2. Depreciation on plant assets for the year, $12,827. 3. Sold the long-term…arrow_forwardUse the information below for Harding Company to answer the question that follow. Harding Company Accounts payable $38,576 Accounts receivable 62,104 Accrued liabilities 6,548 Cash 15,575 Intangible assets 39,083 Inventory 71,044 Long-term investments 90,442 Long-term liabilities 74,452 Marketable securities 38,270 Notes payable (short-term) 24,003 Property, plant, and equipment 652,967 Prepaid expenses 2,137 Based on the data for Harding Company, what is the amount of quick assets?arrow_forwardThe comparative balance sheets for 2018 and 2017 and the statement of income for 2018 are given below for Dux Company. Additional information from Dux's accounting records is provided also. Assets Cash Accounts receivable Less: Allowance for uncollectible accounts Dividends receivable Inventory Long-term investment Land Buildings and equipment Less: Accumulated depreciation Liabilities Accounts payable Salaries payable Interest payable Income tax payable Notes payable Bonds payable Less: Discount on bonds Shareholders' Equity Common stock Paid-in capital-excess of par Retained earnings DUX COMPANY Comparative Balance Sheets December 31, 2018 and 2017 ($ in 900s) Less: Treasury stock DUX COMPANY Income Statement For Year Ended December 31, 2018 ($ in 800s) Revenues Sales revenue Dividend revenue Expenses Cost of goods sold. Salaries expense Depreciation expense Bad debt expense Interest expense Loss on sale of building Income tax expense Net income $325 9 $334 134 39 33 1 22 6 31 266…arrow_forward

- The following December 31, 2024, fiscal year-end account balance information is available for the Stonebridge Corporation: Cash and cash equivalents Accounts receivable (net) $ 6,300 33,000 73,000 Inventory Property, plant, and equipment (net) 185,000 Accounts payable 52,000 Salaries payable Paid-in capital 24,000 165,000 The only asset not listed is short-term investments. The only liabilities not listed are $43,000 notes payable due in two years and related accrued interest payable of $1,000 due in four months. The current ratio at year-end is 1.5:1. Required: Determine the following at December 31, 2024: 1. Total current assets 2. Short-term investments 3. Retained earningsarrow_forwardUse the information below for Harding Company to answer the question that follow. Harding Company Accounts payable $35,479 Accounts receivable 69,658 Accrued liabilities 6,342 Cash 21,866 Intangible assets 40,636 Inventory 81,299 Long-term investments 116,464 Long-term liabilities 78,760 Marketable securities 34,728 Notes payable (short-term) 21,173 Property, plant, and equipment 607,986 Prepaid expenses 2,827 Based on the data for Harding Company, what is the amount of quick assets? a.$56,594 b.$126,252 c.$1,510,965 d.$745,879arrow_forwardJust Dew It Corporation reports the following balance sheet information for 2020 and 2021. JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets Assets 2020 2021 Liabilities and Owners' Equity 2020 2021 Current assets Current liabilities Cash $ 10, 620 $ 13, 275 Accounts payable $ 52, 560 $ 60, 750 Accounts receivable 21,420 29, 925 Notes payable 19, 260 24,075 Inventory 67, 860 82, 575 Total $ 99,900 $ 125, 775 Total $ 71,820 $ 84, 825 Long-term debt $ 36,000 $ 27,000 Owners' equity Common stock and paid - in surplus $ 45,000 $ 45,000 Retained earnings 207, 180 293, 175 Net plant and equipment $ 260, 100 $ 324, 225 Total $ 252, 180 $ 338, 175 Total assets $ 360,000 $ 450,000 Total liabilities and owners' equity $ 360,000 $ 450,000 For each account on this company's balance sheet, show the change in the account during 2021 and note whether this change was a source or use of cash. (If there is no action select "None" from the dropdown options. Leave no cells blank - be certain to enter…arrow_forward

- Use the following information for Taco Swell, Incorporated, (assume the tax rate is 24 percent): Sales Depreciation Cost of goods sold Other expenses Interest Cash Accounts receivable Short-term notes payable Long-term debt Net fixed assets Accounts payable Inventory Dividends 2020 $ 18,549 2,416 5,890 Cash flow from assets Cash flow to creditors Cash flow to stockholders 1,371 1,130 GA 8,696 11,528 1,714 29,180 72,861 6,293 20,492 2,179 For 2021, calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. $ $ $ 2021 $ 18,888 2,524 6,771 1,198 1,345 9,367 13,602 1,681 35,329 77,730 6,760 21,902 2,354 -1,538.80 -4,804.00 7,250.00arrow_forwardThe table below contains data on Fincorp Incorporated. The balance sheet items correspond to values at year-end 2021 and 2022, while the income statement items correspond to revenues or expenses during the year ended 2021 and 2022. All values are in thousands of dollars. Revenue Cost of goods sold Depreciation Inventories Administrative expenses Interest expense Federal and state taxes* Accounts payable Accounts receivable. Net fixed assets* Long-term debt Notes payable Dividends paid Cash and marketable securities 2021 $ 4,100 1,700 470 270 520 240 340 320 350 4,800 2,400 687 380 760 Net working capital 2022 $ 4,200 1,800 490 335 570 240 360 355 395 * Taxes are paid in their entirety in the year that the tax obligation is incurred. t Net fixed assets are fixed assets net of accumulated depreciation since the asset was installed. 5,540 2,860 540 380 480 What was the change in net working capital during the year? Note: Enter your answer in thousands of dollars. byarrow_forwardThe balance sheets for Dual Monitors Corporation and additional information are provided below. DUAL MONITORS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets. Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable. Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional information for 2024: 1. Net income is $91,560. 2. Sales on account are $1,416,800. (All sales are credit sales.) 3. Cost of goods sold is $1,098,500. 2024 $149,560 72,000 92,000 3,700 450,000 760,000 2023 450,000 640,000 (398,000) (238,000) $1,129,260 $1,136,700 $95,400 6,000 8,000 $117,000 89,000 77,000 1,700 $82,000 11,700 4,700 220,000 670,000 148,300 110,000 670,000 239,860 $1,129,260 $1,136,700 Required: 1. Calculate the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education