FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

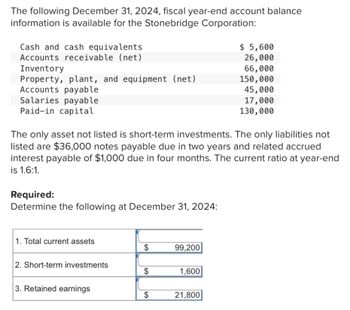

Transcribed Image Text:The following December 31, 2024, fiscal year-end account balance

information is available for the Stonebridge Corporation:

Cash and cash equivalents

Accounts receivable (net)

Inventory

Property, plant, and equipment (net)

Accounts payable

Salaries payable

Paid-in capital

The only asset not listed is short-term investments. The only liabilities not

listed are $36,000 notes payable due in two years and related accrued

interest payable of $1,000 due in four months. The current ratio at year-end

is 1.6:1.

Required:

Determine the following at December 31, 2024:

1. Total current assets

2. Short-term investments

3. Retained earnings

$

EA

$

EA

$

99,200

1,600

$ 5,600

26,000

66,000

150,000

45,000

17,000

130,000

21,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduce to accounting equation

VIEW Step 2: Working for total current liabilities and total liabilities

VIEW Step 3: Working for total current assets and short term investment

VIEW Step 4: Working for total assets

VIEW Step 5: Working for retained earnings

VIEW Step 6: Working for retained earnings

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kingbird, Inc. owns the following assets at December 31, 2020: Cash in bank savings account $47,000 Chequing account balance $30,000 Cash on hand 14,000 Postdated cheque from Blossom Company 440 Refund due (overpayment of income taxes) 30,000 Cash in a foreign bank (CAD equivalent) 88,000 Preferred shares acquired shortly before their fixed maturity date 15,000 Debt instrument with a maturity date of three months from the date acquired 11,000 (a1)If Kingbird follows ASPE and follows a policy of including all possible items in cash and cash equivalent, what amount should be reported as cash and cash equivalents? (Do not leave any answer field blank. Enter 0 for amounts.) Cash and cash equivalents under ASPE $enter Cash and cash equivalents under ASPE in dollars (a2)If Kingbird follows IFRS what amount should be reported as cash and cash equivalents? Cash and cash equivalents under IFRS $enter Cash and cash equivalents…arrow_forwardRequired Information [The following Information applies to the questions displayed below.] On January 1, 2021, the general ledger of ACME Fireworks Includes the following account balances: Accounts Cash Debit. Credit Accounts Receivable Allowance for Uncollectible Accounts $ 27,100 50,200 $ 6,200 Inventory 22,000 Land 66,000 Equipment 25,000 Accumulated Depreciation 3,500 Accounts Payable 30,500 Notes Payable (6%, due April 1, 2022) 70,000 Common Stock 55,000 Retained Earnings 25,100 Totals $190,300 $190,300 During January 2021, the following transactions occur: January 2 Sold gift cards totaling $12,000. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $167,000. January 15 Firework sales for the first half of the month total $155,000. All of these sales are on account. The cost of the units sold is $83,800. January 23 Receive $127,400 from customers on accounts receivable. January 25 Pay $110,000 to…arrow_forwardThe table below contains data on Fincorp Incorporated. The balance sheet items correspond to values at year-end 2021 and 2022, while the income statement items correspond to revenues or expenses during the year ended 2021 and 2022. All values are in thousands of dollars. Revenue Cost of goods sold Depreciation Inventories Administrative expenses Interest expense Federal and state taxes* Accounts payable Accounts receivable. Net fixed assets* Long-term debt Notes payable Dividends paid Cash and marketable securities 2021 $ 4,100 1,700 470 270 520 240 340 320 350 4,800 2,400 687 380 760 Net working capital 2022 $ 4,200 1,800 490 335 570 240 360 355 395 * Taxes are paid in their entirety in the year that the tax obligation is incurred. t Net fixed assets are fixed assets net of accumulated depreciation since the asset was installed. 5,540 2,860 540 380 480 What was the change in net working capital during the year? Note: Enter your answer in thousands of dollars. byarrow_forward

- In the past year, Blossom Corporation reported assets of $230229000. Liabilities reported on the balance sheet on the same date were reported at $69091655. Blossom issued a new note payable for cash during the year. The 8%, 5-year note was issued at a face value of $5008000. What is the company's debt to asset ratio after the refinance? O 29.37% 31.50% 32.18% O 30.01%arrow_forwardBelow is the financial information for AXZ Corporation for fiscal year-ending June 30, 2020. (Amounts in millions $s) Cash flows from operations $2,908.3 Total revenues 14,892.2 Shareholders’ equity 4,482.3 Cash flows from financing (110.0) Total liabilities 7,034.4 Cash, ending year 2,575.7 Expenses 14,883.4 Noncash assets 8,941.0 Cash flows from investing (1,411.2) Net earnings 8.8 Cash, beginning year 1,188.6 Required: Using the information above, prepare the company’s: Balance sheet as of June 30, 2020. Income Statement for the fiscal year ended June 30, 2020. Cash Flow Statement for the fiscal year ending June 30, 2020.arrow_forwardPLEASE HELP MEarrow_forward

- FDN Company shows the following balances on December 31, 2021: Accounts receivable P250,000 Accumulated depreciation P200,000 Allowance for uncollectible accounts P76,000 Cash P200,000 Property, plant and equipment P900,000 Supplies P30,000 How much is the Current Assets in the Statement of Financial Position as of December 31, 2021?arrow_forwardAccording to the balance sheet of Free Inc, at the end of the 2020 fiscal year, the cash balance is $200,000, account available balance is $500,000, inventory balance is $750,000; the net fixed asset is $1,500,000. On the other side, the account payable is $250,000, the accrual $40,000, the notes payable is $300,000, long-term debt is $510,000, common stock is $1,200,000, retained earnings is $650,000. The net income is $900,000; the interest payment is $45,600; the tax rate is 25%. If the sales is $10,000,000, what is the operating margin?b. 13.26%c. 11.45%d. 10.66%arrow_forwardRamakrishnan, Incorporated, reported 2024 net income of $40 million and depreciation of $2,900,000. The top part of Ramakrishnan, Incorporated's 2024 and 2023 balance sheets is reproduced below (in millions of dollars): 2024 2023 2024 2023 Current assets: Current liabilities: Cash and marketable securities Accounts receivable $ 45 $ 16 85 Inventory 161 82 124 Accrued wages and taxes Accounts payable Notes payable $ 28 $ 25 89 85 85 80 Total $ 291 $ 222 Total $ 202 $ 190 Calculate the 2024 net cash flow from operating activities for Ramakrishnan, Incorporated. Note: Enter your answer in dollars not in millions. Net cash flowarrow_forward

- Please help me with this problem. copy and paste onlyarrow_forwardGALLAGHER CORPORATION Income Statement For the Year Ending December 31, 2021 Sales revenue 950,000 Less: Cost of Goods Sold 600,000 Gross Profit 350,000 Less Operating Expenses 250,000 100,000 Income from Operations Other revenues and expenses 15,000 (3,000) Gain on sale of investments Loss on sale of equipment 12,000 Income before taxes 112,000 Income taxes 45,000 Net Income $ 67,000 Additional Information 1. Equipment costing $10,000 was sold and was 60% depreciated. New equipment was also purchased during the year 2. Cash dividends were declared and paid. 3. Common stock was exchanged for Land. 4. Debt investments costing $35,000 were sold during the year. New debt investment were purchased during the year for $5,000. 5. Accounts receivable are shown net of the allowance for doubtful accounts, because there were no account write-offs during the year. 6. Operating expenses include: Depreciation Expense, $21,000, Amortization Expense, and Interest Expense, $3,300 Instructions: 1.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education